A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

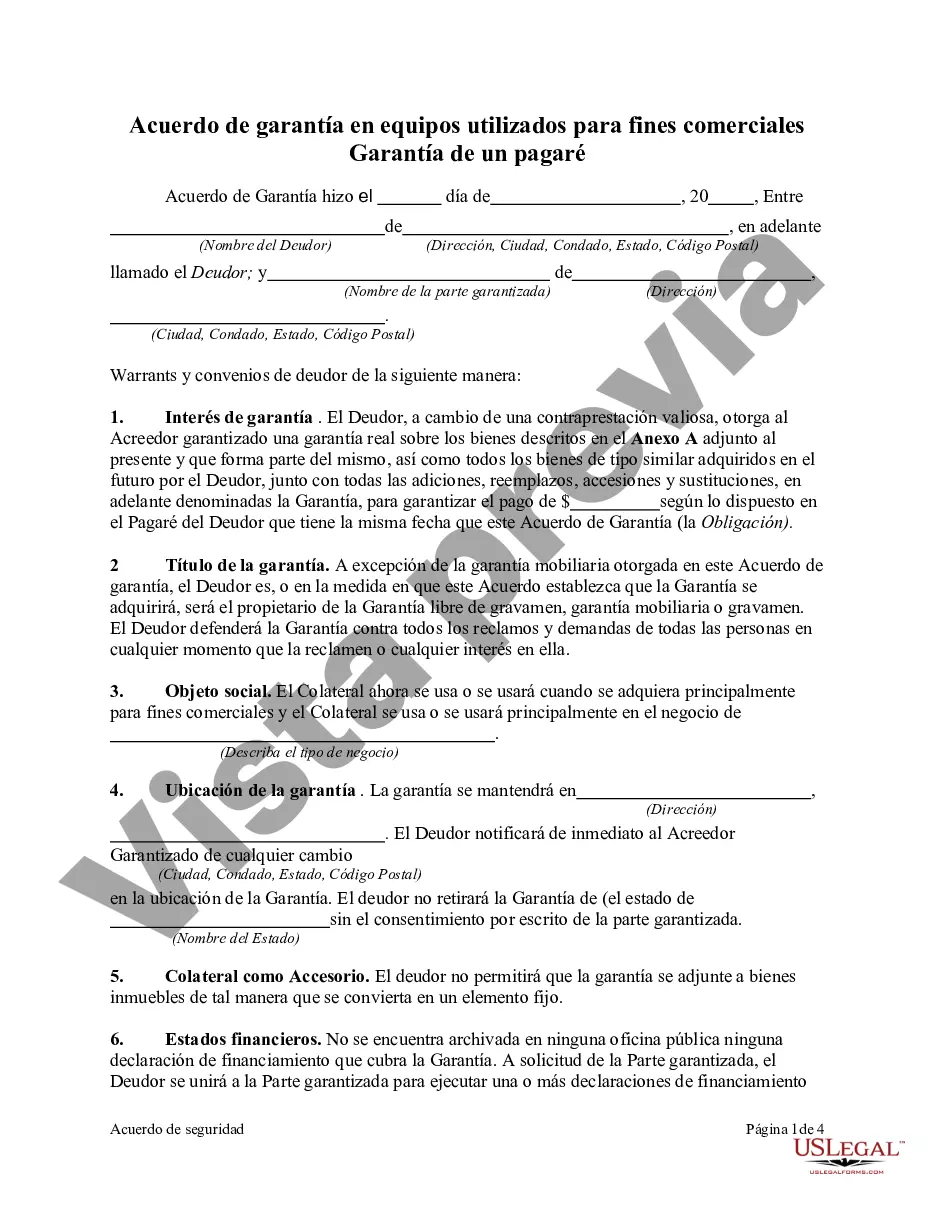

Middlesex Massachusetts Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding document designed to create a security interest in the equipment owned by a business entity. It ensures that the lender has a right to seize and sell the equipment in case the borrower defaults on their payment obligations under the promissory note. This type of security agreement is crucial for both the borrower and the lender as it protects their respective interests. By securing the promissory note with the equipment, the lender can have a level of assurance that they have collateral to rely on if the borrower fails to repay the loan. Similarly, the borrower can gain access to financing options by providing the lender with this added security. Keywords: Middlesex Massachusetts, security agreement, equipment, business purposes, promissory note, collateral, financing options, secured loan, borrower, lender. There are different types of Middlesex Massachusetts Security Agreements in Equipment for Business Purposes — Securing Promissory Note, such as: 1. Specific Equipment Security Agreement: This type of security agreement identifies and describes specific pieces of equipment that will serve as collateral for the promissory note. It provides a detailed inventory of the equipment being secured and outlines the rights and responsibilities of both the borrower and the lender. 2. Floating Equipment Security Agreement: In contrast to the specific equipment security agreement, a floating equipment security agreement encompasses a broader range of equipment that the borrower may own at any given time. This type of agreement enables the borrower to use different equipment as collateral without having to amend the security agreement each time equipment changes. 3. PSI Equipment Security Agreement: Purchase Money Security Interest (PSI) equipment security agreement is used when the lender provides financing specifically for the purchase of equipment. In this scenario, the lender has a superior claim over the equipment compared to any existing creditors, as the loan proceeds are used to acquire the equipment. 4. Multi-Party Equipment Security Agreement: This type of security agreement is relevant when multiple parties are involved in financing the equipment purchase. It helps establish the rights and priorities of each party involved, ensuring that their respective interests are protected. Regardless of the type of Middlesex Massachusetts Security Agreement in Equipment for Business Purposes — Securing Promissory Note, it is important to consult with legal professionals and ensure that all relevant state laws and regulations are adhered to.Middlesex Massachusetts Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding document designed to create a security interest in the equipment owned by a business entity. It ensures that the lender has a right to seize and sell the equipment in case the borrower defaults on their payment obligations under the promissory note. This type of security agreement is crucial for both the borrower and the lender as it protects their respective interests. By securing the promissory note with the equipment, the lender can have a level of assurance that they have collateral to rely on if the borrower fails to repay the loan. Similarly, the borrower can gain access to financing options by providing the lender with this added security. Keywords: Middlesex Massachusetts, security agreement, equipment, business purposes, promissory note, collateral, financing options, secured loan, borrower, lender. There are different types of Middlesex Massachusetts Security Agreements in Equipment for Business Purposes — Securing Promissory Note, such as: 1. Specific Equipment Security Agreement: This type of security agreement identifies and describes specific pieces of equipment that will serve as collateral for the promissory note. It provides a detailed inventory of the equipment being secured and outlines the rights and responsibilities of both the borrower and the lender. 2. Floating Equipment Security Agreement: In contrast to the specific equipment security agreement, a floating equipment security agreement encompasses a broader range of equipment that the borrower may own at any given time. This type of agreement enables the borrower to use different equipment as collateral without having to amend the security agreement each time equipment changes. 3. PSI Equipment Security Agreement: Purchase Money Security Interest (PSI) equipment security agreement is used when the lender provides financing specifically for the purchase of equipment. In this scenario, the lender has a superior claim over the equipment compared to any existing creditors, as the loan proceeds are used to acquire the equipment. 4. Multi-Party Equipment Security Agreement: This type of security agreement is relevant when multiple parties are involved in financing the equipment purchase. It helps establish the rights and priorities of each party involved, ensuring that their respective interests are protected. Regardless of the type of Middlesex Massachusetts Security Agreement in Equipment for Business Purposes — Securing Promissory Note, it is important to consult with legal professionals and ensure that all relevant state laws and regulations are adhered to.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.