Middlesex Massachusetts Revocable Trust for Estate Planning is a legal arrangement that allows individuals in Middlesex County, Massachusetts, to manage and distribute their assets during their lifetime and after death. It is an estate planning tool specifically designed to provide flexibility, privacy, and control over assets while avoiding probate delays and expenses. A Middlesex Massachusetts Revocable Trust is a customizable document created by the settler, who is the person forming the trust. The settler appoints a trustee to manage the trust assets for the benefit of the beneficiaries. The trustee has a fiduciary duty to act in the best interest of the beneficiaries according to the terms of the trust. There are several types of Middlesex Massachusetts Revocable Trusts commonly used for estate planning purposes, including: 1. Living Trust: This type of trust is established during the settler's lifetime and allows them to maintain full control and access to their assets. It can be amended or revoked at any time by the settler. 2. Testamentary Trust: Unlike a living trust, a testamentary trust is created through a will and only goes into effect after the settler's death. It allows for the management and distribution of assets according to specific instructions outlined in the will. 3. Marital Trust: This trust is established to benefit a surviving spouse, providing them with income and access to assets while preserving the remaining assets for the ultimate beneficiaries, typically children or other family members. 4. Charitable Trust: This type of trust is designed to donate assets to a charitable organization or cause. It can provide certain tax benefits while allowing the settler to support a cause close to their heart. 5. Special Needs Trust: A special needs trust is created to financially support individuals with disabilities without jeopardizing their eligibility for government benefits. It ensures that the trust assets are used to enhance their quality of life without disqualifying them from assistance programs. Middlesex Massachusetts Revocable Trusts offer advantages such as avoiding probate, maintaining privacy, reducing estate taxes, and ensuring a smooth asset distribution process. It is recommended to consult an experienced estate planning attorney in Middlesex County, Massachusetts, to determine the specific type of trust that best suits individual circumstances and achieve desired objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Fideicomiso revocable para planificación patrimonial - Revocable Trust for Estate Planning

Description

How to fill out Middlesex Massachusetts Fideicomiso Revocable Para Planificación Patrimonial?

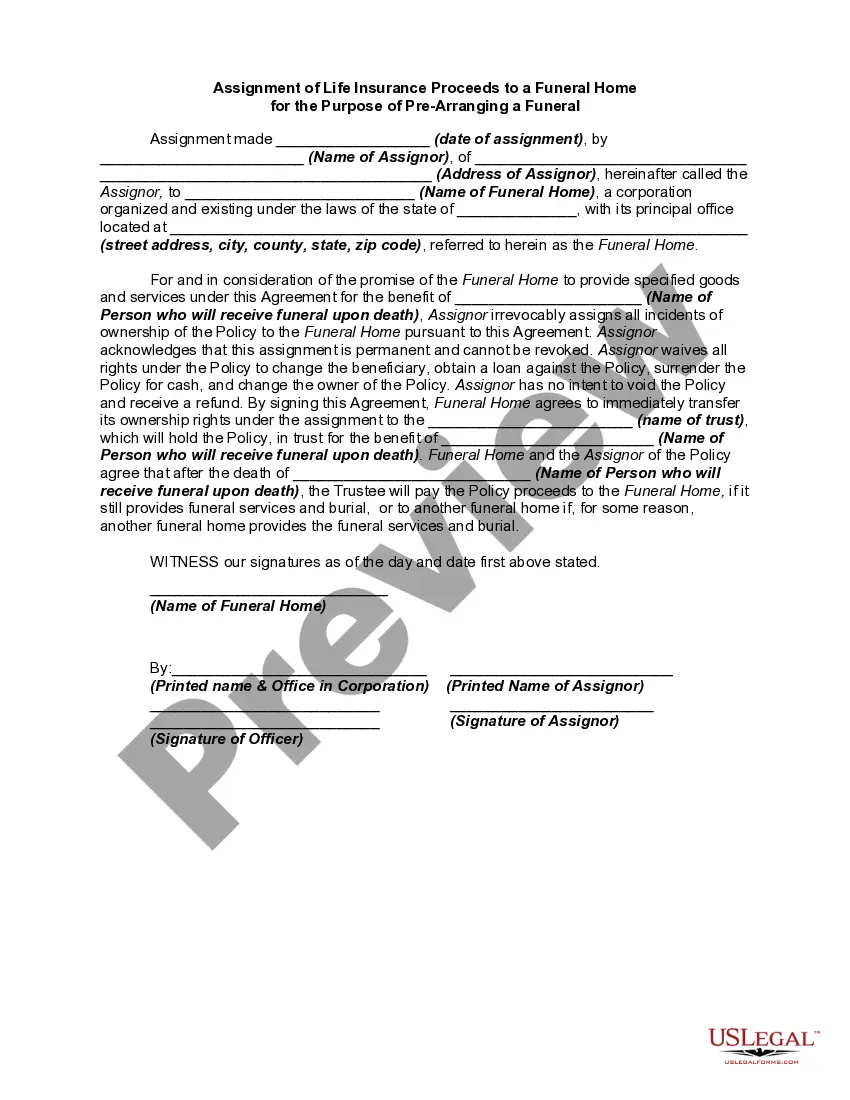

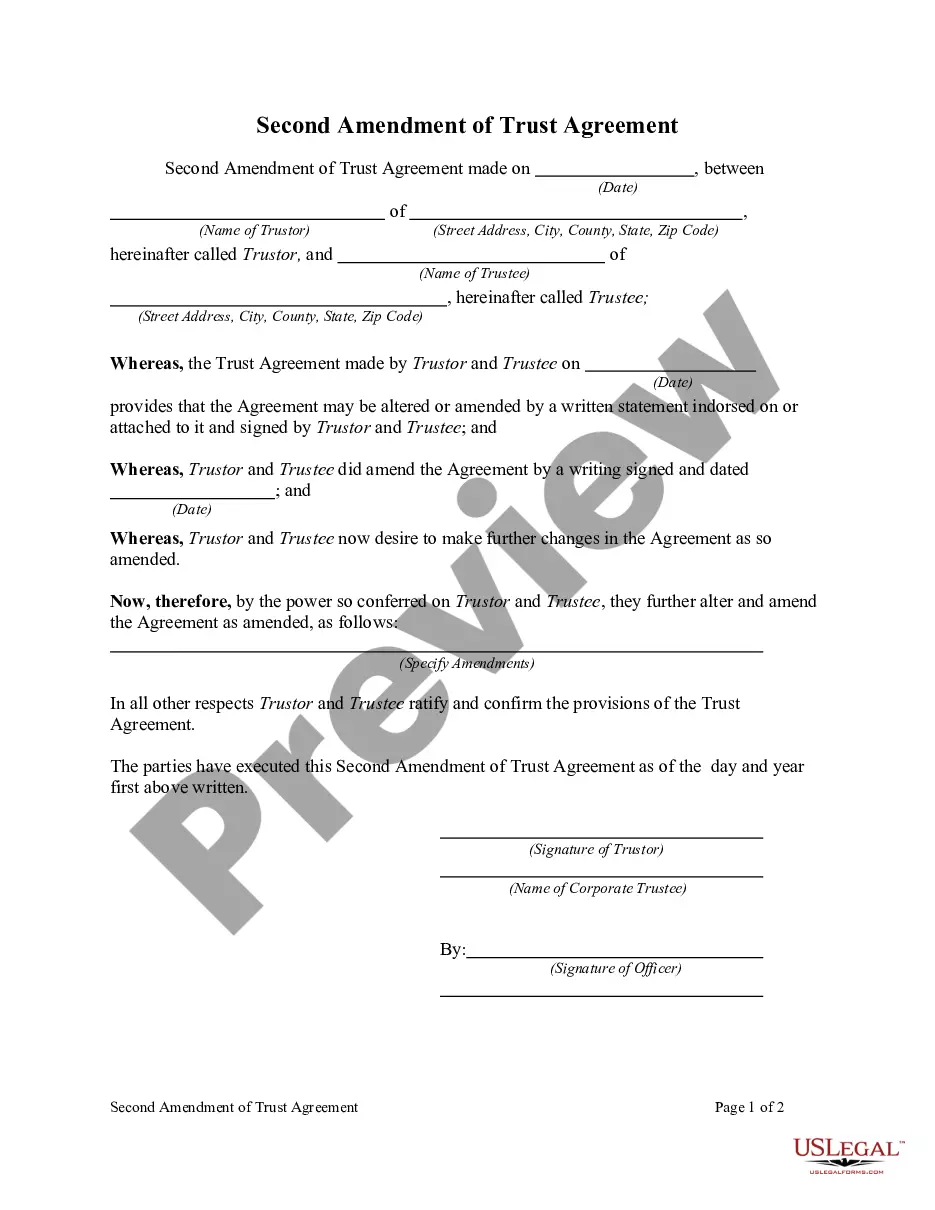

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Middlesex Revocable Trust for Estate Planning is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Middlesex Revocable Trust for Estate Planning. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Middlesex Revocable Trust for Estate Planning in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!