A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

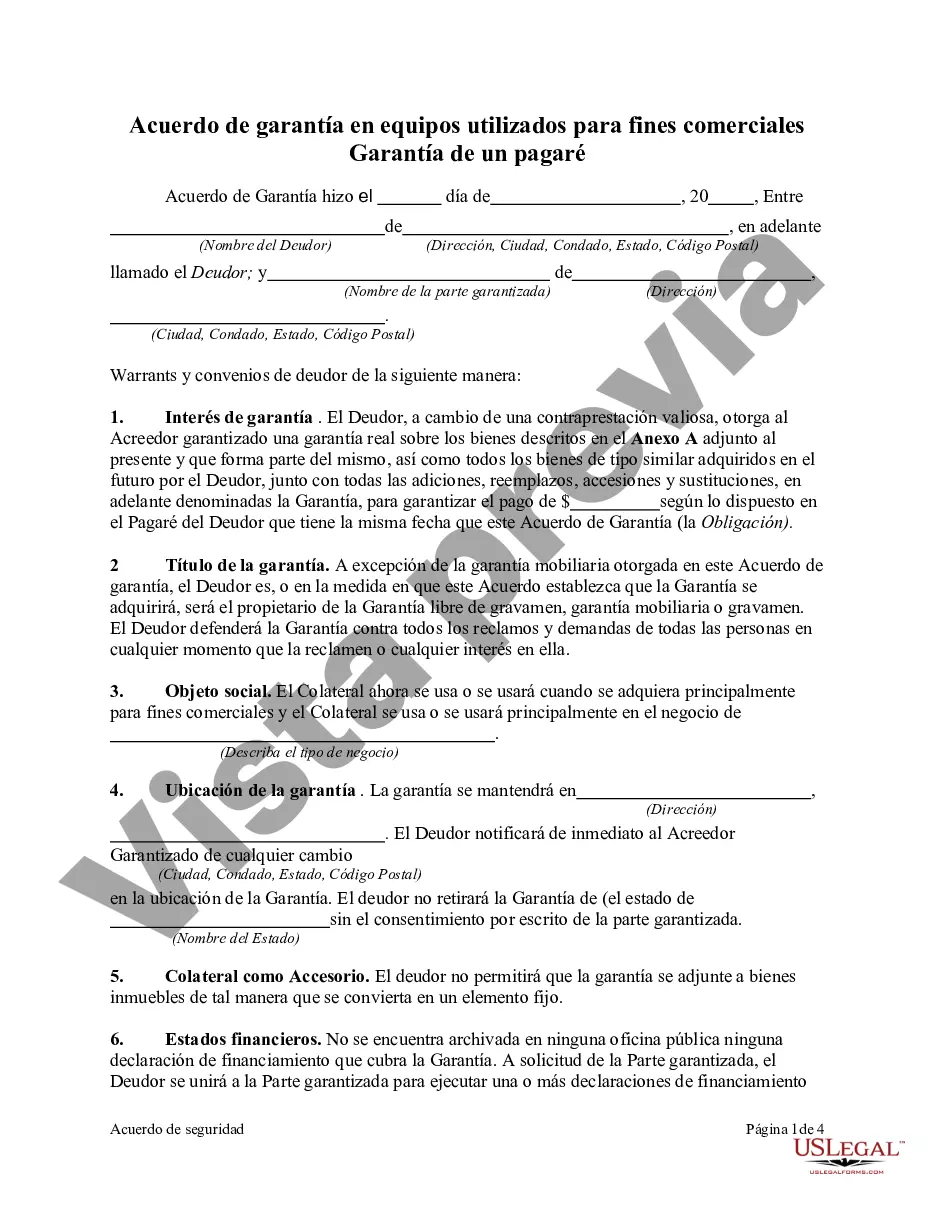

The Harris Texas Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions regarding the use of equipment for business purposes. This agreement serves as a security measure to protect the lender's interest in case the borrower fails to repay the promissory note. Keywords: Harris Texas, security agreement, equipment, business purposes, promissory note. There are various types of Harris Texas Security Agreements in Equipment for Business Purposes — Securing Promissory Note, including: 1. General Security Agreement: This type of agreement is the most common and covers a wide range of equipment used for business purposes. It provides a comprehensive and detailed description of the equipment being pledged as collateral. 2. Specific Security Agreement: Unlike the general security agreement, this type focuses on specific pieces of equipment or assets that the borrower is using as collateral. It provides a detailed description of each item and its value. 3. Floating Security Agreement: This type of security agreement is flexible and allows the borrower to add or remove equipment from the collateral without having to amend the agreement. It is commonly used when the borrower's inventory or equipment is constantly changing. 4. Fixed Asset Security Agreement: This agreement is specifically used for securing promissory notes with fixed assets, such as machinery or vehicles. It outlines the details of the fixed assets being used as collateral. 5. Floating Charge Security Agreement: This type allows the borrower to use a floating charge on all present and future assets of the business. It provides a broad scope of security for the lender in case the borrower defaults on the promissory note. Overall, a Harris Texas Security Agreement in Equipment for Business Purposes — Securing Promissory Note plays a vital role in protecting the lender's interest and ensuring that the borrower meets their obligations. It serves as a legal contract that defines the terms and conditions regarding the use of equipment as collateral, providing security and peace of mind for both parties involved.The Harris Texas Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions regarding the use of equipment for business purposes. This agreement serves as a security measure to protect the lender's interest in case the borrower fails to repay the promissory note. Keywords: Harris Texas, security agreement, equipment, business purposes, promissory note. There are various types of Harris Texas Security Agreements in Equipment for Business Purposes — Securing Promissory Note, including: 1. General Security Agreement: This type of agreement is the most common and covers a wide range of equipment used for business purposes. It provides a comprehensive and detailed description of the equipment being pledged as collateral. 2. Specific Security Agreement: Unlike the general security agreement, this type focuses on specific pieces of equipment or assets that the borrower is using as collateral. It provides a detailed description of each item and its value. 3. Floating Security Agreement: This type of security agreement is flexible and allows the borrower to add or remove equipment from the collateral without having to amend the agreement. It is commonly used when the borrower's inventory or equipment is constantly changing. 4. Fixed Asset Security Agreement: This agreement is specifically used for securing promissory notes with fixed assets, such as machinery or vehicles. It outlines the details of the fixed assets being used as collateral. 5. Floating Charge Security Agreement: This type allows the borrower to use a floating charge on all present and future assets of the business. It provides a broad scope of security for the lender in case the borrower defaults on the promissory note. Overall, a Harris Texas Security Agreement in Equipment for Business Purposes — Securing Promissory Note plays a vital role in protecting the lender's interest and ensuring that the borrower meets their obligations. It serves as a legal contract that defines the terms and conditions regarding the use of equipment as collateral, providing security and peace of mind for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.