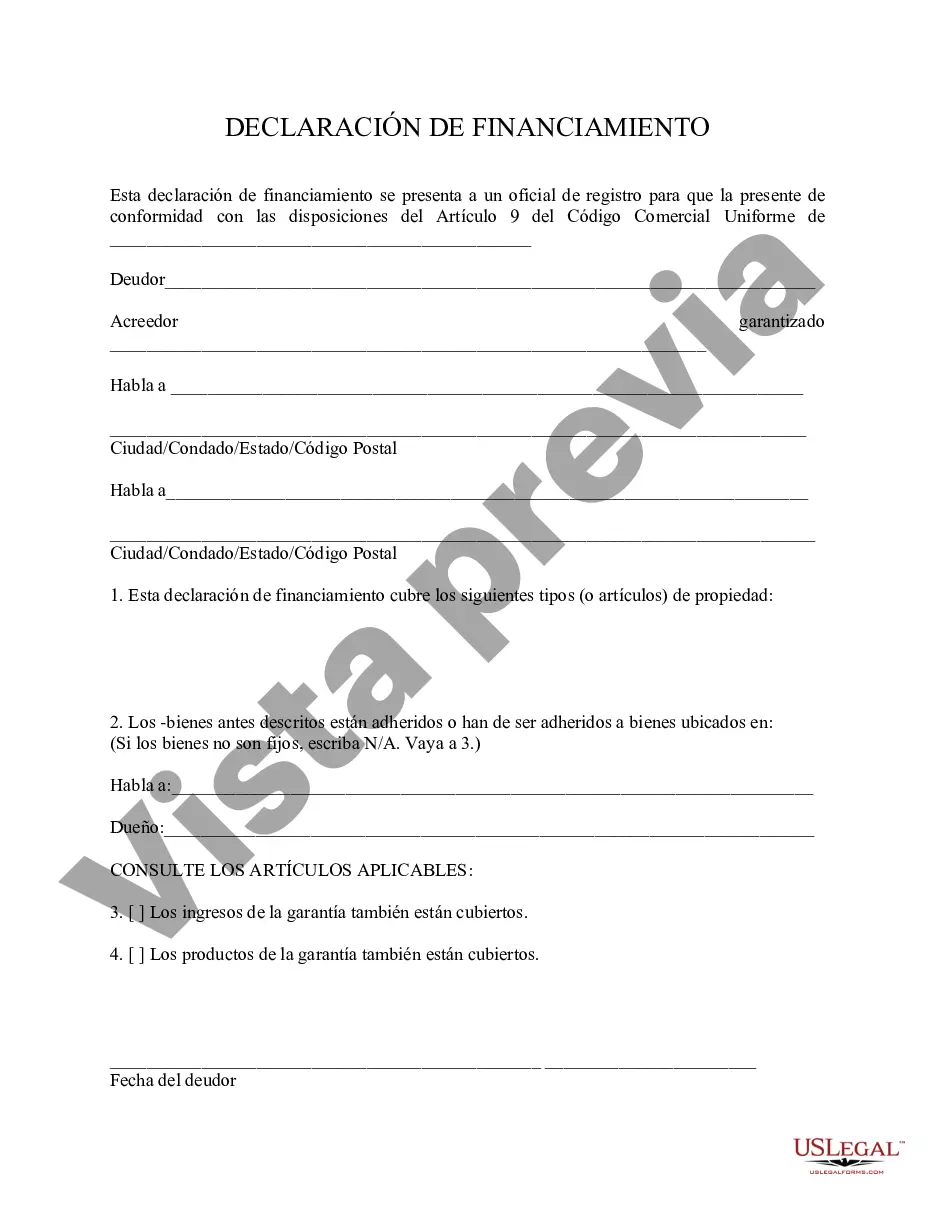

Dallas Texas Financing Statement is a legally binding document that provides information about a secured party's interest in personal property as collateral for a loan in Dallas, Texas. It is filed with the Secretary of State's office to publicly disclose and establish priority in case of bankruptcy or default by the debtor. The Dallas Texas Financing Statement includes specific details regarding the parties involved, such as the name and address of the secured party (lender) and the debtor (borrower). It also identifies the collateral being pledged, which can include tangible assets like inventory, equipment, vehicles, or accounts receivable, as well as intangible assets such as patents or trademarks. By filing a Dallas Texas Financing Statement, the secured party ensures that their interest in the collateral is recognized legally and is superior to any subsequent claims made by other creditors or individuals. This statement provides protection and establishes priority in case the debtor defaults or files for bankruptcy. It helps potential lenders assess the debtor's existing obligations and determine if they can extend additional credit to them. In Dallas, Texas, two main types of financing statements are commonly used: the Uniform Commercial Code (UCC) financing statement and the chattel mortgage. The UCC financing statement is the most commonly used and provides a comprehensive and standardized format for documenting the security interest. The chattel mortgage specifically covers interests in movable property, such as vehicles or equipment. The Dallas Texas Financing Statement is an essential tool for lenders, creditors, and buyers to perform due diligence before entering into transactions involving personal property as collateral. It facilitates transparency and ensures a fair and orderly process for resolving conflicting claims. By searching the public records, interested parties can verify the existence and priority of any existing liens or security interests against the debtor's assets. In summary, Dallas Texas Financing Statement is a legal document used to disclose a secured party's interest in personal property as collateral for a loan. It protects the lender's rights and establishes priority in case of default or bankruptcy. Types of financing statements in Dallas may include UCC financing statements and chattel mortgages, each serving specific needs for documenting security interests on movable property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Declaración de Financiamiento - Financing Statement

Description

How to fill out Dallas Texas Declaración De Financiamiento?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Financing Statement, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the latest version of the Dallas Financing Statement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Dallas Financing Statement:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Dallas Financing Statement and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!