A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

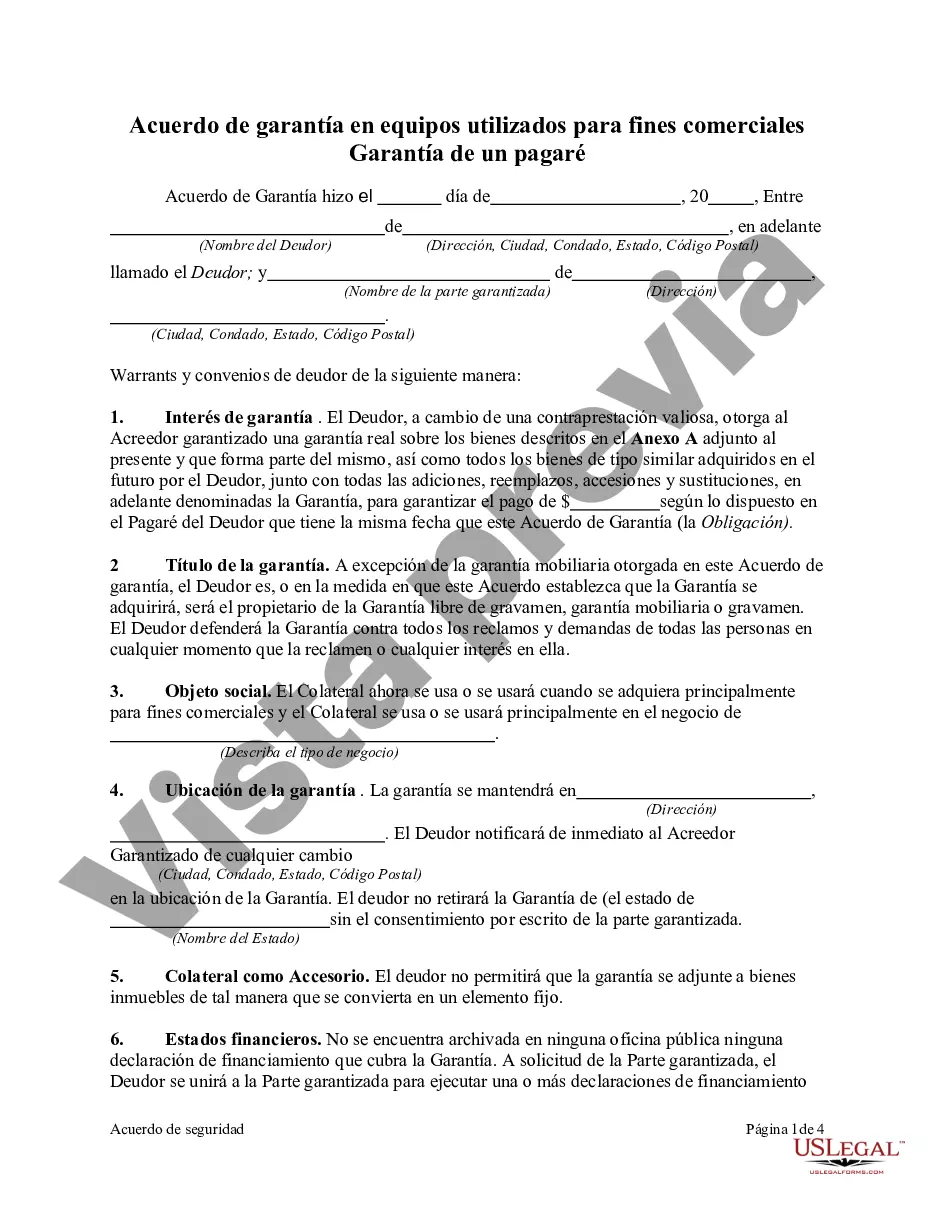

A Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal contract designed to protect both parties involved in a business transaction where equipment is being used as collateral. This agreement ensures that the lender has a security interest in the equipment being used as collateral, ensuring repayment of the promissory note. The Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial document in commercial lending, as it provides security to the lender and offers legal protection to the borrower. By signing this agreement, the borrower allows the lender to claim the identified equipment in case of default on the promissory note. The Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note serves as a legal record of the transaction, outlining the responsibilities and rights of both parties. It typically includes the identification of the equipment being used as collateral, the terms of the promissory note, and the rights and remedies available to the lender in case of default. Different types of Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include variations based on specific circumstances or customized agreements. Some common variations could be: 1. General Equipment Security Agreement: This type of agreement covers a broad range of equipment being used as collateral for a promissory note. It is applicable to various types of businesses and industries. 2. Specialized Equipment Security Agreement: This type of agreement is specific to a particular industry or equipment category. It may include additional provisions addressing unique considerations related to the specialized equipment being used as collateral. 3. Leasehold Equipment Security Agreement: In situations where the equipment is leased rather than owned by the borrower, this agreement secures the lender's interest in the leased equipment and the promissory note associated with it. 4. Purchase Money Security Agreement: This type of agreement is used when the promissory note is directly linked to the purchase of the equipment. It ensures that the lender has a priority claim on the financed equipment if default occurs. 5. Floating Lien Agreement: This variation allows for flexibility in securing future equipment acquisitions. It creates a floating security interest that automatically attaches to subsequently acquired equipment, subject to certain limitations stated in the agreement. It is crucial for both parties to carefully review and understand the terms of the Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Consulting with a legal professional is advisable to ensure compliance with local laws and to address any specific requirements or modifications needed based on the unique circumstances of the transaction.A Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal contract designed to protect both parties involved in a business transaction where equipment is being used as collateral. This agreement ensures that the lender has a security interest in the equipment being used as collateral, ensuring repayment of the promissory note. The Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial document in commercial lending, as it provides security to the lender and offers legal protection to the borrower. By signing this agreement, the borrower allows the lender to claim the identified equipment in case of default on the promissory note. The Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note serves as a legal record of the transaction, outlining the responsibilities and rights of both parties. It typically includes the identification of the equipment being used as collateral, the terms of the promissory note, and the rights and remedies available to the lender in case of default. Different types of Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include variations based on specific circumstances or customized agreements. Some common variations could be: 1. General Equipment Security Agreement: This type of agreement covers a broad range of equipment being used as collateral for a promissory note. It is applicable to various types of businesses and industries. 2. Specialized Equipment Security Agreement: This type of agreement is specific to a particular industry or equipment category. It may include additional provisions addressing unique considerations related to the specialized equipment being used as collateral. 3. Leasehold Equipment Security Agreement: In situations where the equipment is leased rather than owned by the borrower, this agreement secures the lender's interest in the leased equipment and the promissory note associated with it. 4. Purchase Money Security Agreement: This type of agreement is used when the promissory note is directly linked to the purchase of the equipment. It ensures that the lender has a priority claim on the financed equipment if default occurs. 5. Floating Lien Agreement: This variation allows for flexibility in securing future equipment acquisitions. It creates a floating security interest that automatically attaches to subsequently acquired equipment, subject to certain limitations stated in the agreement. It is crucial for both parties to carefully review and understand the terms of the Cuyahoga Ohio Security Agreement in Equipment for Business Purposes — Securing Promissory Note. Consulting with a legal professional is advisable to ensure compliance with local laws and to address any specific requirements or modifications needed based on the unique circumstances of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.