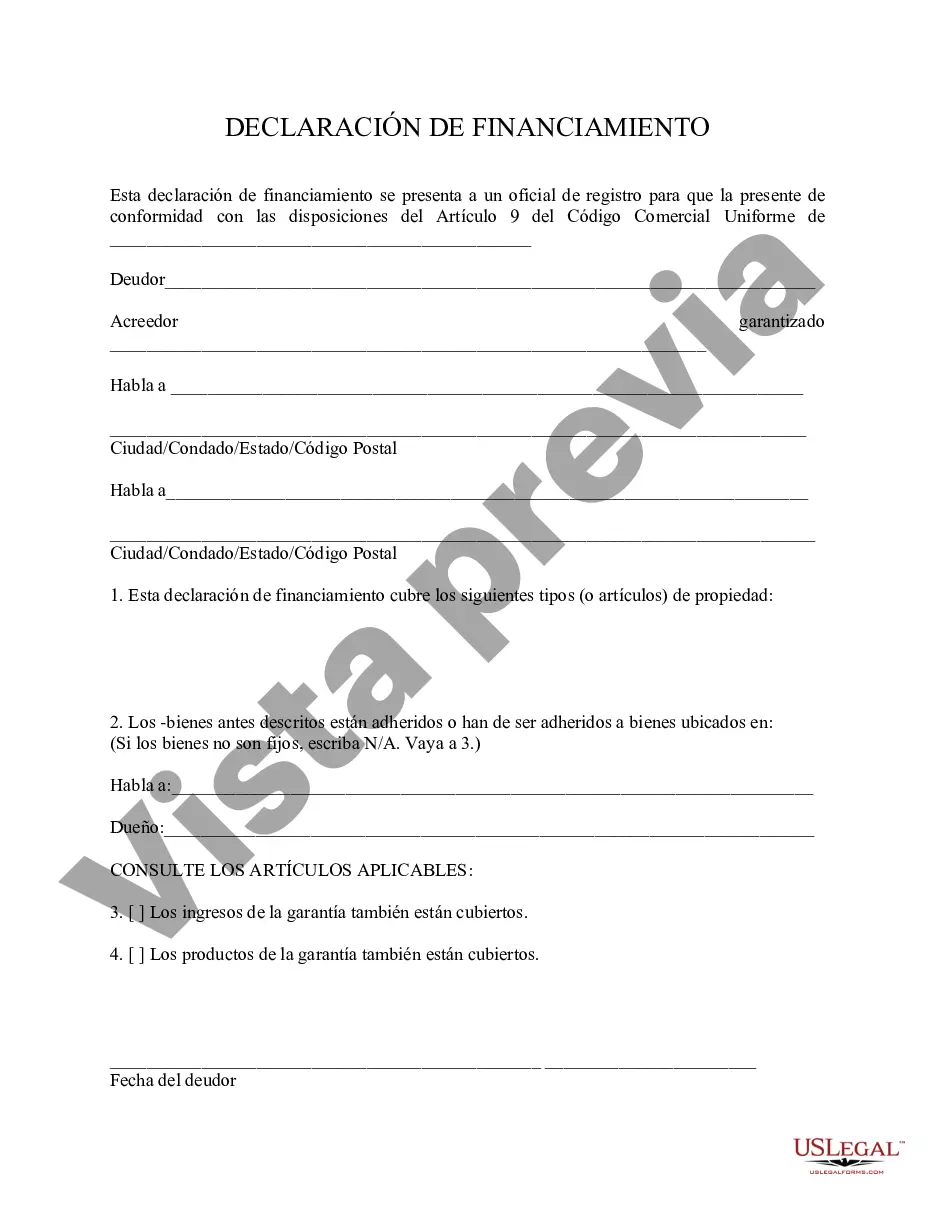

Miami-Dade Florida Financing Statement is a legal document used to secure interests in personal property as collateral for loans and other financial transactions. It plays a crucial role in providing a public record of the rights and claims against the property, ensuring transparency and protection for lenders and borrowers alike. By filing a Financing Statement in Miami-Dade County, Florida, parties can establish their priority over other potential creditors and safeguard their investments. The Miami-Dade Florida Financing Statement follows the guidelines set forth in the Uniform Commercial Code (UCC), a standard framework adopted by most U.S. jurisdictions to regulate commercial transactions. This standardized form aids in maintaining consistency and clarity across different regions. Key elements included in the Miami-Dade Florida Financing Statement are the names and addresses of both the debtor (the party who owes the debt) and the secured party (the party who has a security interest in the property). Additionally, a detailed description of the collateral being used as security is necessary to accurately identify the property. It is important to note that there are different types of Financing Statements applicable in Miami-Dade, Florida, depending on the nature of the transaction and the type of collateral involved. Some common types include: 1. General Financing Statement: This type of statement is used when a creditor seeks to secure their interest in general assets of the debtor, such as inventory, accounts receivable, equipment, or other personal property. It provides a broad security interest against a wide range of collateral. 2. Specific Financing Statement: Also known as a "Fixture Filing," this type of statement is utilized for securing interests in specific assets attached to real property, commonly referred to as fixtures. Examples of fixtures can include machinery permanently affixed to a building or specific installations. 3. Agricultural Lien Financing Statement: Designed specifically for agricultural transactions, this type of Financing Statement is used to provide comprehensive protection for lenders in the agricultural industry. It covers interests related to crops, livestock, machinery, and other agricultural assets. 4. Manufactured Home Financing Statement: This category applies to financing transactions involving manufactured homes. By filing this statement, lenders ensure their claims against the manufactured home are duly recorded and protect their financial interests. In conclusion, the Miami-Dade Florida Financing Statement is a legal document used to secure interests in personal property, providing protection and transparency for lenders and borrowers. It follows the guidelines of the Uniform Commercial Code and comes in various types depending on the nature of the transaction and the type of collateral involved. By properly filing a Financing Statement, parties can establish their priorities, safeguard their investments, and ensure compliance with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Declaración de Financiamiento - Financing Statement

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-01693-AZ

Format:

Word

Instant download

Description

AZ-PRODUCTOS-21

Miami-Dade Florida Financing Statement is a legal document used to secure interests in personal property as collateral for loans and other financial transactions. It plays a crucial role in providing a public record of the rights and claims against the property, ensuring transparency and protection for lenders and borrowers alike. By filing a Financing Statement in Miami-Dade County, Florida, parties can establish their priority over other potential creditors and safeguard their investments. The Miami-Dade Florida Financing Statement follows the guidelines set forth in the Uniform Commercial Code (UCC), a standard framework adopted by most U.S. jurisdictions to regulate commercial transactions. This standardized form aids in maintaining consistency and clarity across different regions. Key elements included in the Miami-Dade Florida Financing Statement are the names and addresses of both the debtor (the party who owes the debt) and the secured party (the party who has a security interest in the property). Additionally, a detailed description of the collateral being used as security is necessary to accurately identify the property. It is important to note that there are different types of Financing Statements applicable in Miami-Dade, Florida, depending on the nature of the transaction and the type of collateral involved. Some common types include: 1. General Financing Statement: This type of statement is used when a creditor seeks to secure their interest in general assets of the debtor, such as inventory, accounts receivable, equipment, or other personal property. It provides a broad security interest against a wide range of collateral. 2. Specific Financing Statement: Also known as a "Fixture Filing," this type of statement is utilized for securing interests in specific assets attached to real property, commonly referred to as fixtures. Examples of fixtures can include machinery permanently affixed to a building or specific installations. 3. Agricultural Lien Financing Statement: Designed specifically for agricultural transactions, this type of Financing Statement is used to provide comprehensive protection for lenders in the agricultural industry. It covers interests related to crops, livestock, machinery, and other agricultural assets. 4. Manufactured Home Financing Statement: This category applies to financing transactions involving manufactured homes. By filing this statement, lenders ensure their claims against the manufactured home are duly recorded and protect their financial interests. In conclusion, the Miami-Dade Florida Financing Statement is a legal document used to secure interests in personal property, providing protection and transparency for lenders and borrowers. It follows the guidelines of the Uniform Commercial Code and comes in various types depending on the nature of the transaction and the type of collateral involved. By properly filing a Financing Statement, parties can establish their priorities, safeguard their investments, and ensure compliance with applicable laws.

Free preview