A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

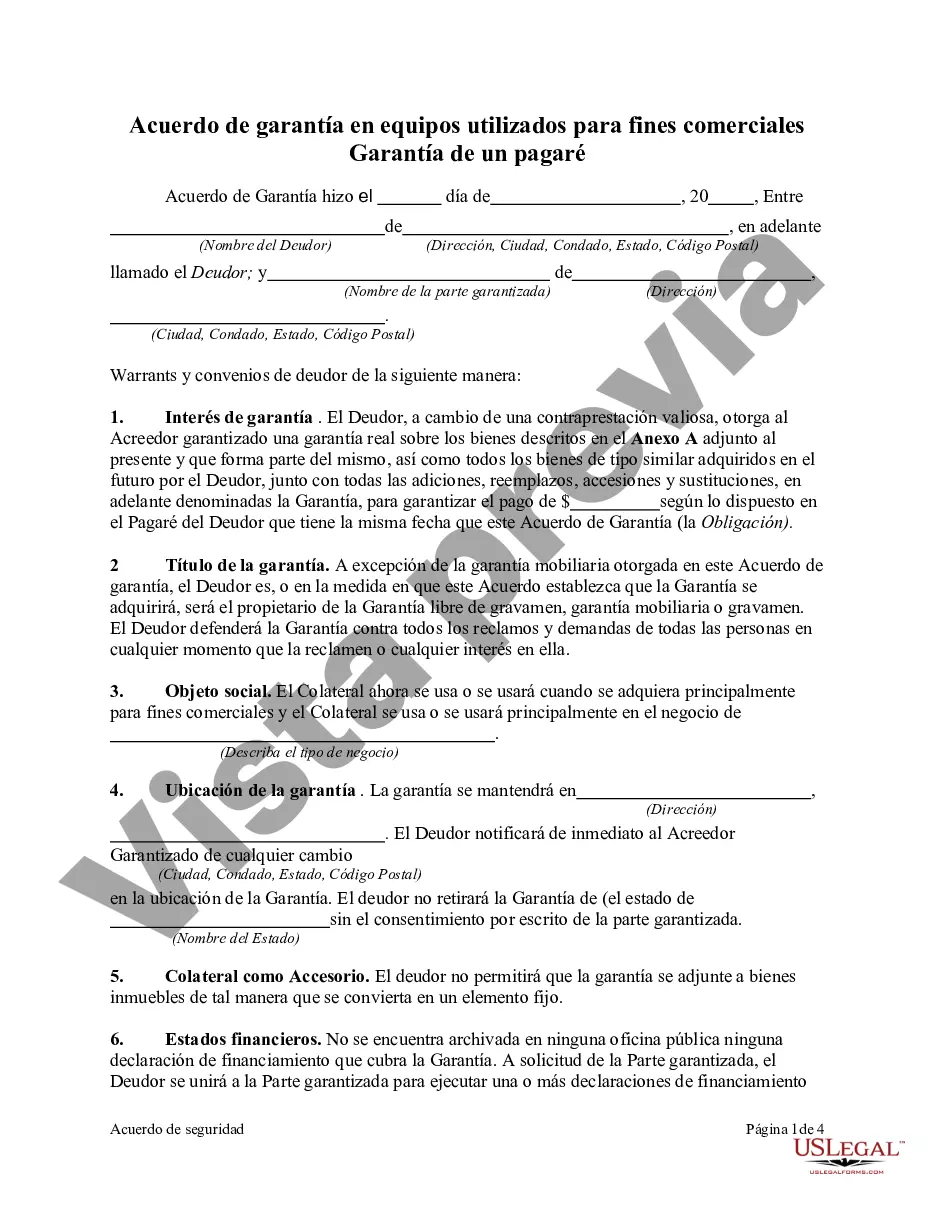

Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that serves as a contract between a borrower and a lender regarding the use of equipment to secure a promissory note. This agreement ensures that the lender has a legal claim to the equipment in the event of default or non-payment by the borrower. It provides a detailed outline of the terms and conditions to safeguard the lender's interests. The Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes the following key elements: 1. Parties Involved: It identifies the borrower and the lender, stating their legal names and contact details as well as any other relevant information. 2. Equipment Description: This section enumerates the equipment that will act as collateral for the loan. It includes detailed descriptions, such as make, model, serial number, and any other relevant identifying information. 3. Security Interest: The agreement clearly states that the lender has a security interest in the equipment mentioned. It specifies that this interest is in relation to the borrower's obligations under the promissory note. 4. Perfection of Security Interest: This section explains the steps required to perfect the security interest. It may include the necessity of filing financing statements with the appropriate authorities or taking other legal actions to ensure the priority of the lender's claim. 5. Default and Remedies: The agreement outlines the events that can trigger a default, such as non-payment or breach of other obligations under the promissory note. It also describes the remedies available to the lender in case of default, which may include repossession and sale of the equipment. 6. Insurance and Maintenance: The agreement often requires the borrower to maintain appropriate insurance coverage for the equipment and to keep it in good working condition throughout the loan term. Types of Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include: 1. Fixed Equipment Agreement: This type of security agreement focuses on specific fixed assets or machinery used in a business. It provides detailed descriptions and identifies the equipment's unique features and value. 2. Floating Equipment Agreement: A floating equipment agreement encompasses a broader range of assets, allowing the borrower to use various types of equipment as collateral. It is commonly used when multiple types of equipment are involved in the business operations. 3. Specific Purpose Equipment Agreement: This agreement is designed for specific equipment used exclusively for certain purposes in the business. It may include specialized machinery or tools required for specific industry operations. In conclusion, the Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial legal document that protects the interests of lenders by establishing a claim to specific equipment used as collateral against a promissory note. Various types of agreements exist based on the nature of the equipment and its application in the borrower's business.Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that serves as a contract between a borrower and a lender regarding the use of equipment to secure a promissory note. This agreement ensures that the lender has a legal claim to the equipment in the event of default or non-payment by the borrower. It provides a detailed outline of the terms and conditions to safeguard the lender's interests. The Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes the following key elements: 1. Parties Involved: It identifies the borrower and the lender, stating their legal names and contact details as well as any other relevant information. 2. Equipment Description: This section enumerates the equipment that will act as collateral for the loan. It includes detailed descriptions, such as make, model, serial number, and any other relevant identifying information. 3. Security Interest: The agreement clearly states that the lender has a security interest in the equipment mentioned. It specifies that this interest is in relation to the borrower's obligations under the promissory note. 4. Perfection of Security Interest: This section explains the steps required to perfect the security interest. It may include the necessity of filing financing statements with the appropriate authorities or taking other legal actions to ensure the priority of the lender's claim. 5. Default and Remedies: The agreement outlines the events that can trigger a default, such as non-payment or breach of other obligations under the promissory note. It also describes the remedies available to the lender in case of default, which may include repossession and sale of the equipment. 6. Insurance and Maintenance: The agreement often requires the borrower to maintain appropriate insurance coverage for the equipment and to keep it in good working condition throughout the loan term. Types of Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include: 1. Fixed Equipment Agreement: This type of security agreement focuses on specific fixed assets or machinery used in a business. It provides detailed descriptions and identifies the equipment's unique features and value. 2. Floating Equipment Agreement: A floating equipment agreement encompasses a broader range of assets, allowing the borrower to use various types of equipment as collateral. It is commonly used when multiple types of equipment are involved in the business operations. 3. Specific Purpose Equipment Agreement: This agreement is designed for specific equipment used exclusively for certain purposes in the business. It may include specialized machinery or tools required for specific industry operations. In conclusion, the Fairfax Virginia Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial legal document that protects the interests of lenders by establishing a claim to specific equipment used as collateral against a promissory note. Various types of agreements exist based on the nature of the equipment and its application in the borrower's business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.