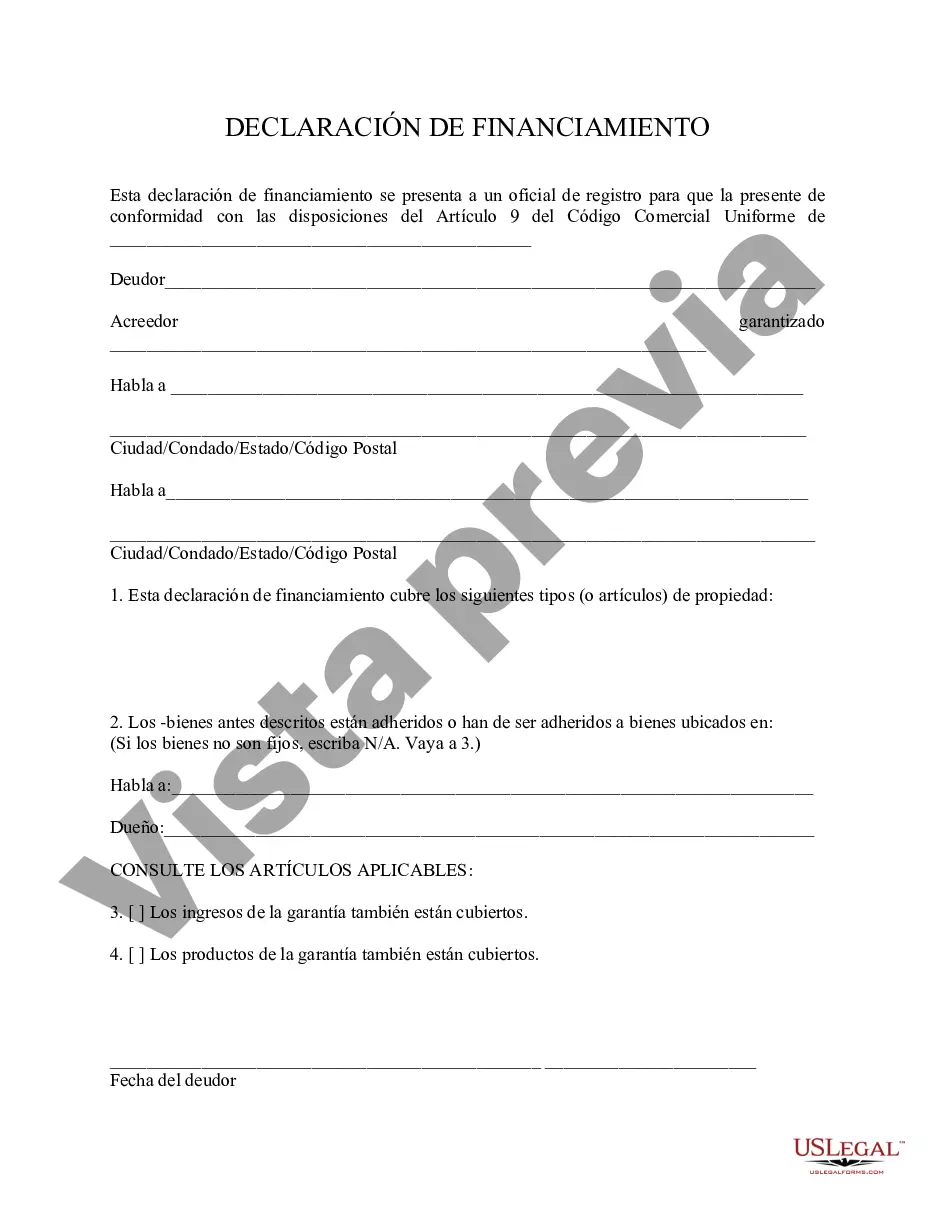

Wayne Michigan Financing Statement is a legal document filed to provide notice of a security interest in personal property. It is an important component of the Uniform Commercial Code (UCC), which governs commercial transactions and protects the rights of creditors and debtors. The Wayne Michigan Financing Statement is typically filed by secured creditors, such as banks, financial institutions, or private lenders, when they lend money to borrowers and take an interest in the borrower's personal property as collateral. By filing this statement, the creditor establishes a priority claim on the specified property, ensuring they have a legal right to repossess and sell it in case the borrower defaults on their loan payments. The financing statement contains relevant information about the debtor, secured creditor, and the collateral. It includes details such as the debtor's legal name, the creditor's name and address, a description of the collateral, and any applicable terms and conditions. This document is filed with the Secretary of State's office or a designated agency responsible for maintaining the public record of such statements. In Wayne Michigan, there are various types of financing statements, including: 1. General Wayne Michigan Financing Statement: This is the most common type of financing statement, used to establish a broad security interest in most types of tangible and intangible personal property. 2. Fixture Financing Statement: This type of statement is specific to fixtures, which are goods that are attached to real property, such as machinery or equipment. By filing a fixture financing statement, the creditor ensures their security interest in the fixtures is recognized in relation to the real property. 3. Agriculture Financing Statement: This statement is applicable when the collateral is agricultural-related property, such as crops, livestock, or farm equipment. It takes into account specialized requirements and regulations related to agricultural transactions. 4. Transmitting Utility Financing Statement: If the collateral includes property related to transmitting utilities, such as power lines, pipelines, or communication systems, this type of financing statement is used. It is crucial for creditors to file accurate and complete financing statements to protect their interests and establish priority over other potential creditors. Debtor names, collateral descriptions, and legal compliance are vital aspects of a valid financing statement. Professional legal advice should be sought to ensure compliance with the UCC regulations and state-specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Declaración de Financiamiento - Financing Statement

Description

How to fill out Wayne Michigan Declaración De Financiamiento?

Are you looking to quickly create a legally-binding Wayne Financing Statement or probably any other form to manage your personal or corporate affairs? You can go with two options: contact a professional to write a valid document for you or create it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Wayne Financing Statement and form packages. We provide templates for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Wayne Financing Statement is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were seeking by using the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Wayne Financing Statement template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Moreover, the templates we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!