Title: Understanding the Houston Texas General Form of Revocable Trust Agreement: Types and Detailed Description Introduction: In Houston, Texas, individuals often opt for a General Form of Revocable Trust Agreement to effectively manage their assets and plan for their future. This legally binding agreement allows the granter (person creating the trust) to retain control over their assets during their lifetime while ensuring a seamless transfer of wealth upon their death. Let's explore the intricacies of the Houston Texas General Form of Revocable Trust Agreement. Key Features of a Houston Texas General Form of Revocable Trust Agreement: 1. Comprehensive Asset Management: The General Form of Revocable Trust Agreement empowers the granter to consolidate all their assets, such as real estate, financial accounts, personal property, and investments, into a single trust entity. This centralized approach simplifies asset management and provides a holistic view to streamline financial affairs. 2. Granter's Retention of Control: Unlike irrevocable trusts, which offer limited control, a revocable trust allows the granter to make changes or even revoke the trust entirely at any time during their lifetime. Consequently, the granter retains the flexibility to manage their assets as they see fit. 3. Revocability and Flexibility: The Houston Texas General Form of Revocable Trust Agreement grants the granter the freedom to alter beneficiaries, modify distribution percentages, appoint trustees, or add or remove assets from the trust. This flexibility ensures that the trust evolves along with the granter's changing circumstances and intentions. 4. Avoidance of Probate: One of the significant benefits of using a revocable trust is the avoidance of probate. By transferring assets into the trust, the granter ensures that their estate does not go through the costly and time-consuming probate process, thus expediting asset distribution and reducing legal complexities. Types of Houston Texas General Form of Revocable Trust Agreements: 1. Basic Revocable Trust Agreement: The basic form of a Houston Texas General Form of Revocable Trust Agreement provides standard clauses and provisions to meet general estate planning needs. It covers asset distribution, trustee appointments, and other essential elements. 2. Asset-Specific Revocable Trust Agreement: This type of trust agreement focuses on managing specific types of assets, such as real estate or business interests. It tailors the trust's language and provisions to effectively address the unique considerations associated with those specific assets. 3. Survivor's Trust Agreement: A Survivor's Trust Agreement is often used in joint revocable trust setups. It allows the surviving spouse or partner to maintain control over the trust assets after the first spouse's death, ensuring seamless administration and asset distribution. 4. Special Needs/Henson Trust Agreement: Designed to meet the unique requirements of individuals with disabilities, the Special Needs Trust Agreement (also known as a Henson Trust) protects the beneficiary's eligibility for government benefits while providing supplemental financial support. Conclusion: The Houston Texas General Form of Revocable Trust Agreement offers residents a flexible and efficient means to manage their assets, avoid probate, and provide for the seamless transfer of wealth. By understanding the different types of trust agreements available, individuals can tailor their estate planning according to their specific needs and goals. Seek legal advice to ensure compliance with Texas state laws and create a trust agreement that best aligns with your individual circumstances.

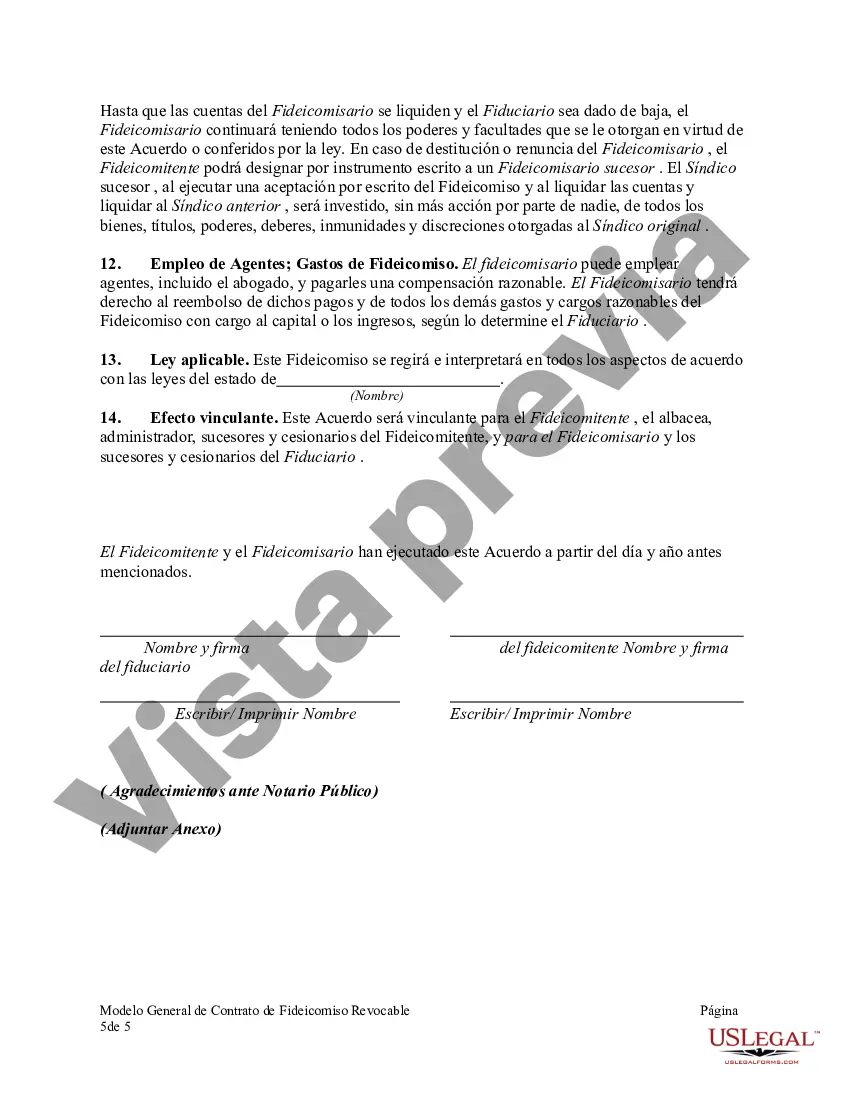

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Forma General de Contrato de Fideicomiso Revocable - General Form of Revocable Trust Agreement

Description

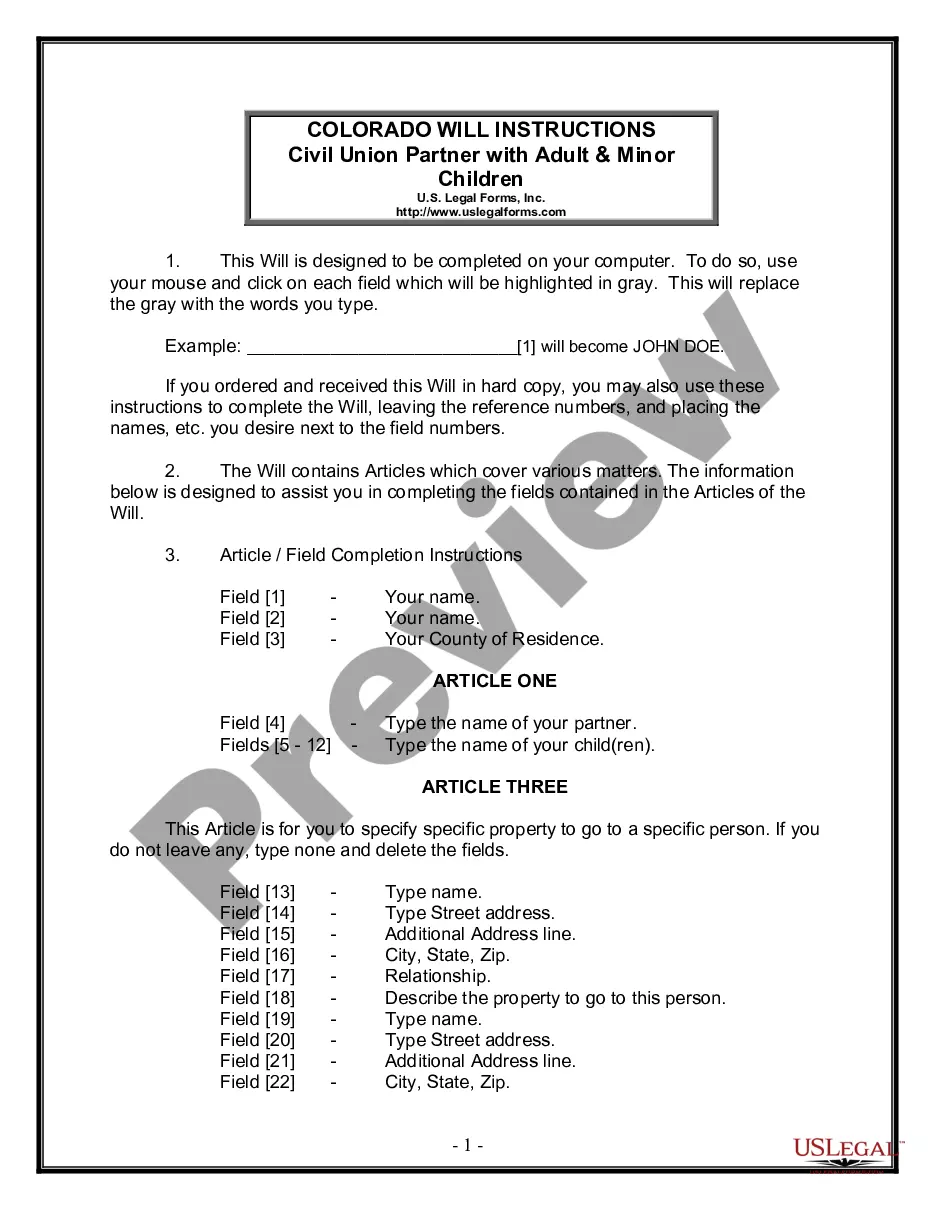

How to fill out Houston Texas Forma General De Contrato De Fideicomiso Revocable?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Houston General Form of Revocable Trust Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can purchase and download Houston General Form of Revocable Trust Agreement.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Houston General Form of Revocable Trust Agreement.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Houston General Form of Revocable Trust Agreement, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you have to cope with an exceptionally complicated case, we recommend using the services of a lawyer to check your document before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-compliant documents effortlessly!