A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

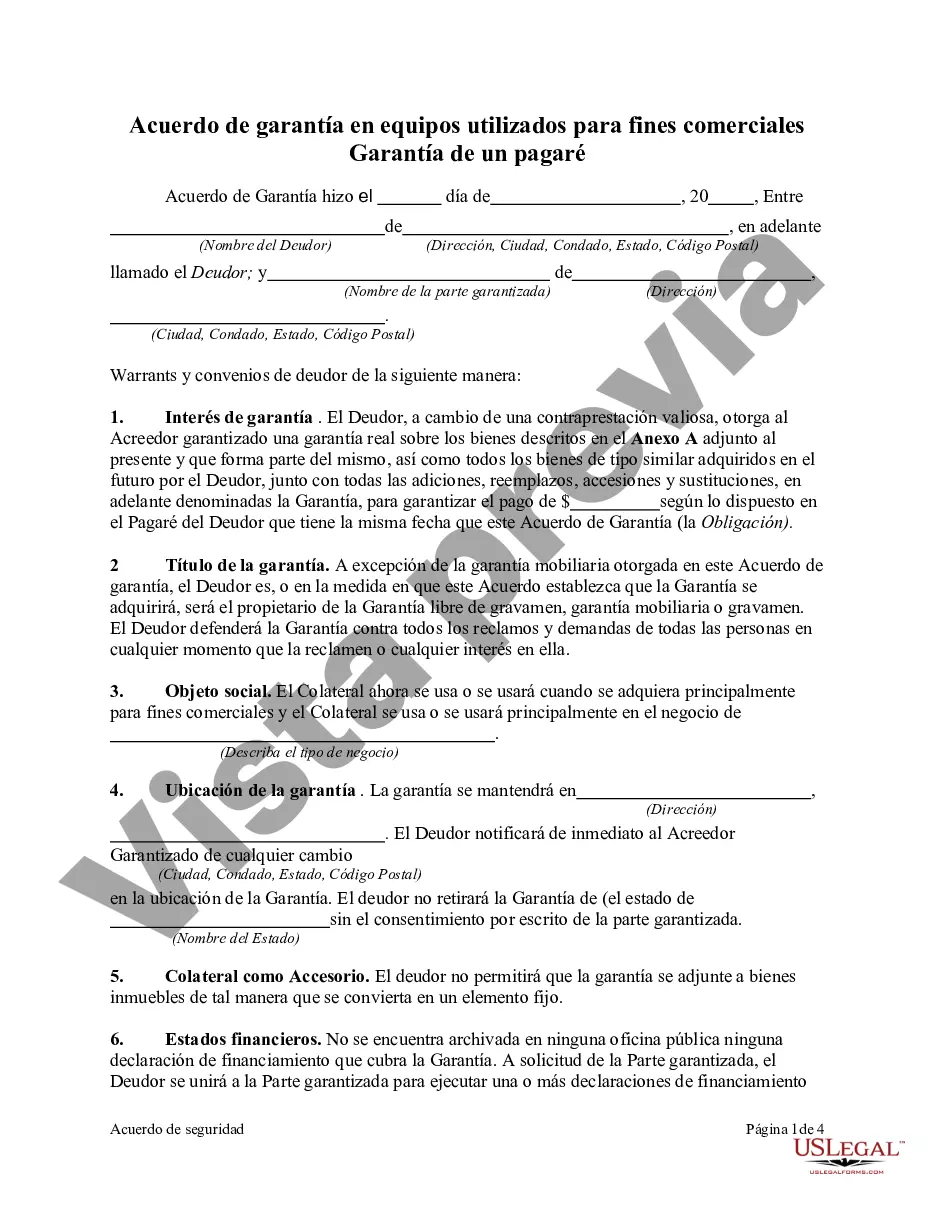

The Mecklenburg North Carolina Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions for securing a promissory note with equipment owned by a business. This agreement is commonly used in Mecklenburg County, North Carolina, to provide security to lenders or creditors in case of default or non-payment by the borrower. The purpose of this security agreement is to establish a lien on the equipment owned by the borrower, ensuring that the lender has the right to seize and sell the equipment to recover the outstanding debt if the borrower fails to repay the promissory note. This agreement is crucial for lenders as it provides an added layer of protection and reduces the risk associated with lending money. This document includes various key elements, such as: 1. Identification of the parties involved: The security agreement clearly identifies the borrower (the individual or business who is obtaining the loan) and the lender (the party providing the loan). 2. Description of the equipment: The agreement provides a detailed description of the equipment being pledged as collateral. This includes the make, model, serial number, and any other necessary identifying information. 3. Secured debt: The agreement specifies the amount of money borrowed by the borrower and secured by the equipment. 4. Security interest: The agreement establishes a security interest in the equipment, granting the lender the right to repossess and sell the equipment if the borrower fails to fulfill their obligations. 5. Default provisions: The agreement outlines the conditions under which the borrower would be considered in default, such as non-payment or other contractual breaches. 6. Enforcement of the security interest: The agreement details the rights and remedies available to the lender in case of default, including the right to take possession of the equipment and sell it to recover the outstanding debt. 7. Governing law: The agreement specifies that Mecklenburg County, North Carolina law governs the interpretation and enforcement of the security agreement. Different types or variations of this security agreement may exist depending on the specific terms negotiated between the lender and the borrower. These variations could include modifications to the default provisions, interest rates, repayment schedules, or additional provisions depending on the nature of the business, the value of the equipment, and the preferences of the parties involved. In summary, the Mecklenburg North Carolina Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal contract that ensures lenders are protected by establishing a security interest in equipment owned by a borrower. By detailing the terms and conditions of securing the promissory note with equipment, this agreement helps minimize risks and safeguard the interests of both parties involved in the loan agreement.The Mecklenburg North Carolina Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions for securing a promissory note with equipment owned by a business. This agreement is commonly used in Mecklenburg County, North Carolina, to provide security to lenders or creditors in case of default or non-payment by the borrower. The purpose of this security agreement is to establish a lien on the equipment owned by the borrower, ensuring that the lender has the right to seize and sell the equipment to recover the outstanding debt if the borrower fails to repay the promissory note. This agreement is crucial for lenders as it provides an added layer of protection and reduces the risk associated with lending money. This document includes various key elements, such as: 1. Identification of the parties involved: The security agreement clearly identifies the borrower (the individual or business who is obtaining the loan) and the lender (the party providing the loan). 2. Description of the equipment: The agreement provides a detailed description of the equipment being pledged as collateral. This includes the make, model, serial number, and any other necessary identifying information. 3. Secured debt: The agreement specifies the amount of money borrowed by the borrower and secured by the equipment. 4. Security interest: The agreement establishes a security interest in the equipment, granting the lender the right to repossess and sell the equipment if the borrower fails to fulfill their obligations. 5. Default provisions: The agreement outlines the conditions under which the borrower would be considered in default, such as non-payment or other contractual breaches. 6. Enforcement of the security interest: The agreement details the rights and remedies available to the lender in case of default, including the right to take possession of the equipment and sell it to recover the outstanding debt. 7. Governing law: The agreement specifies that Mecklenburg County, North Carolina law governs the interpretation and enforcement of the security agreement. Different types or variations of this security agreement may exist depending on the specific terms negotiated between the lender and the borrower. These variations could include modifications to the default provisions, interest rates, repayment schedules, or additional provisions depending on the nature of the business, the value of the equipment, and the preferences of the parties involved. In summary, the Mecklenburg North Carolina Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal contract that ensures lenders are protected by establishing a security interest in equipment owned by a borrower. By detailing the terms and conditions of securing the promissory note with equipment, this agreement helps minimize risks and safeguard the interests of both parties involved in the loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.