A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

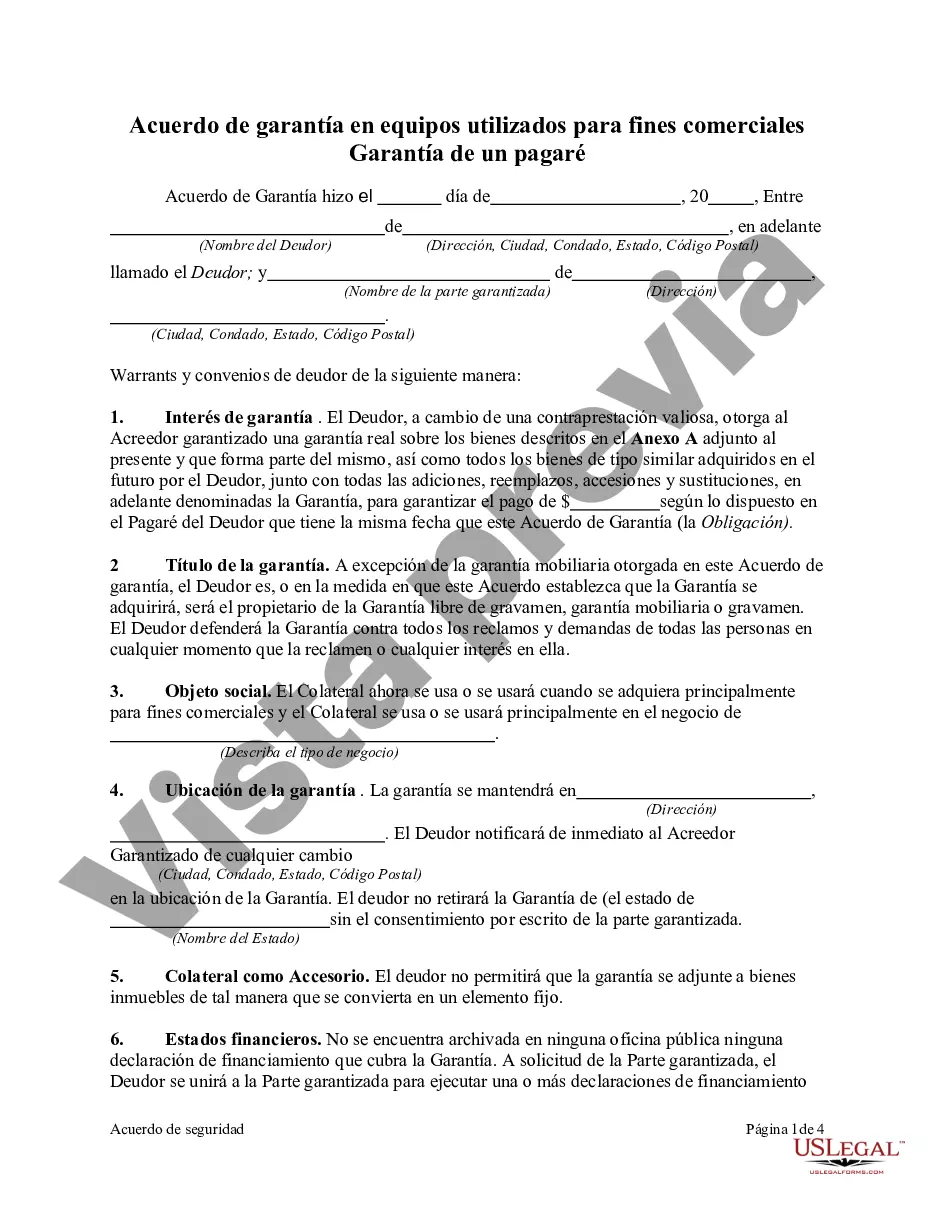

Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding document that helps protect both the equipment provider and the borrower in a business transaction involving the use of equipment. It sets forth the terms and conditions regarding the security interest in the equipment being used as collateral to secure a promissory note. The security agreement is designed to ensure that the lender has a legal claim over the equipment in case the borrower defaults on the repayment of the promissory note. It grants the lender the right to repossess or sell the equipment to recover the outstanding debt. This agreement provides a sense of security to the lender, making it more likely for them to offer favorable loan terms or equipment leasing options. There are different types of Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note, including: 1. Purchase money security interest (PSI) agreement: This type of agreement is used when the borrowed funds are explicitly used to purchase the equipment. In this case, the lender has priority over other creditors in claiming the equipment if the borrower defaults. 2. Attachment agreement: This agreement ensures that the lender's security interest "attaches" to the equipment and becomes enforceable against the borrower. It defines the conditions under which the security interest is deemed attached to the equipment. 3. Perfection agreement: This agreement specifies the steps taken by the lender to perfect their security interest in the equipment. Perfection is important as it establishes the lender's priority over other parties who may claim an interest in the equipment. 4. UCC-1 financing statement: This document is filed with the appropriate state agency to publicly establish the lender's security interest in the equipment. It includes details about the lender, borrower, and the collateral being used to secure the loan. 5. Guaranty agreement: In some cases, a third-party guarantor may be required to guarantee the repayment of the promissory note. This agreement outlines the responsibilities and obligations of the guarantor in case the borrower defaults. It is important for both the lender and the borrower to carefully review and understand the terms of the Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Seeking legal advice or assistance during the drafting and signing of this agreement is highly recommended ensuring compliance with applicable laws and to protect the rights and interests of both parties involved.Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding document that helps protect both the equipment provider and the borrower in a business transaction involving the use of equipment. It sets forth the terms and conditions regarding the security interest in the equipment being used as collateral to secure a promissory note. The security agreement is designed to ensure that the lender has a legal claim over the equipment in case the borrower defaults on the repayment of the promissory note. It grants the lender the right to repossess or sell the equipment to recover the outstanding debt. This agreement provides a sense of security to the lender, making it more likely for them to offer favorable loan terms or equipment leasing options. There are different types of Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note, including: 1. Purchase money security interest (PSI) agreement: This type of agreement is used when the borrowed funds are explicitly used to purchase the equipment. In this case, the lender has priority over other creditors in claiming the equipment if the borrower defaults. 2. Attachment agreement: This agreement ensures that the lender's security interest "attaches" to the equipment and becomes enforceable against the borrower. It defines the conditions under which the security interest is deemed attached to the equipment. 3. Perfection agreement: This agreement specifies the steps taken by the lender to perfect their security interest in the equipment. Perfection is important as it establishes the lender's priority over other parties who may claim an interest in the equipment. 4. UCC-1 financing statement: This document is filed with the appropriate state agency to publicly establish the lender's security interest in the equipment. It includes details about the lender, borrower, and the collateral being used to secure the loan. 5. Guaranty agreement: In some cases, a third-party guarantor may be required to guarantee the repayment of the promissory note. This agreement outlines the responsibilities and obligations of the guarantor in case the borrower defaults. It is important for both the lender and the borrower to carefully review and understand the terms of the Bronx New York Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Seeking legal advice or assistance during the drafting and signing of this agreement is highly recommended ensuring compliance with applicable laws and to protect the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.