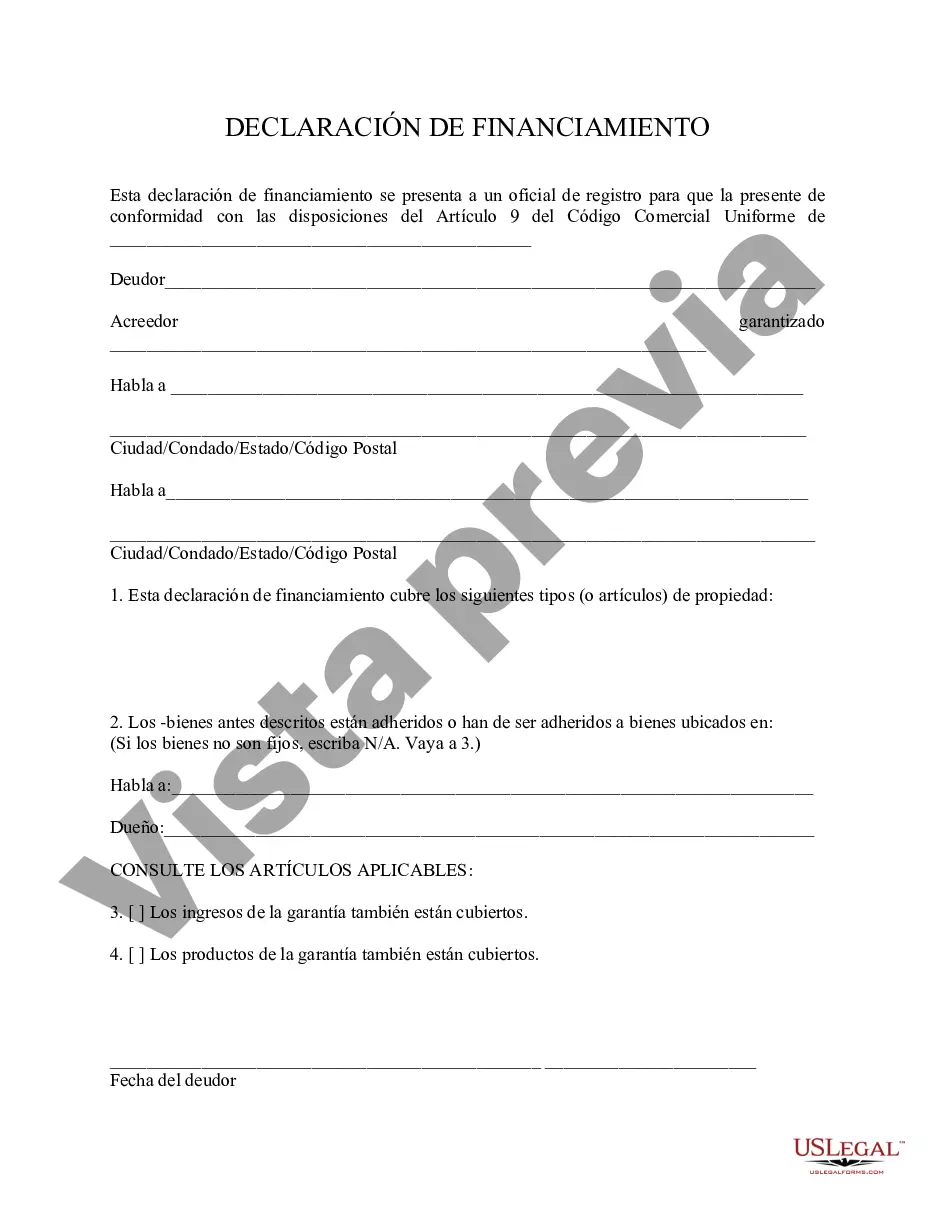

San Jose California Financing Statement is a legally binding document used to secure a loan on personal property in the city of San Jose, California. It serves as a public notice to inform potential creditors about an individual or business's pledge of their personal property as collateral for a loan. The financing statement is filed with the California Secretary of State's office and becomes part of the public record. Keywords: San Jose California, financing statement, personal property, collateral, loan, public notice, creditors, Secretary of State's office, public record. There are multiple types of San Jose California Financing Statements that individuals and businesses may use depending on their specific needs: 1. Individual Financing Statement: This type of financing statement is used by individuals to pledge their personal property as collateral for loans. It is commonly used for consumer loans, such as vehicle or personal loans. 2. Business Financing Statement: Businesses in San Jose, California, use this type of financing statement to secure loans on their personal property. It helps businesses obtain credit by utilizing their assets, such as equipment, inventory, or accounts receivable, as collateral. 3. Agricultural Financing Statement: Farmers and agricultural businesses in San Jose, California, can utilize this specific type of financing statement to secure loans specifically for agricultural purposes. It encompasses machinery, livestock, crops, and other agricultural assets as collateral. 4. Uniform Commercial Code (UCC) Financing Statement: The UCC financing statement is a widely used standardized form that creates a lien on personal property. It applies to both individuals and businesses and covers a broad range of assets, such as equipment, inventory, accounts receivable, and more. 5. Real Estate Financing Statement: While the primary focus of San Jose California Financing Statements is personal property, in certain cases, real estate may be used as collateral. This type of financing statement specifically pertains to loans secured by real estate, such as mortgages or property development loans. By filing a San Jose California Financing Statement, individuals or businesses assert their interests over personal property, making it clear to potential creditors that the property is encumbered by a loan. Properly completing and submitting the financing statement is essential for protecting both the lender's and borrower's rights, ensuring transparency and legal compliance in the borrowing process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Declaración de Financiamiento - Financing Statement

Description

How to fill out San Jose California Declaración De Financiamiento?

Whether you intend to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like San Jose Financing Statement is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the San Jose Financing Statement. Follow the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Financing Statement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!