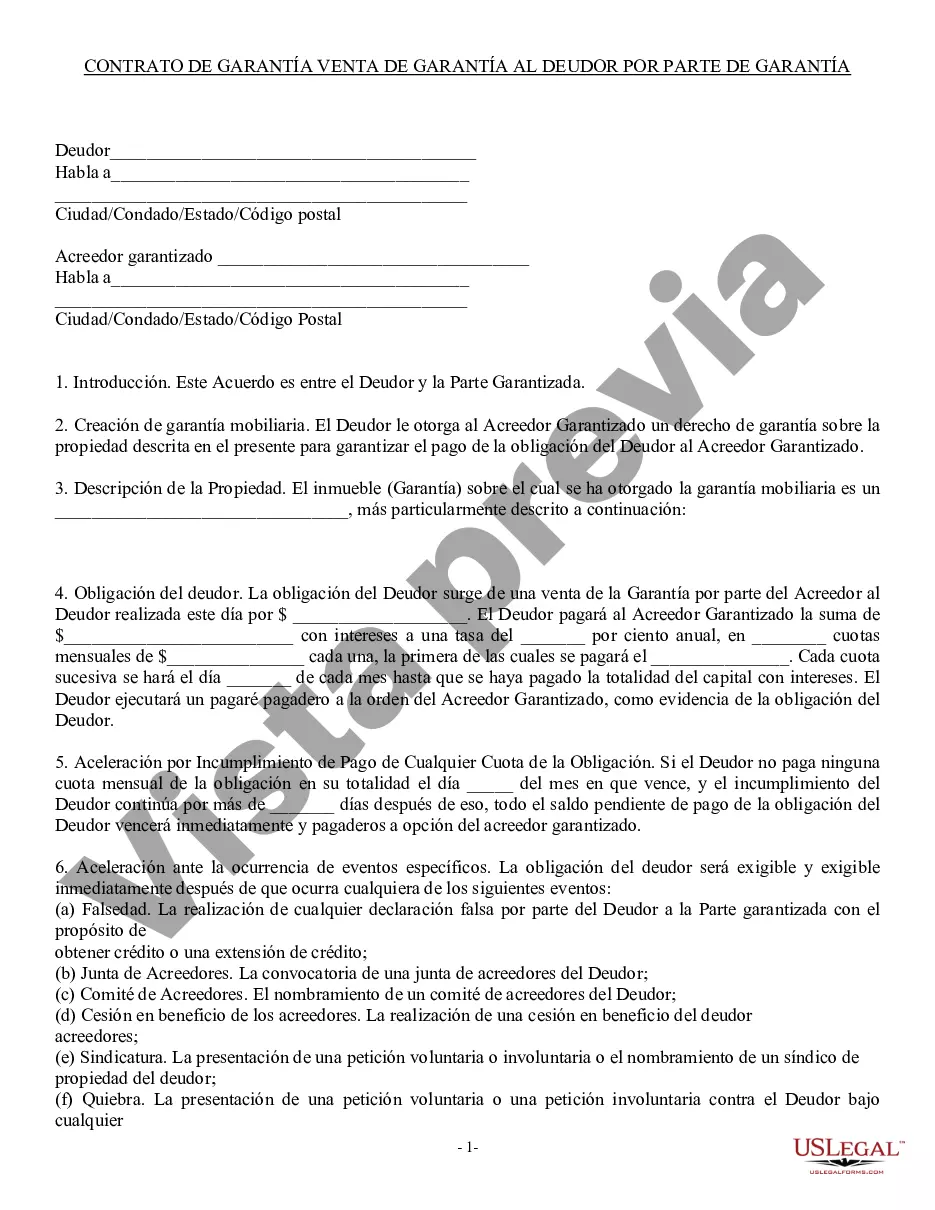

Miami-Dade County is located in the state of Florida and is known for its diverse population and vibrant culture. In Miami-Dade County, a Security Agreement involving the Sale of Collateral by the Debtor is a legally binding agreement that outlines the terms and conditions of a transaction where the debtor sells collateral as a means to secure a debt. The Miami-Dade Florida Security Agreement involving Sale of Collateral by the Debtor is designed to protect the rights of both the debtor and the creditor in a collateralized transaction. This agreement establishes the terms of the sale, including the price, delivery, and transfer of ownership of the collateral. Keywords: Miami-Dade County, Florida, Security Agreement, Sale of Collateral, Debtor, legally binding agreement, transaction, collateralized transaction, debtor, creditor, terms and conditions, price, delivery, transfer of ownership. Different types of Miami-Dade Florida Security Agreement involving Sale of Collateral by Debtor may include: 1. Real Estate Security Agreement: This type of security agreement involves the sale of real estate property by the debtor to secure a debt. The collateral in this case would be the property itself, and the agreement would outline the specific details of the sale, such as the property description, purchase price, and any conditions for the sale. 2. Personal Property Security Agreement: This agreement involves the sale of personal property, such as vehicles, equipment, or inventory, to secure a debt. The agreement would specify the details of the sale, including the description of the collateral, sale price, delivery terms, and transfer of ownership. 3. Intellectual Property Security Agreement: This type of security agreement pertains to the sale of intellectual property rights, such as patents, copyrights, or trademarks, as collateral for a debt. The agreement would include provisions for the transfer of these rights and any restrictions or conditions for their sale. 4. Accounts Receivable Security Agreement: In this type of security agreement, the debtor may sell their accounts receivable, which are unpaid invoices or debts owed to them, to secure a debt. The agreement would outline the terms of the sale, including the assignment of accounts, payment terms, and any guarantees or warranties. 5. Investment Security Agreement: This agreement involves the sale of financial investments or securities by the debtor to secure a debt. The collateral would typically include stocks, bonds, or other investment instruments, and the agreement would specify the details of the sale, including the transfer of ownership and any restrictions or conditions. These different types of Miami-Dade Florida Security Agreement involving Sale of Collateral by Debtor cater to various scenarios and assets, ensuring that the agreement is tailored to meet the specific needs of both the debtor and the creditor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

State:

Multi-State

County:

Miami-Dade

Control #:

US-01692-AZ

Format:

Word

Instant download

Description

AZ-PRODUCTOS-20

Miami-Dade County is located in the state of Florida and is known for its diverse population and vibrant culture. In Miami-Dade County, a Security Agreement involving the Sale of Collateral by the Debtor is a legally binding agreement that outlines the terms and conditions of a transaction where the debtor sells collateral as a means to secure a debt. The Miami-Dade Florida Security Agreement involving Sale of Collateral by the Debtor is designed to protect the rights of both the debtor and the creditor in a collateralized transaction. This agreement establishes the terms of the sale, including the price, delivery, and transfer of ownership of the collateral. Keywords: Miami-Dade County, Florida, Security Agreement, Sale of Collateral, Debtor, legally binding agreement, transaction, collateralized transaction, debtor, creditor, terms and conditions, price, delivery, transfer of ownership. Different types of Miami-Dade Florida Security Agreement involving Sale of Collateral by Debtor may include: 1. Real Estate Security Agreement: This type of security agreement involves the sale of real estate property by the debtor to secure a debt. The collateral in this case would be the property itself, and the agreement would outline the specific details of the sale, such as the property description, purchase price, and any conditions for the sale. 2. Personal Property Security Agreement: This agreement involves the sale of personal property, such as vehicles, equipment, or inventory, to secure a debt. The agreement would specify the details of the sale, including the description of the collateral, sale price, delivery terms, and transfer of ownership. 3. Intellectual Property Security Agreement: This type of security agreement pertains to the sale of intellectual property rights, such as patents, copyrights, or trademarks, as collateral for a debt. The agreement would include provisions for the transfer of these rights and any restrictions or conditions for their sale. 4. Accounts Receivable Security Agreement: In this type of security agreement, the debtor may sell their accounts receivable, which are unpaid invoices or debts owed to them, to secure a debt. The agreement would outline the terms of the sale, including the assignment of accounts, payment terms, and any guarantees or warranties. 5. Investment Security Agreement: This agreement involves the sale of financial investments or securities by the debtor to secure a debt. The collateral would typically include stocks, bonds, or other investment instruments, and the agreement would specify the details of the sale, including the transfer of ownership and any restrictions or conditions. These different types of Miami-Dade Florida Security Agreement involving Sale of Collateral by Debtor cater to various scenarios and assets, ensuring that the agreement is tailored to meet the specific needs of both the debtor and the creditor.

Free preview