A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

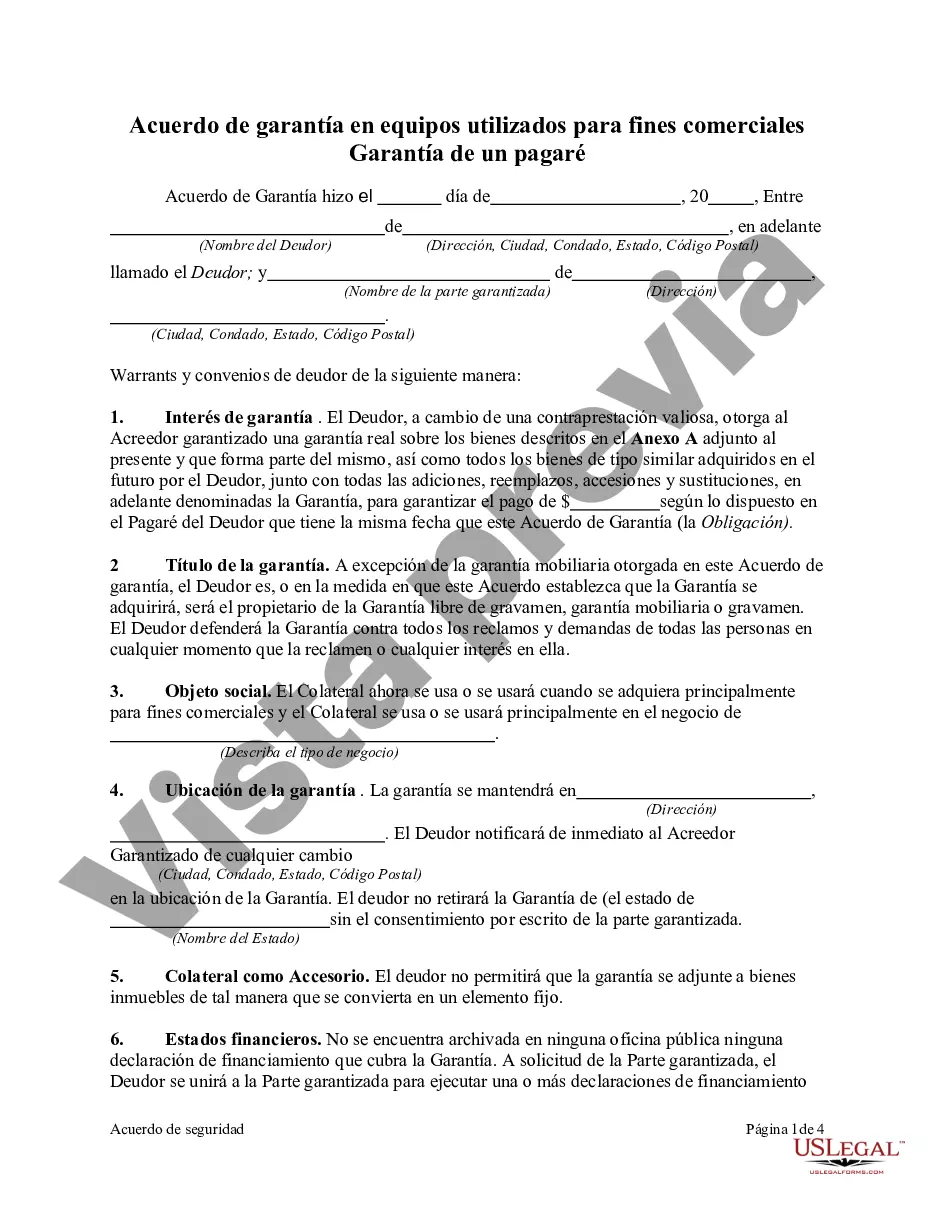

A Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions for securing a promissory note with equipment in the business context. This agreement is commonly used when a borrower needs financial assistance to purchase or lease equipment, and the lender requires security to protect their investment. The primary purpose of the security agreement is to establish a legal claim on the equipment in case the borrower fails to fulfill their payment obligations under the promissory note. By securing the note with equipment, the lender can seek remedies such as repossession and sale of the equipment to recover their funds in case of default. The content of a Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes: 1. Identification of the parties: The agreement starts by stating the names and contact details of the borrower (also referred to as the debtor) and the lender (also known as the secured party). It is important to accurately identify both parties to ensure enforceability. 2. Description of the equipment: The agreement provides a detailed description of the equipment being used as collateral, including its make, model, serial number, and any other relevant specifications. This ensures clarity and avoids any confusion about the specific assets securing the promissory note. 3. Terms of the promissory note: The agreement should reference the promissory note being secured and outline the terms, such as the principal loan amount, interest rate, repayment schedule, and other provisions. This helps to establish a clear connection between the security agreement and the underlying loan. 4. Granting of security interest: The borrower gives the lender a security interest in the equipment, granting the lender the right to repossess and sell the equipment to satisfy the debt in case of default. This section will specify the specific rights and remedies available to the lender. 5. Representations and warranties: The borrower typically provides assurances that they are the rightful owner of the equipment, that it is free from any liens or encumbrances, and that they have the authority to grant a security interest. These representations protect the lender's interest and provide assurance against potential claims from third parties. 6. Security interest perfection: To ensure the validity and priority of the lender's security interest, the agreement may require the borrower to take additional steps, such as registering a UCC-1 financing statement with the appropriate state authorities. This step is crucial in preserving the lender's rights against competing creditors. Additional types of Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include variations based on specific business transactions or special circumstances. These variations might involve leases instead of purchases, different types of equipment, or additional clauses tailored to meet the needs of the parties involved. In conclusion, Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial legal document that protects the interests of both lenders and borrowers. It establishes the terms for securing a promissory note with equipment, ensuring that lenders have a legal claim on the assets in case of default.A Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that outlines the terms and conditions for securing a promissory note with equipment in the business context. This agreement is commonly used when a borrower needs financial assistance to purchase or lease equipment, and the lender requires security to protect their investment. The primary purpose of the security agreement is to establish a legal claim on the equipment in case the borrower fails to fulfill their payment obligations under the promissory note. By securing the note with equipment, the lender can seek remedies such as repossession and sale of the equipment to recover their funds in case of default. The content of a Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes: 1. Identification of the parties: The agreement starts by stating the names and contact details of the borrower (also referred to as the debtor) and the lender (also known as the secured party). It is important to accurately identify both parties to ensure enforceability. 2. Description of the equipment: The agreement provides a detailed description of the equipment being used as collateral, including its make, model, serial number, and any other relevant specifications. This ensures clarity and avoids any confusion about the specific assets securing the promissory note. 3. Terms of the promissory note: The agreement should reference the promissory note being secured and outline the terms, such as the principal loan amount, interest rate, repayment schedule, and other provisions. This helps to establish a clear connection between the security agreement and the underlying loan. 4. Granting of security interest: The borrower gives the lender a security interest in the equipment, granting the lender the right to repossess and sell the equipment to satisfy the debt in case of default. This section will specify the specific rights and remedies available to the lender. 5. Representations and warranties: The borrower typically provides assurances that they are the rightful owner of the equipment, that it is free from any liens or encumbrances, and that they have the authority to grant a security interest. These representations protect the lender's interest and provide assurance against potential claims from third parties. 6. Security interest perfection: To ensure the validity and priority of the lender's security interest, the agreement may require the borrower to take additional steps, such as registering a UCC-1 financing statement with the appropriate state authorities. This step is crucial in preserving the lender's rights against competing creditors. Additional types of Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note may include variations based on specific business transactions or special circumstances. These variations might involve leases instead of purchases, different types of equipment, or additional clauses tailored to meet the needs of the parties involved. In conclusion, Phoenix Arizona Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a crucial legal document that protects the interests of both lenders and borrowers. It establishes the terms for securing a promissory note with equipment, ensuring that lenders have a legal claim on the assets in case of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.