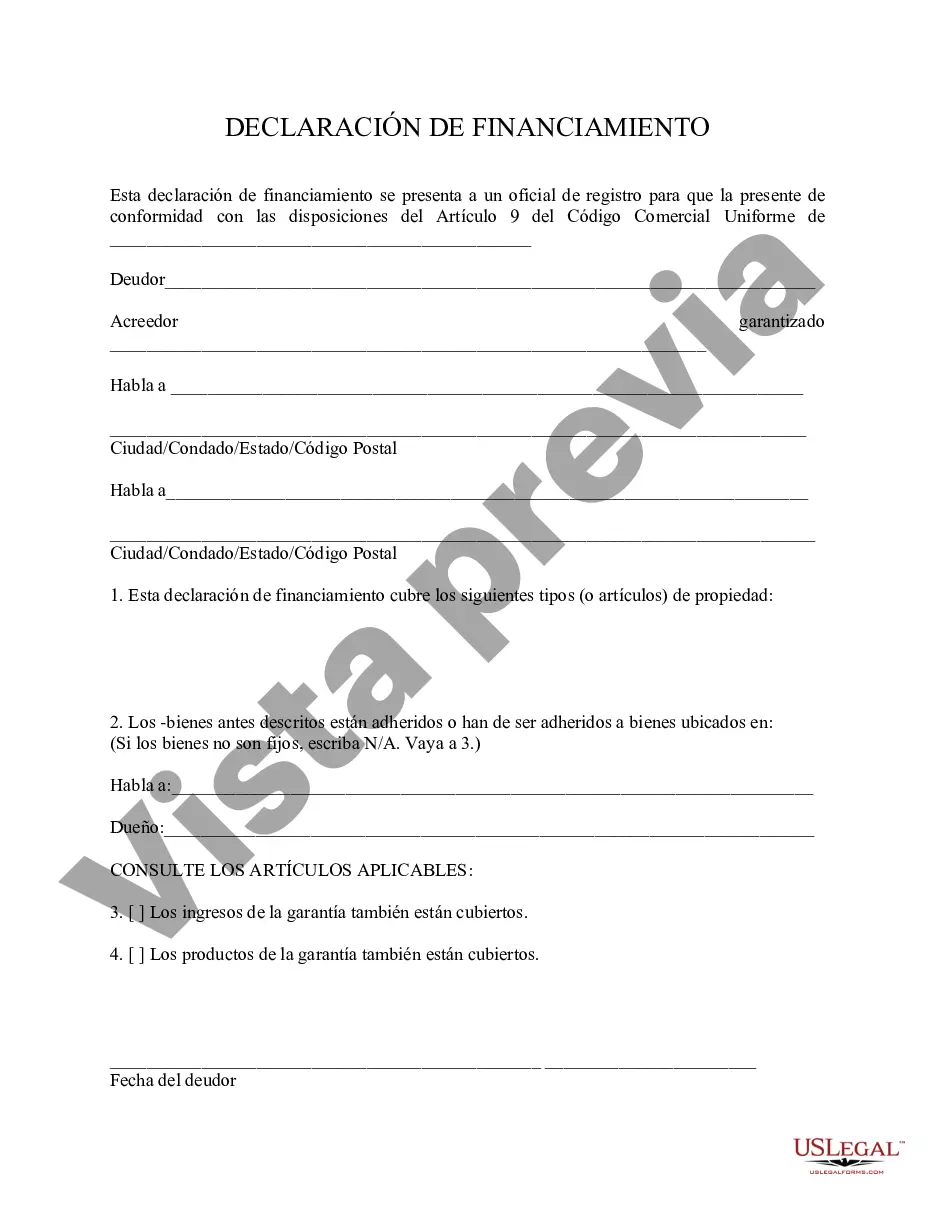

A Santa Clara California Financing Statement is a legal document filed by a lender or creditor to protect their interest in a debtor's personal property. It serves as a public record of a security interest, providing notice to other potential creditors or interested parties. When a borrower pledges personal property as collateral for a loan or extension of credit, the lender files a Financing Statement with the Santa Clara County Clerk-Recorder's Office. This statement ensures that the lender has a secured interest in the collateral and establishes their priority position in case of default or bankruptcy. The Santa Clara California Financing Statement includes essential information such as the name and address of both the debtor and secured party, a description of the collateral being pledged, and any additional terms or conditions. It is crucial to accurately describe the collateral to avoid any confusion or disputes in the future. There are different types of Financing Statements that can be filed in Santa Clara, California. Some of these include: 1. UCC-1 Financing Statement: This is the most common type and is used to establish a general security interest in the debtor's personal property. 2. UCC-3 Financing Statement Amendment: This form is used to make changes or updates to an existing Financing Statement, such as adding or removing collateral, changing the secured party's information, or extending the filing period. 3. UCC-5 Information Statement: This statement is used to provide additional information related to a previously filed financing statement. 4. UCC-11 Information Request: Parties with a legitimate interest can request information about any Financing Statement filed in Santa Clara County. This helps in conducting due diligence or determining the priority of competing security interests. Filing a Financing Statement is an important step in securing a loan and protecting the interests of both the lender and debtor. It enables lenders to assert their rights to the collateral and ensures transparency in commercial transactions. Before filing, it is recommended to understand the specific requirements and guidelines set by the Santa Clara County Clerk-Recorder's Office to avoid any potential complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Declaración de Financiamiento - Financing Statement

Description

How to fill out Santa Clara California Declaración De Financiamiento?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Santa Clara Financing Statement, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any activities related to document completion straightforward.

Here's how you can purchase and download Santa Clara Financing Statement.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Santa Clara Financing Statement.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Santa Clara Financing Statement, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you have to deal with an extremely difficult case, we recommend using the services of an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!