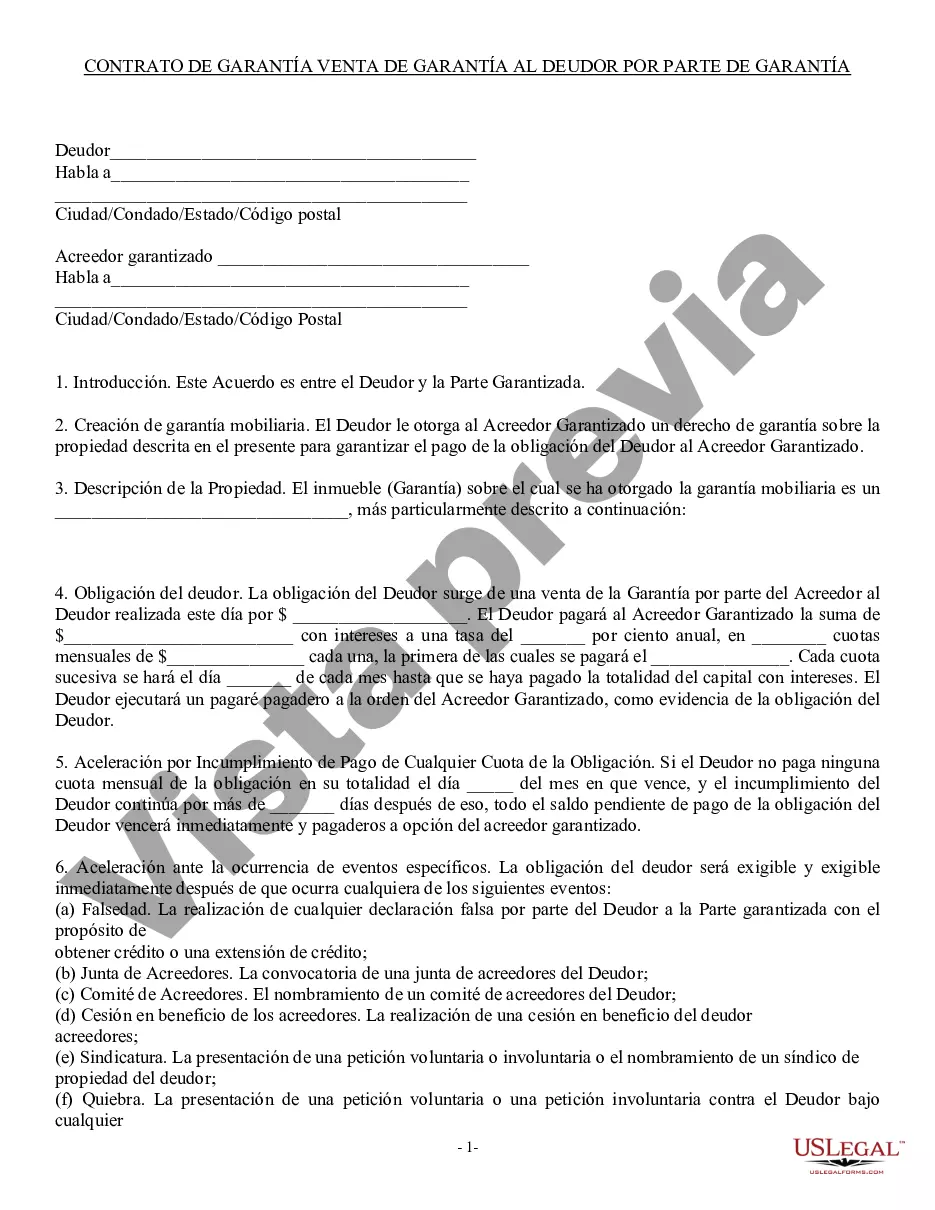

A Salt Lake Utah Security Agreement involving Sale of Collateral by Debtor is a legally binding document that outlines the terms and conditions for securing a loan with collateral in Salt Lake City, Utah. This type of agreement is commonly used by lenders to protect their interests in the event that the debtor defaults on the loan. The agreement typically includes information about the debtor, such as their name, address, and contact details. It also specifies the lender's information, including their name, address, and contact details. The collateral, which is the property or assets used to secure the loan, is described in detail, including its value and any specific details that may be relevant. The terms and conditions of the agreement outline the rights and responsibilities of both the debtor and the lender. These may include the repayment schedule, interest rates, late payment penalties, and any other fees or charges that may apply. The agreement also typically includes provisions for the sale of collateral in the event of default or non-payment by the debtor. There may be different types of Salt Lake Utah Security Agreements involving Sale of Collateral by Debtor, including: 1. Real Estate Collateral: This type of agreement involves securing the loan with real estate property, such as a house, land, or commercial building. 2. Vehicle Collateral: In this type of agreement, the loan is secured using a vehicle as collateral, such as a car, truck, or motorcycle. 3. Equipment Collateral: Some agreements involve securing the loan with specific equipment or machinery, such as construction equipment, medical devices, or manufacturing machinery. 4. Inventory Collateral: This type of agreement allows the lender to secure the loan with the debtor's inventory or stock of goods. It is important for both parties involved to thoroughly review and understand the terms of the agreement before signing. The agreement is legally binding and failure to comply with its terms can result in serious consequences for both the debtor and the lender. Consulting with a legal professional experienced in finance and loan agreements is highly recommended ensuring the agreement is comprehensive and fair to all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de garantía que involucra la venta de garantía por parte del deudor - Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Salt Lake Utah Acuerdo De Garantía Que Involucra La Venta De Garantía Por Parte Del Deudor?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Salt Lake Security Agreement involving Sale of Collateral by Debtor, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Salt Lake Security Agreement involving Sale of Collateral by Debtor from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Salt Lake Security Agreement involving Sale of Collateral by Debtor:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!