A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

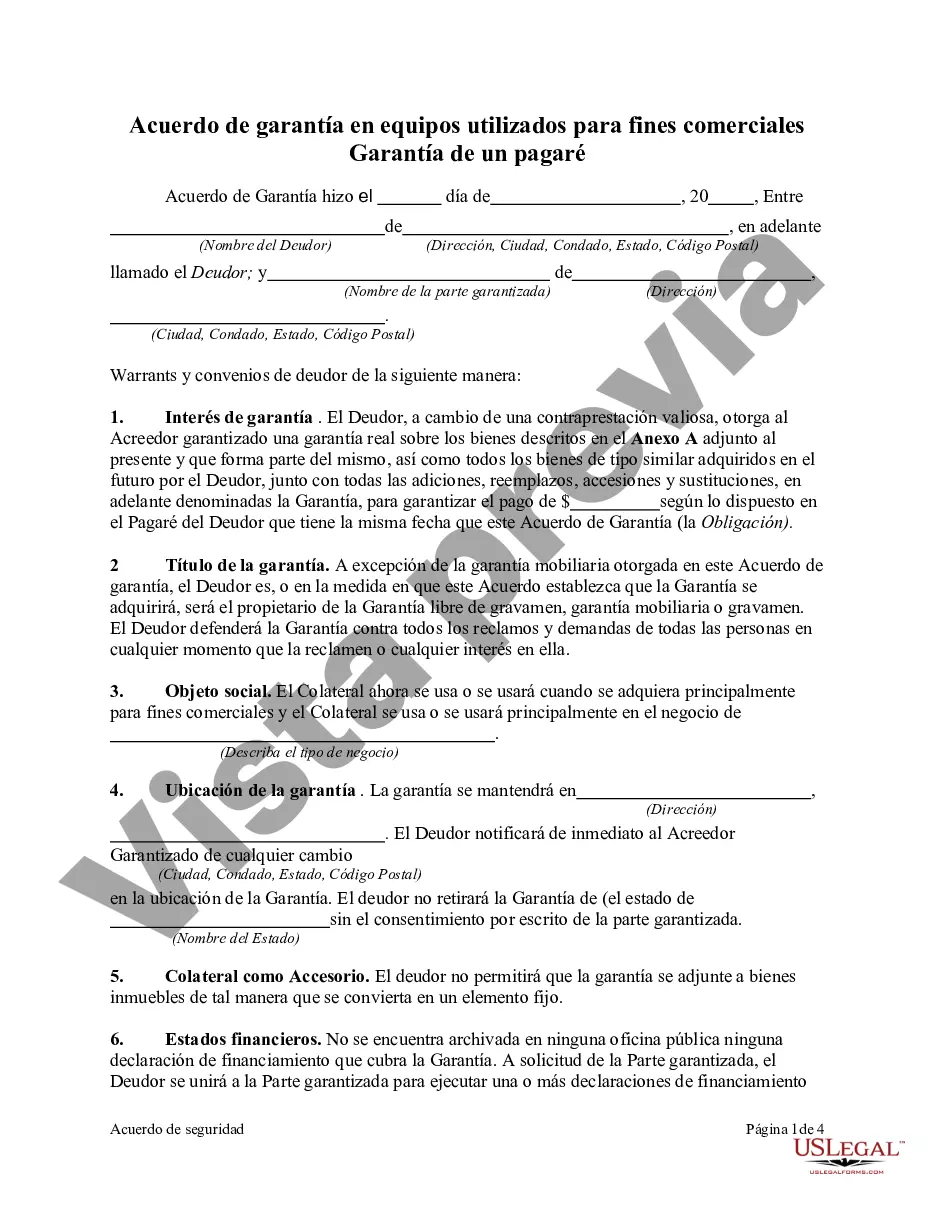

A San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that establishes the terms and conditions under which a borrower secures a promissory note by pledging specific equipment or assets as collateral. This agreement ensures that the lender has a security interest in the equipment, providing them with the right to seize and sell the equipment in the event of default or non-payment by the borrower. The purpose of this agreement is to protect the lender's investment and minimize the risk associated with lending funds for business purposes. By securing the promissory note with specific equipment or assets, the lender can mitigate the financial loss in case of default. The San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes the following details: 1. Parties involved: The agreement identifies the borrower and the lender, including their legal names and addresses. 2. Description of equipment: The agreement specifies the equipment being used as collateral. This may include detailed information like make, model, serial number, condition, and location of the equipment. 3. Security interest: The agreement outlines the lender's security interest in the equipment. This includes the grant of a security interest, the rights and obligations of both parties, and the steps to be taken to perfect the security interest, such as filing a UCC-1 financing statement with the appropriate authority. 4. Promissory note details: The agreement references the promissory note being secured by the equipment. It includes details about the amount borrowed, interest rate, repayment terms, and any other relevant provisions. 5. Default and remedies: The agreement defines the events that would constitute a default, such as non-payment or breach of other terms. It outlines the remedies available to the lender in case of default, including the right to repossess, sell, or dispose of the equipment to recover the outstanding debt. It may also specify the process for giving notice to the borrower before exercising these remedies. 6. Representations and warranties: The agreement may contain representations and warranties from both parties, ensuring that they have the legal authority to enter into the agreement, the equipment is free from liens or encumbrances, and that all information provided is accurate and complete. Types of San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note may vary depending on the specific requirements and circumstances of the parties involved. However, the overall purpose remains the same, which is to provide security for the lender by using equipment or assets as collateral for a promissory note.A San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legal document that establishes the terms and conditions under which a borrower secures a promissory note by pledging specific equipment or assets as collateral. This agreement ensures that the lender has a security interest in the equipment, providing them with the right to seize and sell the equipment in the event of default or non-payment by the borrower. The purpose of this agreement is to protect the lender's investment and minimize the risk associated with lending funds for business purposes. By securing the promissory note with specific equipment or assets, the lender can mitigate the financial loss in case of default. The San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note typically includes the following details: 1. Parties involved: The agreement identifies the borrower and the lender, including their legal names and addresses. 2. Description of equipment: The agreement specifies the equipment being used as collateral. This may include detailed information like make, model, serial number, condition, and location of the equipment. 3. Security interest: The agreement outlines the lender's security interest in the equipment. This includes the grant of a security interest, the rights and obligations of both parties, and the steps to be taken to perfect the security interest, such as filing a UCC-1 financing statement with the appropriate authority. 4. Promissory note details: The agreement references the promissory note being secured by the equipment. It includes details about the amount borrowed, interest rate, repayment terms, and any other relevant provisions. 5. Default and remedies: The agreement defines the events that would constitute a default, such as non-payment or breach of other terms. It outlines the remedies available to the lender in case of default, including the right to repossess, sell, or dispose of the equipment to recover the outstanding debt. It may also specify the process for giving notice to the borrower before exercising these remedies. 6. Representations and warranties: The agreement may contain representations and warranties from both parties, ensuring that they have the legal authority to enter into the agreement, the equipment is free from liens or encumbrances, and that all information provided is accurate and complete. Types of San Jose California Security Agreement in Equipment for Business Purposes — Securing Promissory Note may vary depending on the specific requirements and circumstances of the parties involved. However, the overall purpose remains the same, which is to provide security for the lender by using equipment or assets as collateral for a promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.