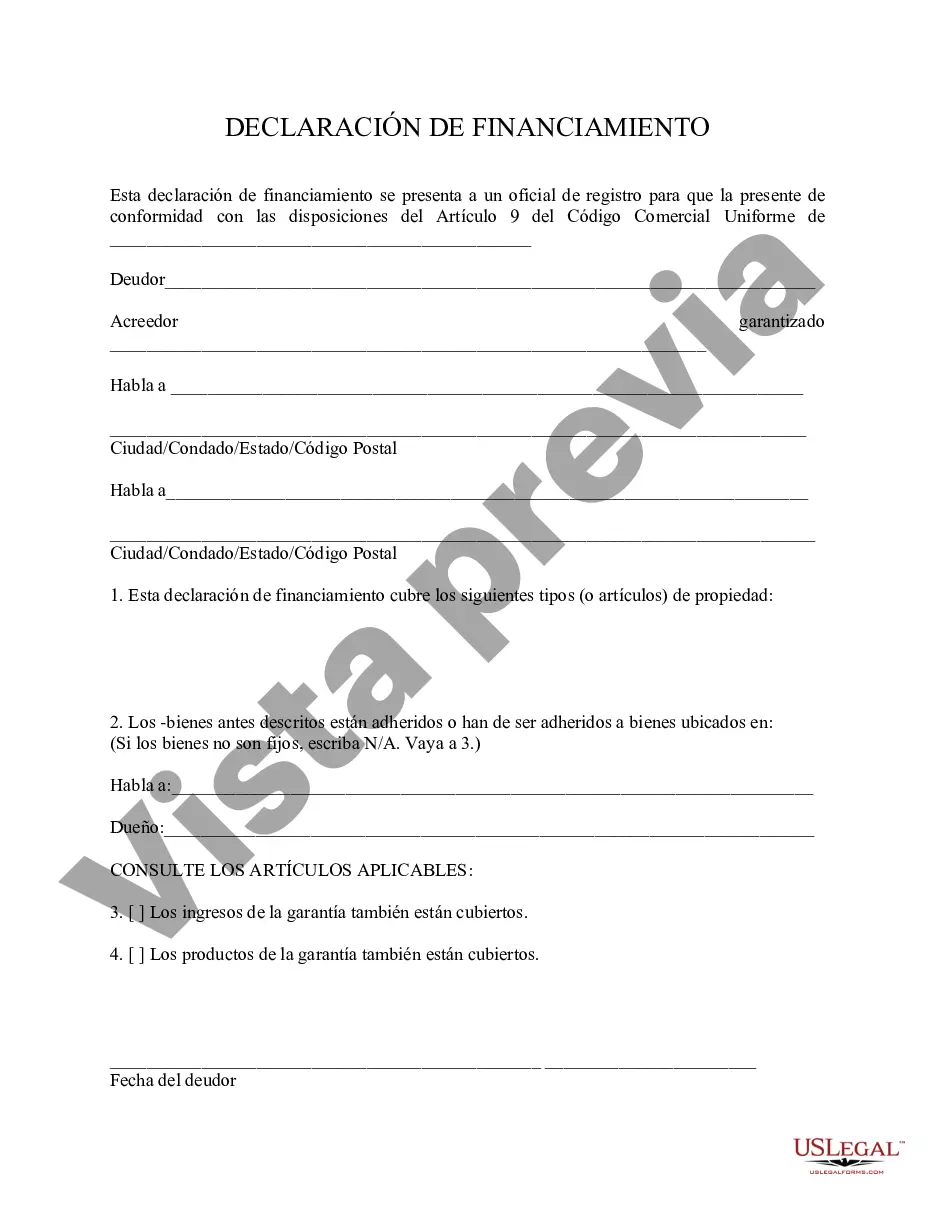

Houston Texas Financing Statement is a legal document used to secure interest in assets as collateral for a loan within the state of Texas, specifically in Houston. It is a crucial part of the lending process, ensuring that lenders can protect their rights when loaning funds or extending credit to parties in Houston Texas. The Houston Texas Financing Statement is primarily governed by the Uniform Commercial Code, specifically Article 9, which sets out the rules and regulations for this type of financial agreement. The purpose of the financing statement is to provide a public record of a lender's security interest in the assets of a debtor, known as collateral. This statement acts as a notice to other parties, such as competing lenders or potential buyers, that the assets listed on the statement are encumbered by the lender's claim. There are different types of Houston Texas Financing Statements that can be filed, depending on the specific circumstances and nature of the transaction. Some common types include: 1. UCC-1 Financing Statement: This is the most standard and widely used form of a financing statement. It covers a broad range of collateral and requires information about the debtor, lender, and a detailed description of the collateral. 2. UCC-3 Financing Statement Amendment: This form is used to amend or terminate an existing financing statement. It allows lenders or debtors to update information, add additional collateral, or terminate a previously filed statement. 3. UCC-1F Financing Statement Fixture Filing: When the collateral involves fixtures, which are goods that are attached to real estate, a UCC-1F financing statement must be filed. This statement includes information about the debtor, lender, and a detailed description of the fixtures. 4. UCC-1Ad Financing Statement Additional Party: In cases where additional parties become obligated as debtors, this financing statement is filed to reflect the changes. It ensures the protection of the lender's interest in the collateral involving multiple parties. It is essential to file the appropriate type of financing statement accurately and timely to ensure the lender's priority and legal rights over the collateral. Failure to file or errors in the statement could result in loss of priority, allowing other creditors to take precedence. In conclusion, the Houston Texas Financing Statement is a crucial legal document used in the lending process in Houston, Texas. It provides lenders with a public record of their security interest in collateral, ensuring their rights are protected. Various types of financing statements exist, such as the UCC-1, UCC-3, UCC-1F, and UCC-1Ad, each serving specific purposes within different transaction scenarios. Lenders and debtors must carefully prepare and file the applicable financing statement to maintain their interests and comply with the relevant regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Ucc Statement Request Form - Financing Statement

Description

How to fill out Houston Texas Declaración De Financiamiento?

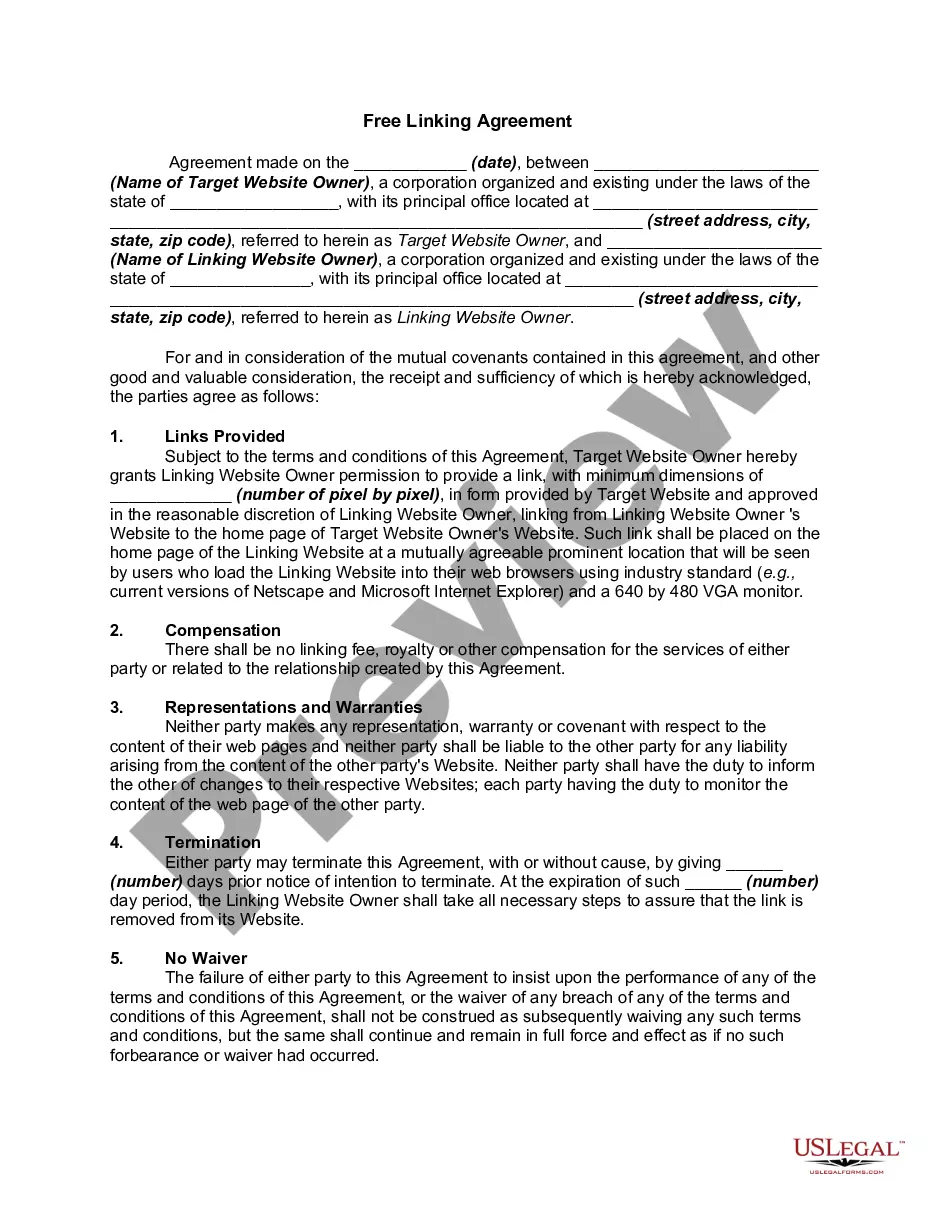

Draftwing paperwork, like Houston Financing Statement, to take care of your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Houston Financing Statement form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading Houston Financing Statement:

- Ensure that your form is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Houston Financing Statement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!