Mecklenburg North Carolina Revocable Trust for Property is a legal arrangement that allows individuals in Mecklenburg County, North Carolina, to establish a trust for property ownership while maintaining control and flexibility. This type of trust can be created during one's lifetime and provides various benefits, such as avoiding probate, ensuring privacy, and facilitating the smooth transfer of property upon death. In Mecklenburg County, there are primarily two types of revocable trusts for property: the Living Trust and the Testamentary Trust. 1. Living Trust: A Living Trust, also known as an Inter Vivos Trust, is established while the granter (the person creating the trust) is still alive. The granter can name themselves as the trustee, retaining full control over the trust's assets. They can also designate a successor trustee to manage the trust in case of incapacity or death. By placing their property into the trust, the granter retains the ability to modify, revoke, or terminate the trust during their lifetime. 2. Testamentary Trust: Unlike the Living Trust, a Testamentary Trust comes into effect only upon the granter's death. This type of revocable trust is created through a valid will or testament, wherein the granter designates specific property to fund the trust. The assets are then transferred to the trust and distributed according to the granter's wishes, as outlined in their will. Unlike Living Trusts, Testamentary Trusts offer less flexibility during the granter's lifetime since they cannot be amended or revoked. Both types of Mecklenburg North Carolina Revocable Trusts for Property can provide numerous advantages, including: 1. Probate avoidance: By placing assets in a trust, they are not subject to probate, as the trust owns the property rather than the deceased individual. This helps to expedite the transfer of assets to beneficiaries while minimizing costs and avoiding the complexities of the probate process. 2. Privacy protection: Unlike wills, which become public records after probate, trusts allow for the confidential distribution of assets. This affords privacy to both the granter and beneficiaries, keeping personal and financial details out of the public domain. 3. Incapacity planning: Living Trusts offer provisions for the granter's incapacity, ensuring smooth management of assets by a successor trustee without the need for court-appointed conservatorship. 4. Flexibility and control: Revocable trusts provide the granter with the ability to manage, modify, or revoke the trust during their lifetime. This flexibility allows for the addition or removal of assets, changes in beneficiaries, and modifications to distribution instructions. It is important to consult with an experienced estate planning attorney in Mecklenburg County, North Carolina, to understand the specific legal requirements and intricacies of establishing a Mecklenburg North Carolina Revocable Trust for Property. They can help guide individuals through the trust creation process, ensuring compliance with state laws and addressing individual concerns and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Fideicomiso revocable para la propiedad - Revocable Trust for Property

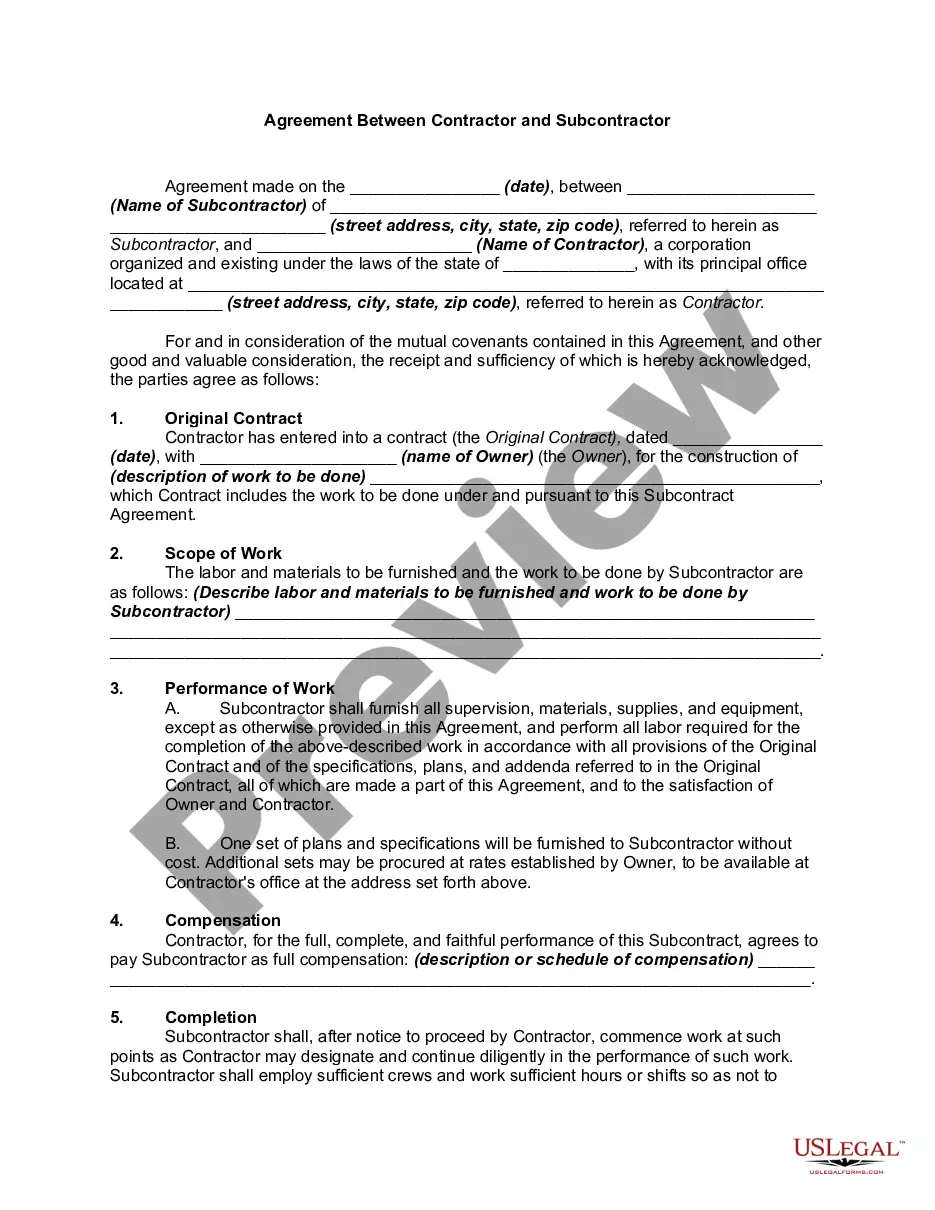

Description

How to fill out Mecklenburg North Carolina Fideicomiso Revocable Para La Propiedad?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, locating a Mecklenburg Revocable Trust for Property suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Aside from the Mecklenburg Revocable Trust for Property, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Mecklenburg Revocable Trust for Property:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Mecklenburg Revocable Trust for Property.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!