San Diego California Revocable Trust for Estate Planning is an essential legal tool used to protect assets and ensure a smooth transfer of property and wealth upon a person's death. With its revocable nature, this type of trust provides flexibility and control, allowing individuals to make changes or even revoke the trust during their lifetime if desired. San Diego offers several types of Revocable Trusts that cater to different needs and preferences of residents. These include: 1. Living Revocable Trust: A popular choice for San Diego residents, this trust is created during the granter's lifetime and can be modified, amended, or revoked as needed. It allows assets to bypass probate, ensuring privacy and efficiency in estate administration. It also helps avoid conservatorship in case of mental incapacity, ensuring a smooth transition of control. 2. Irrevocable Life Insurance Trust (IIT): While not revocable, this type of trust is specifically designed to hold life insurance policies, shielding them from estate taxes upon the granter's death. San Diego residents often opt for an IIT to provide liquidity for estate taxes or for making charitable contributions. 3. Qualified Personnel Residence Trust (PRT): A PRT allows San Diego homeowners to transfer their primary residence or vacation home to an irrevocable trust, while retaining the right to live in the property for a specified period. This type of trust helps reduce estate taxes while still allowing the granter to enjoy the property during their lifetime. 4. Charitable Remainder Trust (CRT): A CRT enables individuals to make charitable donations while providing an income stream for themselves or their beneficiaries. By donating appreciated assets to this trust, San Diego residents can enjoy income tax deductions, avoid capital gains taxes, and support charitable causes that align with their values. 5. Special Needs Trust: This type of trust is designed for individuals with disabilities, ensuring that they receive essential care while maintaining eligibility for government benefits. San Diego residents can establish a Special Needs Trust to provide financial support without jeopardizing crucial assistance programs like Medicaid or Supplemental Security Income (SSI). San Diego California Revocable Trust for Estate Planning is a valuable tool for individuals seeking to protect their assets, minimize taxes, and ensure a seamless transfer of property. It is crucial to consult an experienced estate planning attorney in San Diego to determine the most suitable trust based on individual circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Fideicomiso revocable para planificación patrimonial - Revocable Trust for Estate Planning

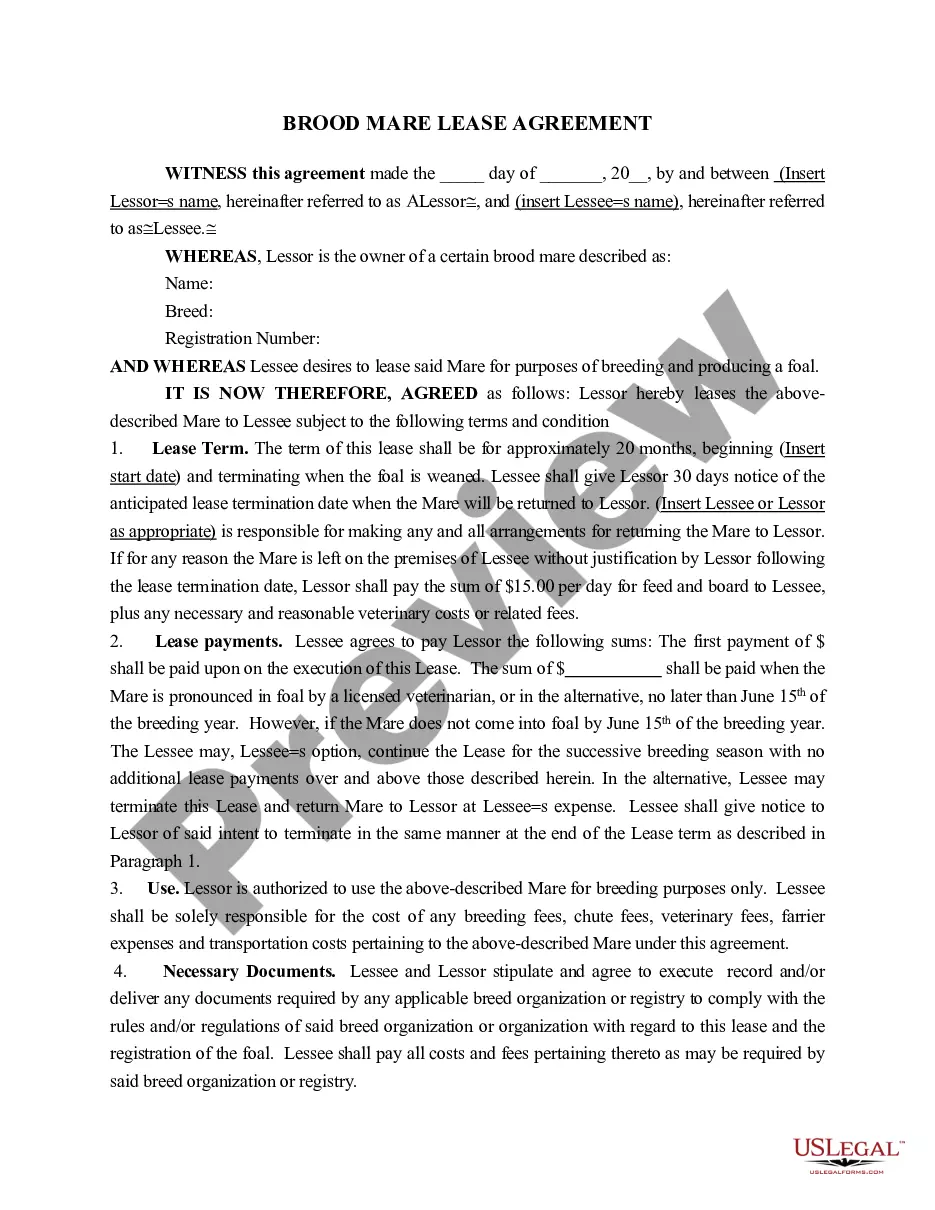

Description

How to fill out San Diego California Fideicomiso Revocable Para Planificación Patrimonial?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the San Diego Revocable Trust for Estate Planning, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Revocable Trust for Estate Planning from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Diego Revocable Trust for Estate Planning:

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!