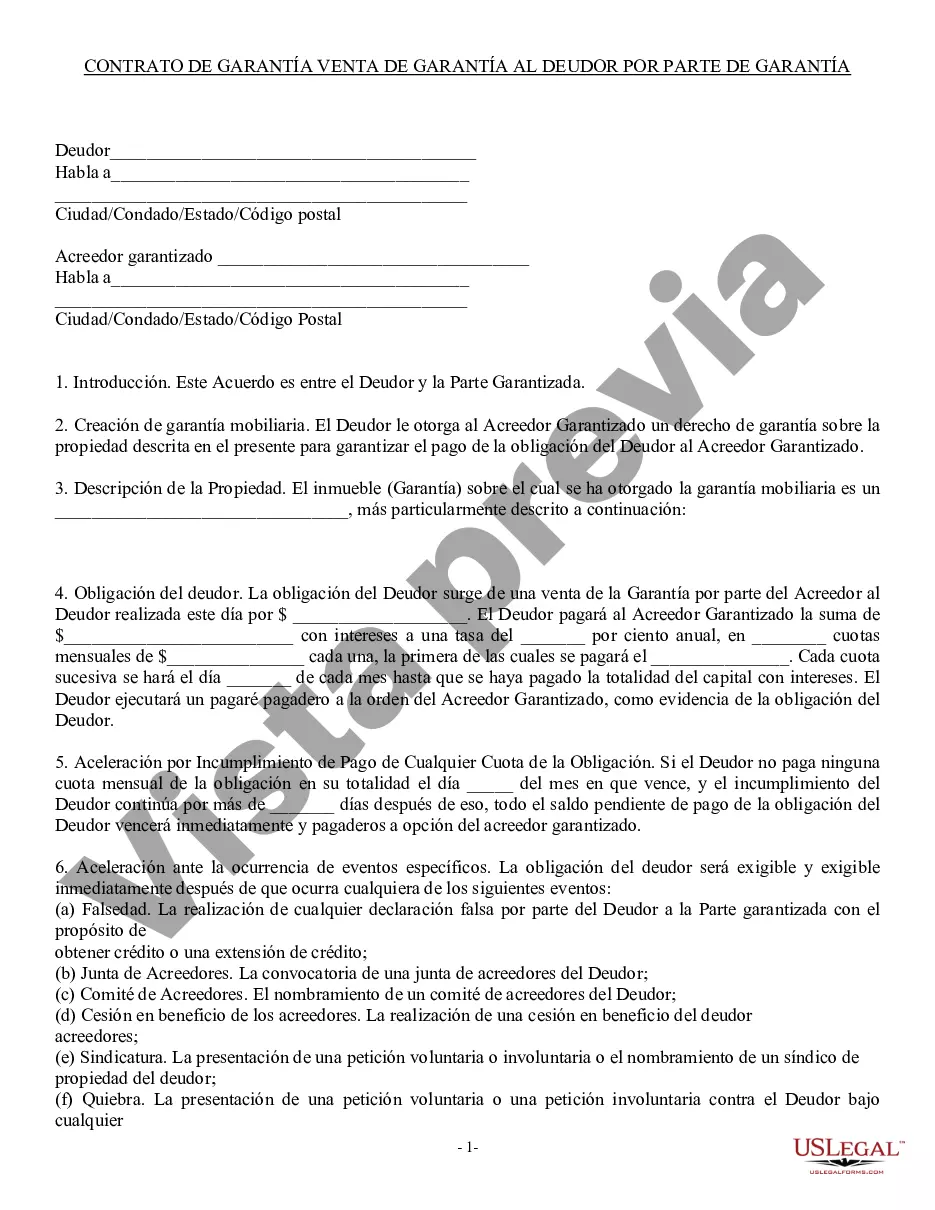

Hillsborough County, Florida is a county located on the western coast of the state, encompassing the city of Tampa and its surrounding areas. In relation to legal matters, a Hillsborough Florida Security Agreement involving the Sale of Collateral by Debtor refers to an agreement that establishes a security interest in collateral to secure the repayment of a debt. The purpose of this security agreement is to protect the creditor's interests by allowing them to sell the collateral if the debtor fails to fulfill their repayment obligations. The collateral typically consists of personal property, such as vehicles, equipment, inventory, or accounts receivable. By entering into this agreement, the debtor grants the creditor a security interest in the collateral, essentially giving the creditor the right to sell it to satisfy the debt owed. There are various types of Hillsborough Florida Security Agreements involving the Sale of Collateral by Debtor, each tailored to meet specific circumstances and requirements. Some common types include: 1. Installment Sales Agreement: This type of agreement allows debtors to purchase goods or services through installment payments. The collateral serves as security for the creditor until the debt is fully repaid. If the debtor defaults, the creditor can sell the collateral to recover the outstanding amount. 2. Chattel Mortgage Agreement: In this type of agreement, the debtor provides a specific item of personal property, known as chattel, as collateral. The ownership of the chattel transfers to the creditor until the debt is satisfied. If the debtor defaults, the creditor can sell the chattel to recover the owed amount. 3. Accounts Receivable Financing Agreement: This type of agreement involves the factoring of accounts receivable as collateral. Businesses can assign their accounts receivable to a creditor as security for a loan. If the debtor fails to make payments, the creditor can sell the accounts receivable to obtain the owed funds. 4. Equipment Financing Agreement: This agreement is designed for businesses seeking financing for the acquisition of equipment or machinery. The equipment serves as collateral, and if the debtor defaults, the creditor can sell the equipment to recover the debt. It is essential for both debtors and creditors to carefully review and understand the terms and conditions of the Hillsborough Florida Security Agreement involving the Sale of Collateral by Debtor. Seeking legal advice is recommended to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Hillsborough Florida Acuerdo De Garantía Que Involucra La Venta De Garantía Por Parte Del Deudor?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Hillsborough Security Agreement involving Sale of Collateral by Debtor is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Hillsborough Security Agreement involving Sale of Collateral by Debtor. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Hillsborough Security Agreement involving Sale of Collateral by Debtor in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!