Subject: Comprehensive Guide: Tarrant Texas Sample Letter for Judgment Confirming Tax Title Dear [Recipient's Name], I hope this message finds you well. Today, I would like to provide you with a detailed description of Tarrant Texas Sample Letter for Judgment Confirming Tax Title, an essential document in the process of obtaining ownership rights to a property acquired through a tax sale. Below, you will find comprehensive information about this letter, its purpose, and its various types. 1. Definition: A Tarrant Texas Sample Letter for Judgment Confirming Tax Title is a legal correspondence sent by the tax buyer (purchaser) to the Tarrant County authorities, following the successful acquisition of a property through a tax sale auction. This letter aims to initiate the process of confirming the buyer's title ownership and resolve any potential legal disputes. 2. Purpose: The main objective of the Sample Letter for Judgment Confirming Tax Title is to request a judgment from the court to officially validate the buyer's claim of ownership for the purchased property. By obtaining this judgment, the tax buyer gains a strengthened legal standing that protects them from challenges, encumbrances, and subsequent claims from other parties. 3. Components: a. Identification Details: The letter should begin with the accurate identification details of the property acquired, including its address, parcel identification number, and any other relevant information. b. Statement of Ownership: The letter should clearly state that the tax buyer is the rightful owner of the property, as acquired through the tax sale process. c. Supporting Documents: Include any necessary supporting documents, such as the tax sale certificate, tax deed, or assignment of bid. d. Request for Judgment: Formally request that the court issue a judgment confirming the tax buyer's ownership rights to the property, thereby resolving any associated legal challenges. e. Contact Information: Provide complete contact details for the tax buyer, including full name, mailing address, phone number, and email address. 4. Types: a. Tarrant Texas Sample Letter for Judgment Confirming Tax Title (Residential Property): This type of letter is used specifically for residential properties acquired through a tax sale in Tarrant County. It follows the same format and components described above. b. Tarrant Texas Sample Letter for Judgment Confirming Tax Title (Commercial Property): This variation of the letter is tailored for commercial properties obtained through a tax sale in the same county. Though similar in format, the specific details and legal considerations may differ. In conclusion, a Tarrant Texas Sample Letter for Judgment Confirming Tax Title is a critical document for tax buyers seeking validation of ownership rights over a property acquired through a tax sale. Whether for residential or commercial properties, this letter serves as a formal request for a court-issued judgment, ensuring the buyer's legal protection and possession. We hope this detailed description of the Tarrant Texas Sample Letter for Judgment Confirming Tax Title proves helpful to you. Should you require any additional assistance or have further inquiries, please do not hesitate to reach out. We are more than happy to lend a hand. Best regards, [Your Name] [Your Organization/Company Name] [Contact Information]

Tarrant Texas Sample Letter for Judgment Confirming Tax Title

Description

How to fill out Tarrant Texas Sample Letter For Judgment Confirming Tax Title?

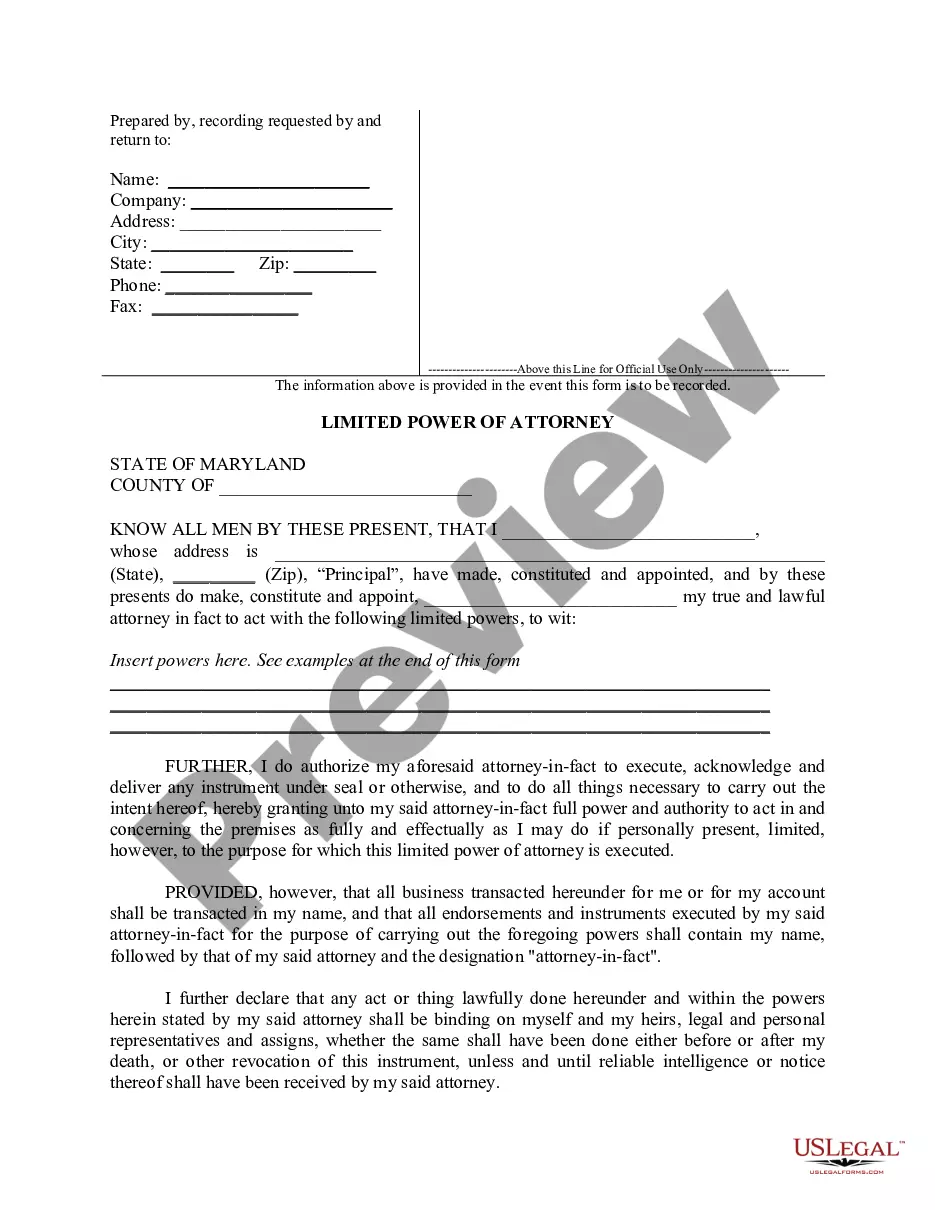

Whether you intend to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Tarrant Sample Letter for Judgment Confirming Tax Title is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Tarrant Sample Letter for Judgment Confirming Tax Title. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Sample Letter for Judgment Confirming Tax Title in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!