A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

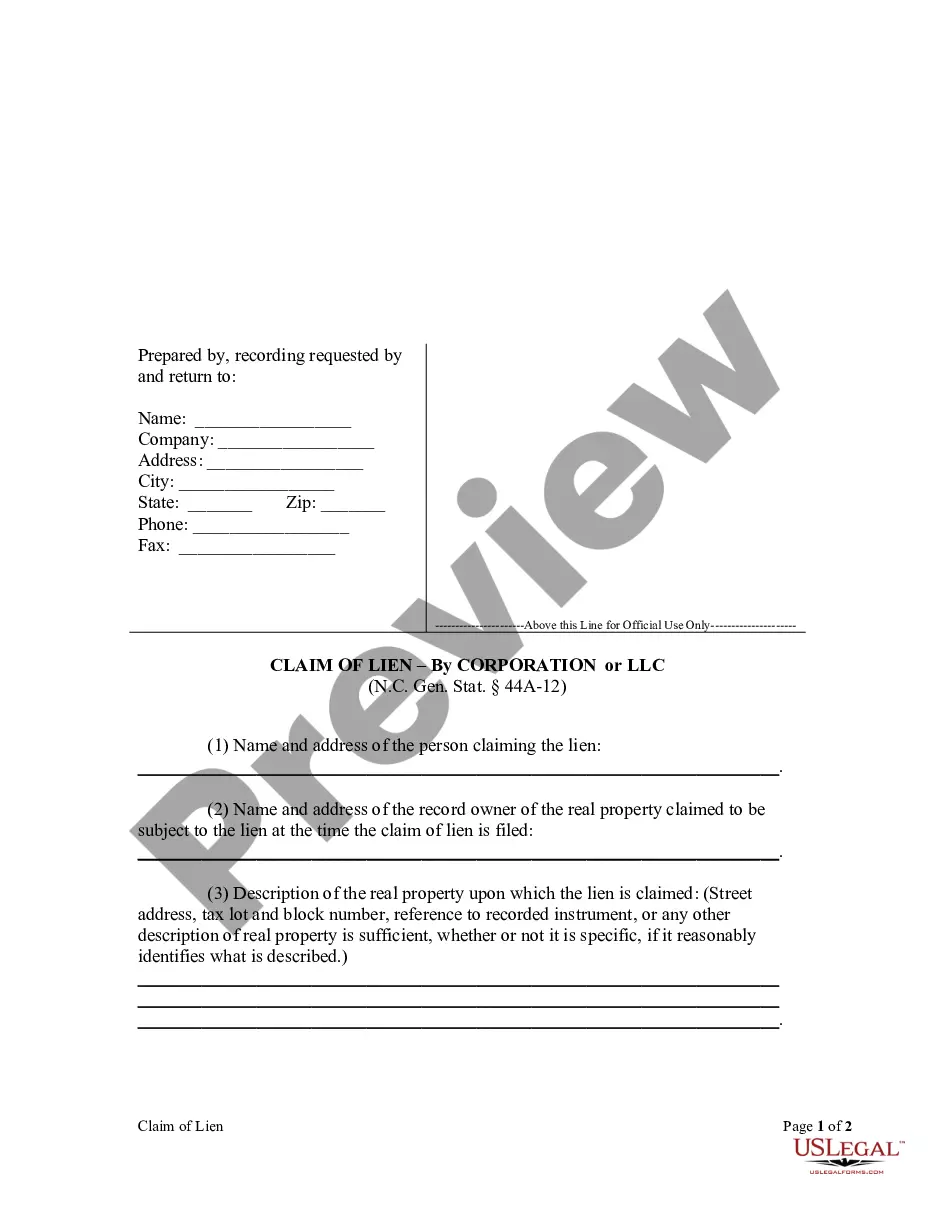

The Maricopa, Arizona General Form of Security Agreement in Equipment is a legal document that establishes a creditor's security interest in certain pieces of equipment owned by a debtor. This agreement ensures that the creditor will have the right to take possession or sell the equipment to satisfy any outstanding debt if the debtor defaults on their loan obligations. This security agreement is specifically applicable in Maricopa, Arizona, and it adheres to the laws and regulations set forth by the state. By signing this agreement, both parties consent to the terms and conditions governing the creditor's security interest in the equipment described within the document. Some relevant keywords that pertain to the Maricopa Arizona General Form of Security Agreement in Equipment are: 1. Security Interest: This term refers to the creditor's right to possess, sell, or reclaim the equipment specified in the agreement in the event of default. 2. Collateral: Equipment acts as collateral in this agreement, meaning it serves as a guarantee or security for the loan provided by the creditor. 3. Maricopa, Arizona: This location is essential as the agreement is tailored specifically to comply with the state's laws and regulations. 4. Debtor: The person or entity who owns the equipment and borrows money or receives credit against it. They are obligated to repay the loan according to the terms specified in the agreement. 5. Creditor: The individual or organization that provides the loan or credit to the debtor and is granted a security interest in the equipment. It is important to note that while the above keywords are relevant universally to security agreements in equipment, any specific variations in the Maricopa, Arizona General Form of Security Agreement in Equipment cannot be determined without detailed knowledge of Maricopa's local laws and regulations. There might be variations or alternative forms of security agreements in equipment specific to Maricopa, Arizona based on factors such as the type of equipment, unique requirements of parties involved, or specific statutory provisions. However, without further information or access to specific legal resources, it is difficult to name them explicitly. It is recommended to consult with legal professionals or refer to Maricopa's local legal resources to obtain detailed information on any specific variations of the Maricopa Arizona General Form of Security Agreement in Equipment.The Maricopa, Arizona General Form of Security Agreement in Equipment is a legal document that establishes a creditor's security interest in certain pieces of equipment owned by a debtor. This agreement ensures that the creditor will have the right to take possession or sell the equipment to satisfy any outstanding debt if the debtor defaults on their loan obligations. This security agreement is specifically applicable in Maricopa, Arizona, and it adheres to the laws and regulations set forth by the state. By signing this agreement, both parties consent to the terms and conditions governing the creditor's security interest in the equipment described within the document. Some relevant keywords that pertain to the Maricopa Arizona General Form of Security Agreement in Equipment are: 1. Security Interest: This term refers to the creditor's right to possess, sell, or reclaim the equipment specified in the agreement in the event of default. 2. Collateral: Equipment acts as collateral in this agreement, meaning it serves as a guarantee or security for the loan provided by the creditor. 3. Maricopa, Arizona: This location is essential as the agreement is tailored specifically to comply with the state's laws and regulations. 4. Debtor: The person or entity who owns the equipment and borrows money or receives credit against it. They are obligated to repay the loan according to the terms specified in the agreement. 5. Creditor: The individual or organization that provides the loan or credit to the debtor and is granted a security interest in the equipment. It is important to note that while the above keywords are relevant universally to security agreements in equipment, any specific variations in the Maricopa, Arizona General Form of Security Agreement in Equipment cannot be determined without detailed knowledge of Maricopa's local laws and regulations. There might be variations or alternative forms of security agreements in equipment specific to Maricopa, Arizona based on factors such as the type of equipment, unique requirements of parties involved, or specific statutory provisions. However, without further information or access to specific legal resources, it is difficult to name them explicitly. It is recommended to consult with legal professionals or refer to Maricopa's local legal resources to obtain detailed information on any specific variations of the Maricopa Arizona General Form of Security Agreement in Equipment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.