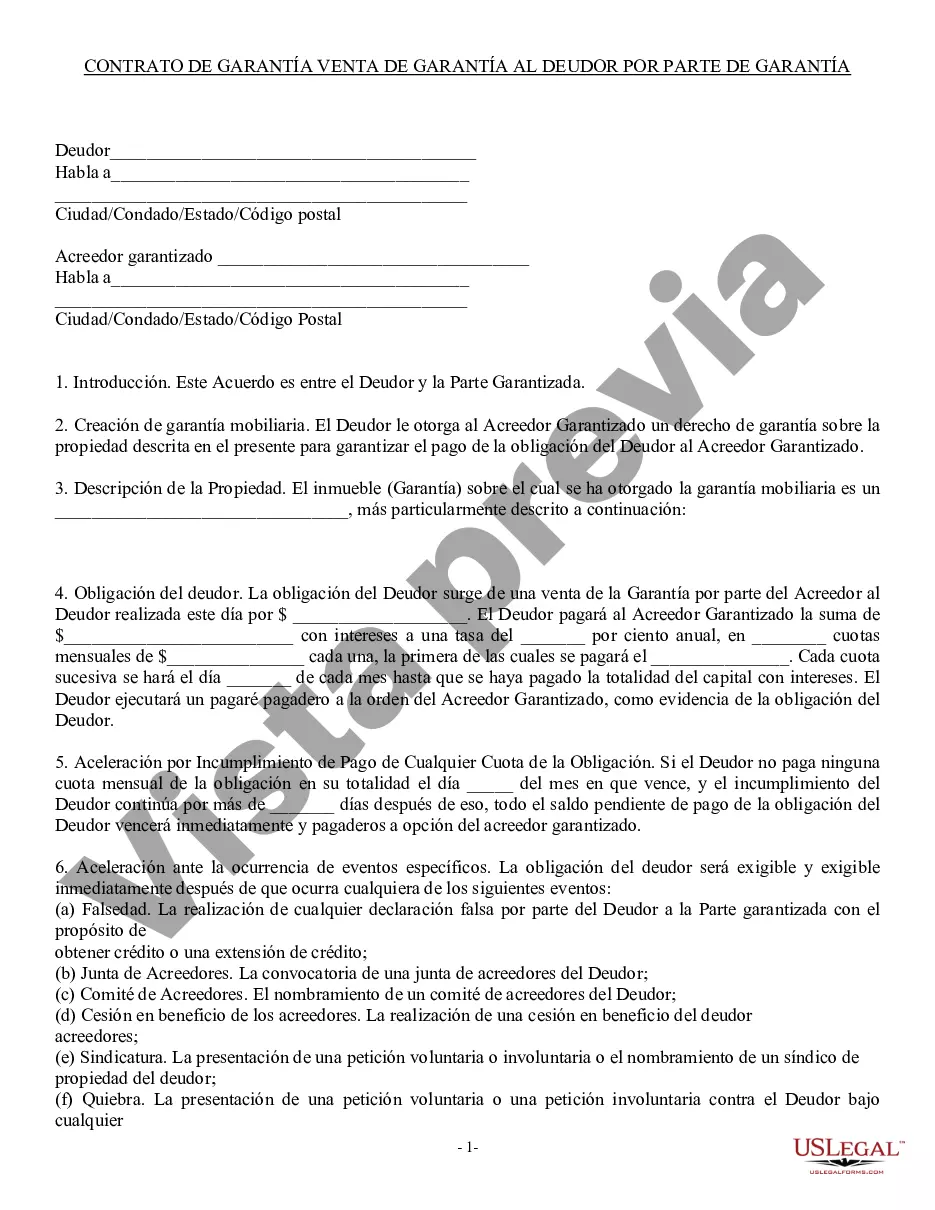

A Palm Beach, Florida Security Agreement involving the sale of collateral by a debtor is a legal document that outlines the terms and conditions of a transaction in which a debtor sells or transfers ownership rights of certain assets, referred to as collateral, to a lender or creditor to secure a loan or debt payment. This agreement is crucial in protecting the interests of both parties involved in the transaction. The purpose of a security agreement is to ensure that the creditor has a legal claim or lien on the collateral provided by the debtor as security for the repayment of the debt. In the event that the debtor defaults on the loan or fails to fulfill their obligations, the creditor can seize or sell the collateral to recover the outstanding debt. There are different types of Palm Beach, Florida Security Agreements involving the sale of collateral by a debtor, each catering to specific situations and assets. Some common variations include: 1. Real Estate Security Agreement: This type of security agreement involves the use of real property, such as land or buildings, as collateral. It outlines the terms of the loan, including the property's legal description, the amount of the loan, and the conditions that trigger default and foreclosure. 2. Personal Property Security Agreement: This agreement pertains to personal property, such as vehicles, equipment, inventory, or intellectual property, used as collateral to secure a loan. It outlines the details of the personal property, including its description, condition, and value. 3. Accounts Receivable Security Agreement: This agreement revolves around using accounts receivable, also known as outstanding invoices or payments owed to a business, as collateral to secure a loan. It details the specific accounts receivable provided as collateral and includes provisions on how the lender can collect on the outstanding debt by demanding payment from the debtor's customers. 4. Investment Securities Security Agreement: This type of agreement involves using investment securities, such as stocks, bonds, or mutual funds, as collateral. It specifies the securities held by the debtor and outlines the rights and responsibilities of both parties in case of default or foreclosure. In summary, a Palm Beach, Florida Security Agreement involving the sale of collateral by a debtor is a legally binding document that establishes the terms and conditions for securing a loan. It is crucial for protecting the interests of both the debtor and the creditor. By clearly outlining the collateral, conditions of default, and recourse in case of non-payment, these agreements provide a framework for a secure transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Palm Beach Florida Acuerdo De Garantía Que Involucra La Venta De Garantía Por Parte Del Deudor?

Do you need to quickly draft a legally-binding Palm Beach Security Agreement involving Sale of Collateral by Debtor or probably any other document to handle your own or corporate affairs? You can select one of the two options: hire a professional to draft a legal document for you or draft it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including Palm Beach Security Agreement involving Sale of Collateral by Debtor and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Palm Beach Security Agreement involving Sale of Collateral by Debtor is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Palm Beach Security Agreement involving Sale of Collateral by Debtor template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the paperwork we provide are reviewed by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!