Allegheny Pennsylvania Financing Statement (APFS) is a legal document filed with the Allegheny County Recorder of Deeds in Pennsylvania for securing the interests of secured parties in collateral. It is an essential tool used in commercial transactions to establish and prioritize the rights and claims of stakeholders involved in lending activities. The APFS serves as a public notice to inform third parties about the security interests of lenders or creditors in specific assets of a debtor. By registering this statement, lenders protect their interests by ensuring they have a legal claim against the collateral provided by the debtor in case of default or non-payment. The main purpose of an APFS is to provide transparency and prevent conflicts or disputes between multiple creditors seeking repayment from the debtor's assets. On the other hand, it enables debtors to demonstrate their financial credibility to potential lenders, helping them secure loans by pledging collateral. There are different types of Allegheny Pennsylvania Financing Statements, including: 1. UCC-1 Financing Statement: This is the most common type of financing statement used in commercial transactions in Allegheny County and throughout Pennsylvania. It covers a broad range of collateral, such as movable assets, inventory, accounts receivable, and equipment. 2. Agricultural Liens: In cases where agricultural products or equipment are used as collateral, a specific agricultural lien financing statement is filed. This type of statement is used to secure loans related to farming operations, livestock, crops, or machinery. 3. Fixture Filing: In situations where collateral includes fixtures, which are goods attached to real property (such as machinery or equipment), a fixture filing statement is required. This statement notifies potential buyers or lenders that the fixtures are subject to existing security interests. 4. PSI Filing: If a creditor has provided a "purchase money security interest" to the debtor to finance the acquisition of specific collateral, they need to file a PSI financing statement. This statement ensures priority in the security interest when multiple parties have claims against the same collateral. Overall, the Allegheny Pennsylvania Financing Statement is a crucial legal instrument used to establish and protect the rights of lenders or creditors in various types of collateral. It plays a vital role in promoting transparency, securing financial transactions, and preventing conflicts between multiple stakeholders in commercial lending.

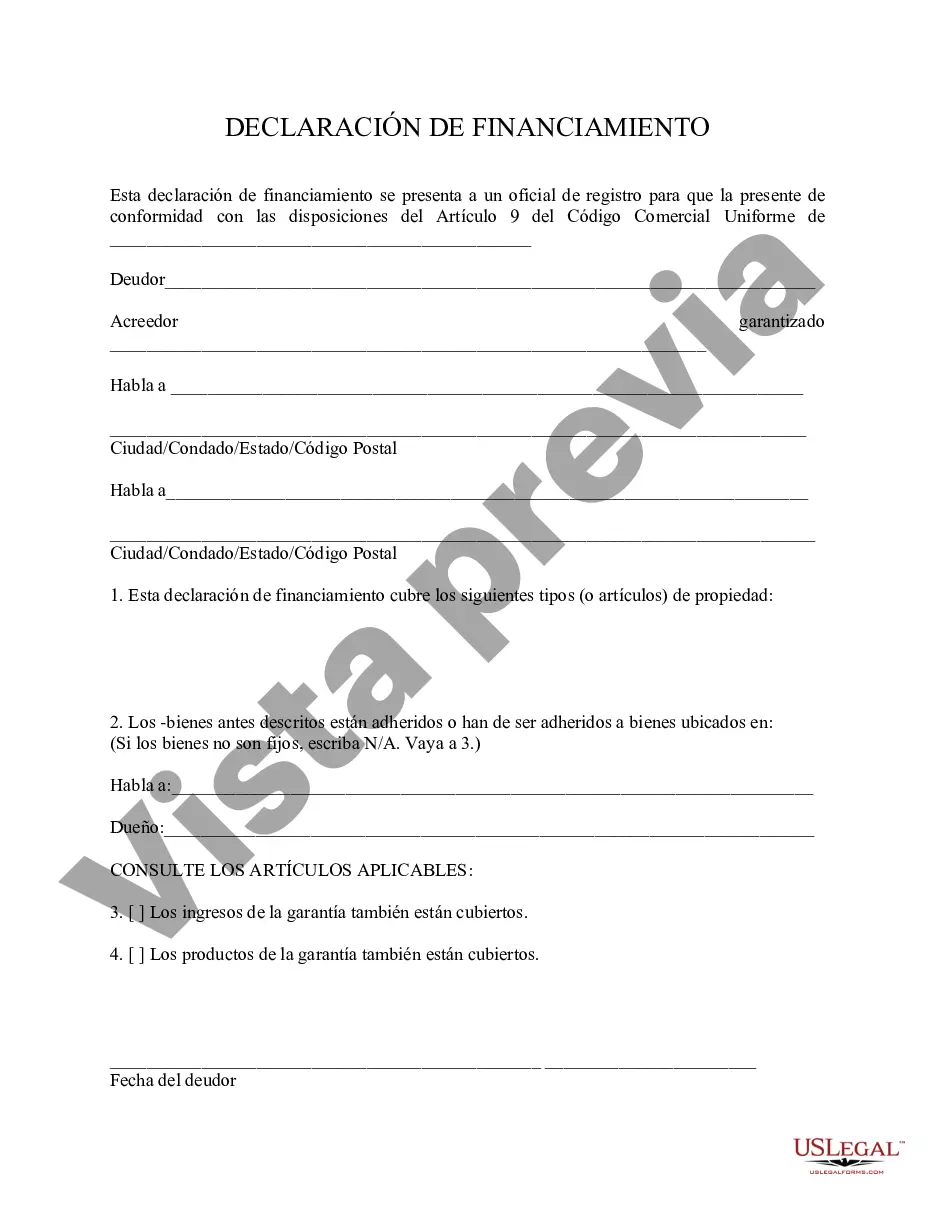

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Declaración de Financiamiento - Financing Statement

Description

How to fill out Allegheny Pennsylvania Declaración De Financiamiento?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the Allegheny Financing Statement.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Allegheny Financing Statement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Allegheny Financing Statement:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Allegheny Financing Statement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!