Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate is a legal provision in the state of North Carolina that aims to protect purchasers of personal property from an estate against any potential claims or liabilities that may arise after the sale. This indemnification ensures that the buyer is safeguarded against any unexpected issues that may arise from the purchase. This provision is particularly necessary when purchasing personal property from an estate, as there may be a likelihood of hidden debts, outstanding taxes, or undisclosed encumbrances associated with the estate. Mecklenburg North Carolina Indemnification ensures that the buyer is not held responsible for any of these unforeseen circumstances. The Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate offers a certain level of protection to buyers, keeping them immune to potential claims that may be made against the purchased property. It relieves the purchaser of any financial burdens or legal disputes that might arise due to the estate's previous ownership. Different types of indemnification provisions may exist in Mecklenburg County, North Carolina, to address various aspects and scenarios related to the purchase of personal property from an estate. Some common types of indemnification provisions include: 1. General Indemnification: This provision ensures that the buyer is protected from all claims, debts, or liabilities associated with the property acquired from the estate. It offers comprehensive coverage to the purchaser, safeguarding them against any unforeseen issues. 2. Financial Indemnification: This provision specifically addresses any outstanding debts or financial obligations attached to the property. It protects the buyer from assuming any unpaid taxes, mortgages, or loans, relieving them from the responsibility of clearing these debts. 3. Title Indemnification: This provision focuses on protecting the buyer against any claims on the property's title. It ensures that the title is free and clear from any encumbrances, legal disputes, or challenges that could potentially affect the buyer's ownership rights. 4. Tax Indemnification: This indemnification provision secures the buyer from any pending tax assessments or liabilities associated with the property. It ensures that the buyer will not be held responsible for any outstanding taxes owed by the estate. 5. Encumbrance Indemnification: This provision protects the buyer from any undisclosed liens, mortgages, or other encumbrances on the property. It ensures that the property is acquired free and clear of any such unwanted legal or financial obligations. By implementing and adhering to Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate provisions, both buyers and sellers can engage in transactions with confidence, knowing that they are protected from any unforeseen liabilities or claims that may arise after the purchase.Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate is a legal provision in the state of North Carolina that aims to protect purchasers of personal property from an estate against any potential claims or liabilities that may arise after the sale. This indemnification ensures that the buyer is safeguarded against any unexpected issues that may arise from the purchase. This provision is particularly necessary when purchasing personal property from an estate, as there may be a likelihood of hidden debts, outstanding taxes, or undisclosed encumbrances associated with the estate. Mecklenburg North Carolina Indemnification ensures that the buyer is not held responsible for any of these unforeseen circumstances. The Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate offers a certain level of protection to buyers, keeping them immune to potential claims that may be made against the purchased property. It relieves the purchaser of any financial burdens or legal disputes that might arise due to the estate's previous ownership. Different types of indemnification provisions may exist in Mecklenburg County, North Carolina, to address various aspects and scenarios related to the purchase of personal property from an estate. Some common types of indemnification provisions include: 1. General Indemnification: This provision ensures that the buyer is protected from all claims, debts, or liabilities associated with the property acquired from the estate. It offers comprehensive coverage to the purchaser, safeguarding them against any unforeseen issues. 2. Financial Indemnification: This provision specifically addresses any outstanding debts or financial obligations attached to the property. It protects the buyer from assuming any unpaid taxes, mortgages, or loans, relieving them from the responsibility of clearing these debts. 3. Title Indemnification: This provision focuses on protecting the buyer against any claims on the property's title. It ensures that the title is free and clear from any encumbrances, legal disputes, or challenges that could potentially affect the buyer's ownership rights. 4. Tax Indemnification: This indemnification provision secures the buyer from any pending tax assessments or liabilities associated with the property. It ensures that the buyer will not be held responsible for any outstanding taxes owed by the estate. 5. Encumbrance Indemnification: This provision protects the buyer from any undisclosed liens, mortgages, or other encumbrances on the property. It ensures that the property is acquired free and clear of any such unwanted legal or financial obligations. By implementing and adhering to Mecklenburg North Carolina Indemnification of Purchaser of Personal Property from Estate provisions, both buyers and sellers can engage in transactions with confidence, knowing that they are protected from any unforeseen liabilities or claims that may arise after the purchase.

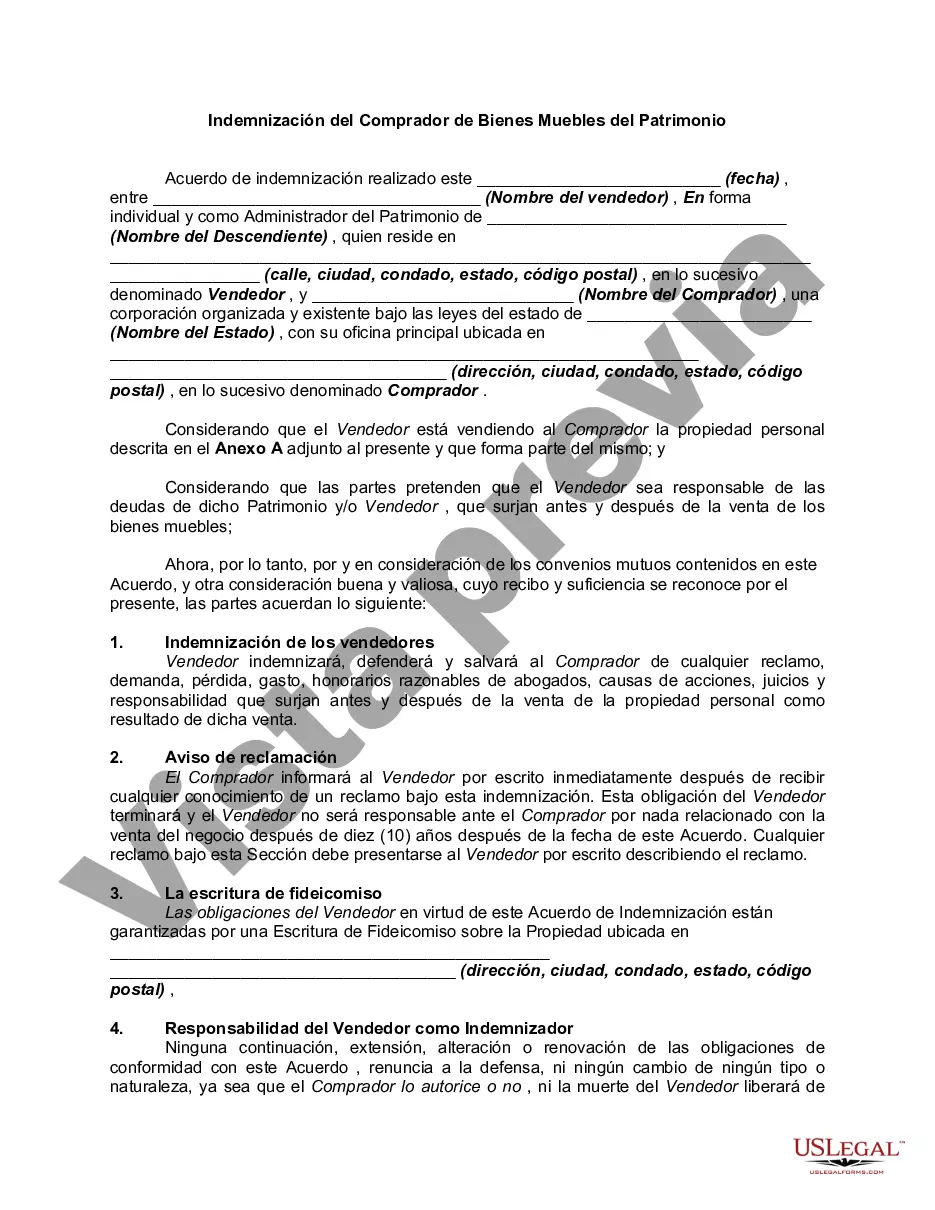

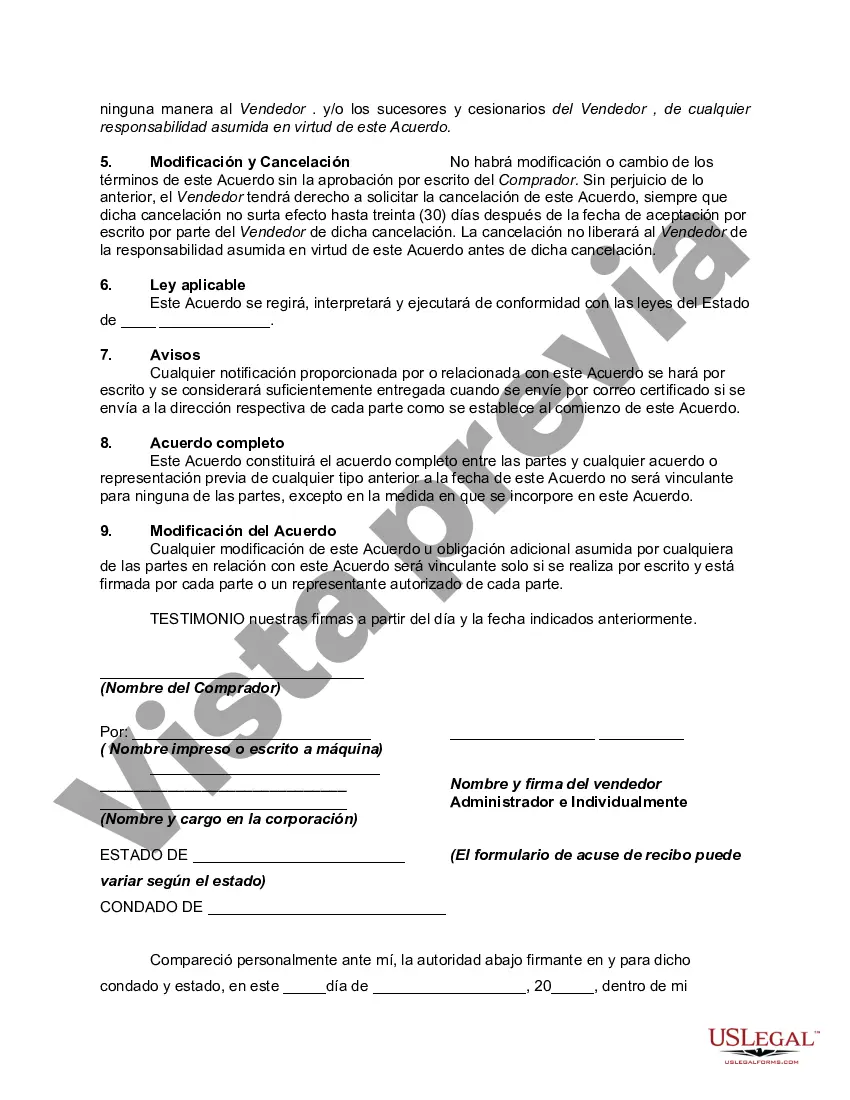

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.