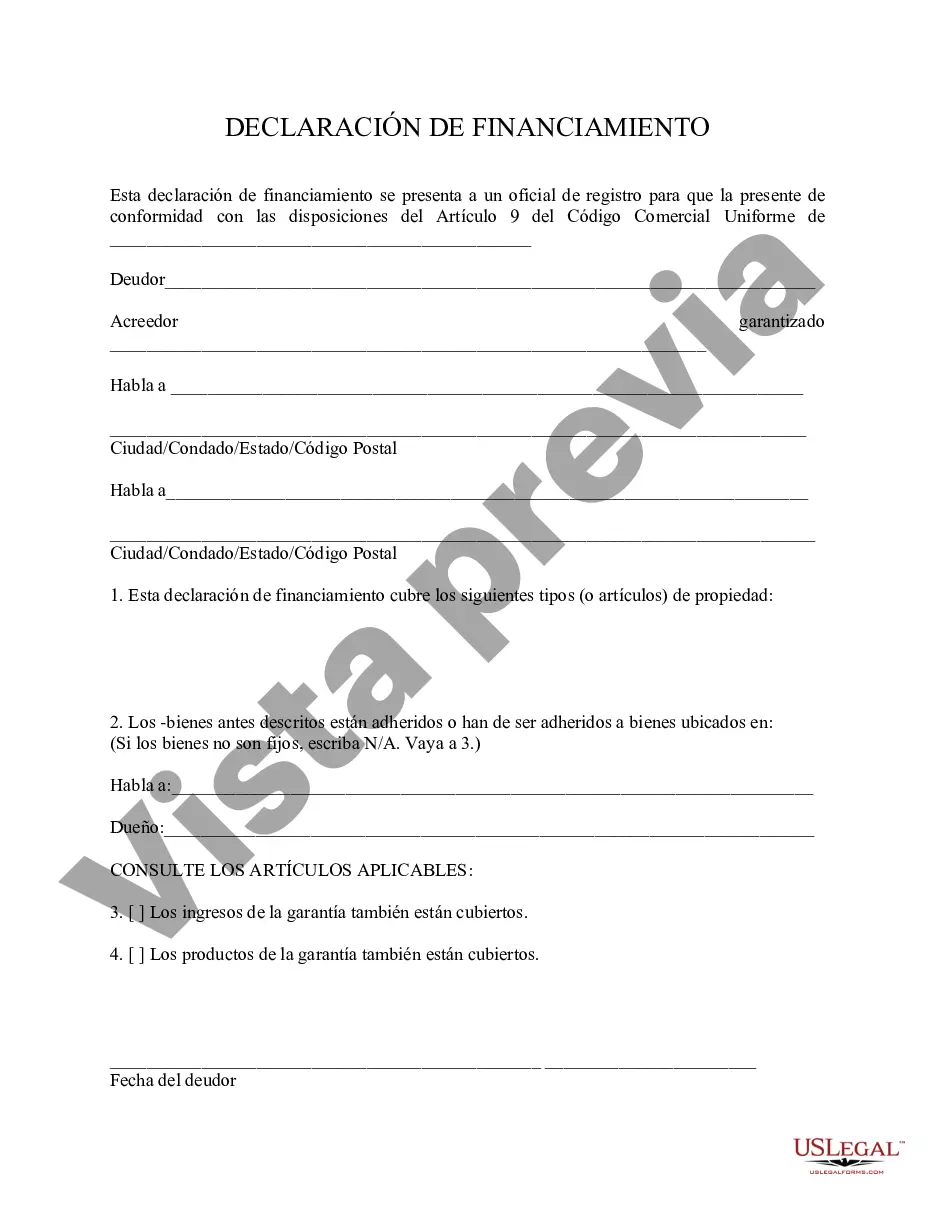

Chicago Illinois Financing Statement is a legal document that helps secure collateral for a loan in the state of Illinois. It provides public notice to potential creditors about the interest a lender has in the collateral, often used in commercial transactions. This statement is governed by the Uniform Commercial Code (UCC) Article 9, which oversees secured transactions throughout the state. The Chicago Illinois Financing Statement includes important details such as the names and addresses of both the debtor (borrower) and the secured party (lender). It also highlights a description of the collateral being used to secure the loan, such as inventory, equipment, accounts receivable, or real estate. This statement is crucial for businesses as it establishes priority rights for lenders in case of default by the borrower. Once filed with the Illinois Secretary of State's office or the appropriate local filing office, it becomes a public record accessible to anyone who wishes to review it. There are various types of Chicago Illinois Financing Statements that can be filed depending on the type of collateral. Some common variations include: 1. Blanket Financing Statement: This type covers a broad range of assets, providing the lender with a general security interest in nearly all the debtor's assets. 2. Specific Financing Statement: Used when the lender wants to secure a particular asset or group of assets, rather than all the debtor's assets. This allows for more specificity in the collateral description. 3. Fixture Filing: When the collateral being used to secure the loan involves fixtures attached to real estate, such as machinery or equipment permanently affixed to a building, a separate financing statement called a Fixture Filing is filed. 4. Agricultural Lien: This type of financing statement is specifically designed for transactions related to farm-related collateral, including crops, livestock, and farm equipment. It is important to note that Chicago Illinois Financing Statements typically have a defined duration, usually five years from the filing date. Lenders must file a continuation statement before the expiration of the initial filing to maintain their priority rights. In conclusion, a Chicago Illinois Financing Statement is a legally binding document used to secure collateral for loans in the state. By filing this statement, lenders establish their rights in the collateral, ensuring they are adequately protected in case of default. Understanding the different types of financing statements available assists lenders in choosing the appropriate one for their specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Declaración de Financiamiento - Financing Statement

Description

How to fill out Chicago Illinois Declaración De Financiamiento?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Chicago Financing Statement, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the recent version of the Chicago Financing Statement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Chicago Financing Statement:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Chicago Financing Statement and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!