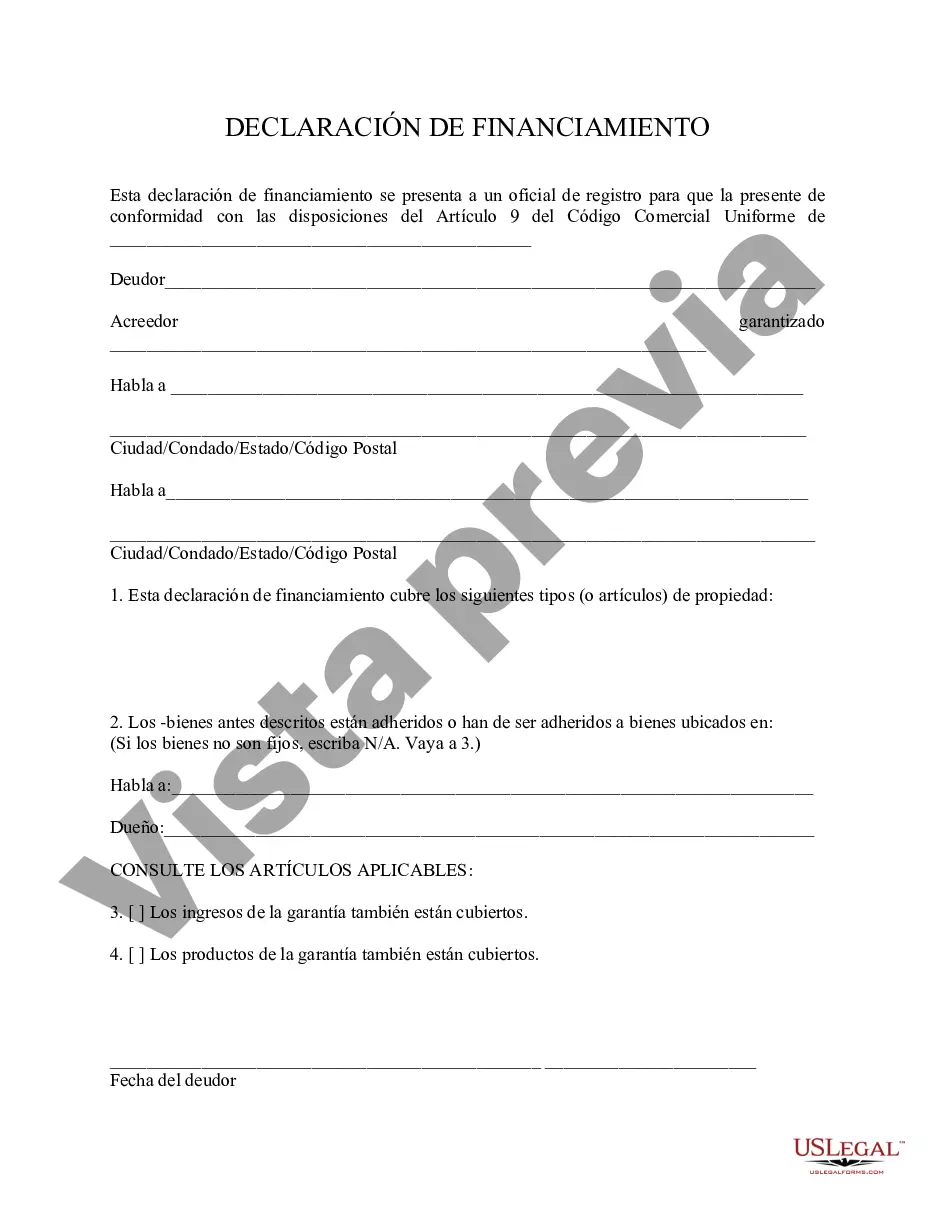

Kings New York Financing Statement, also known as a UCC-1 Financing Statement, is a legal document used to establish a creditor's security interest in a borrower's assets located in Kings County, New York. Primarily governed by Article 9 of the Uniform Commercial Code (UCC), this statement serves to notify interested parties that a particular creditor has a claim on the collateral specified in the document. The purpose of a Kings New York Financing Statement is to publicly record and disclose the details of a loan or credit transaction. By filing this statement with the New York Secretary of State, creditors protect their rights and ensure priority in case of the borrower's default, bankruptcy, or the sale of assets. This filing system helps provide security for lenders and promotes transparency in commercial transactions. The Kings New York Financing Statement contains important information such as the names and addresses of the debtor (borrower) and secured party (creditor), a description of the collateral, and any other necessary details. It should accurately identify both parties and provide a clear description of the assets serving as collateral. This information helps establish the priority of the creditor's claim against other potential claimants. There are no specific types of Kings New York Financing Statements. However, different versions may exist based on the nature of the loan and the type of collateral involved. For example, financing statements could vary for transactions involving real estate, personal property, intellectual property, or even agricultural products. The content and format of the statement may differ depending on the specific circumstances of the loan agreement. In conclusion, Kings New York Financing Statement, also known as UCC-1 Financing Statement, is a crucial legal document utilized by creditors to establish their security interest in a borrower's assets. By filing this statement with the New York Secretary of State, creditors protect their rights and maintain priority in loan transactions. The statement should accurately identify the parties involved and provide a clear description of the collateral. Different variations of this statement exist based on the type of loan and collateral involved, ensuring its relevance across a wide range of industries and transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Declaración de Financiamiento - Financing Statement

Description

How to fill out Kings New York Declaración De Financiamiento?

Do you need to quickly create a legally-binding Kings Financing Statement or probably any other form to manage your own or business affairs? You can select one of the two options: contact a professional to write a legal document for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-compliant form templates, including Kings Financing Statement and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the Kings Financing Statement is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were hoping to find by using the search bar in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Kings Financing Statement template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we offer are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!