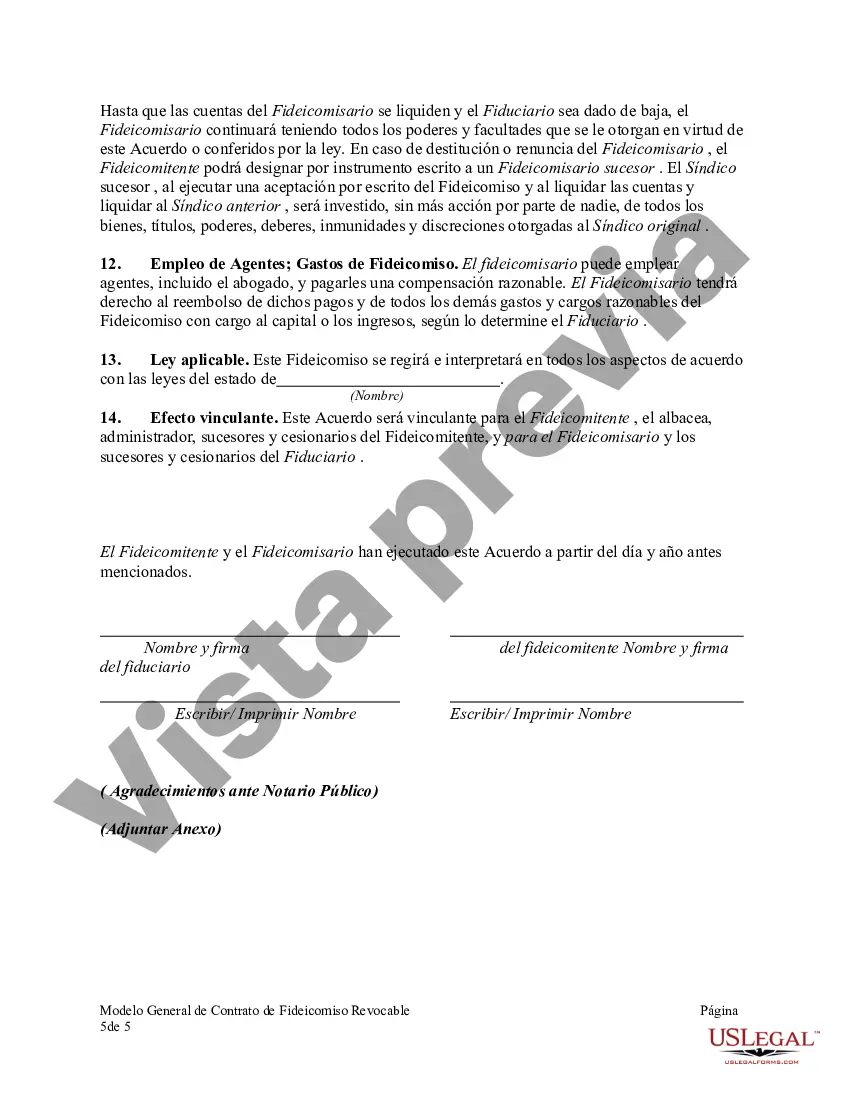

Philadelphia, Pennsylvania, is a vibrant and historic city known for its rich culture, iconic landmarks, and spirited sports community. It is home to a variety of legal processes, including the creation and management of trusts. One such legal document is the General Form of Revocable Trust Agreement in Philadelphia, Pennsylvania. A General Form of Revocable Trust Agreement is a legal agreement created by individuals or couples residing in Philadelphia, Pennsylvania, to establish a trust fund for the management and distribution of their assets during their lifetime and after their death. Also known as a living trust or inter vivos trust, this flexible legal tool allows the granter(s) to maintain control and ownership of their assets while providing for its seamless transfer to beneficiaries upon their passing. The Philadelphia, Pennsylvania, General Form of Revocable Trust Agreement typically contains important provisions such as the identification of the granter(s), successor trustees, beneficiaries, and specific instructions regarding asset distribution. This trust agreement can cover a wide range of assets, including but not limited to real estate, financial accounts, securities, businesses, and personal belongings. Additionally, the General Form of Revocable Trust Agreement in Philadelphia, Pennsylvania, allows for customization to meet the specific needs and goals of the granter(s). For instance, it may include provisions for the care of minor children, charitable donations, special needs beneficiaries, or the establishment of educational funds. There may be various types of General Form of Revocable Trust Agreements available in Philadelphia, Pennsylvania, depending on the specific circumstances of the granter(s). These may include: 1. Individual Revocable Trust Agreement: This type of trust agreement is created by a single individual in Philadelphia, Pennsylvania, to manage their assets during their lifetime and distribute them according to their wishes upon death. 2. Joint Revocable Trust Agreement: A joint trust agreement is created by a couple in Philadelphia, Pennsylvania, typically married or in a domestic partnership. Both partners serve as granters, giving them equal control and ownership over the trust assets, and the provisions of the agreement apply to both partners. 3. Revocable Trust Agreement with Special Needs Provisions: This type of trust agreement is designed to address the unique financial needs of individuals with special needs residing in Philadelphia, Pennsylvania. It ensures that the assets placed in the trust do not jeopardize their eligibility for government benefits, while still providing necessary care and support. In conclusion, the General Form of Revocable Trust Agreement in Philadelphia, Pennsylvania, is a legal document that enables individuals or couples to establish a comprehensive and flexible plan for their assets. Whether through an individual, joint, or special needs trust agreement, this popular estate planning tool offers peace of mind, financial protection, and the efficient transfer of assets in accordance with the granter(s)' wishes and Philadelphia, Pennsylvania's legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Forma General de Contrato de Fideicomiso Revocable - General Form of Revocable Trust Agreement

Description

How to fill out Philadelphia Pennsylvania Forma General De Contrato De Fideicomiso Revocable?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Philadelphia General Form of Revocable Trust Agreement.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Philadelphia General Form of Revocable Trust Agreement will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to get the Philadelphia General Form of Revocable Trust Agreement:

- Ensure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Philadelphia General Form of Revocable Trust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Los representantes legales de una persona juridica deberan realizar el tramite a traves del servicio con clave fiscal Presentaciones digitales, opcion Vinculacion de clave fiscal para personas juridicas (ver requisitos).

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Suggested clip 58 seconds ¿"Como se arma" un Fideicomiso Inmobiliario de Construccion? YouTube Start of suggested clip End of suggested clip

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Para completar el formulario 185 se debera bajar el aplicativo SIAP de la AFIP y luego a traves del modulo RNS proceder con la carga de datos en el formulario. Una vez finalizada la carga debera generar el archivo para transferencia electronica de datos.

Para la documentacion a presentar debera tenerse en cuenta el tipo de fideicomiso que se trate: · Fideicomiso no financiero: Presenta fotocopia del contrato de fideicomiso y segun sea el fiduciario persona fisica o juridica, debera acompanarse tambien la documentacion que, para cada tipo de sujeto corresponda.

Hay contrato de fideicomiso cuando una parte, llamada fiduciante, transmite o se compromete a transmitir la propiedad de bienes a otra persona denominada fiduciario, quien se obliga a ejercerla en beneficio de otra llamada beneficiario, que se designa en el contrato, y a transmitirla al cumplimiento de un plazo o