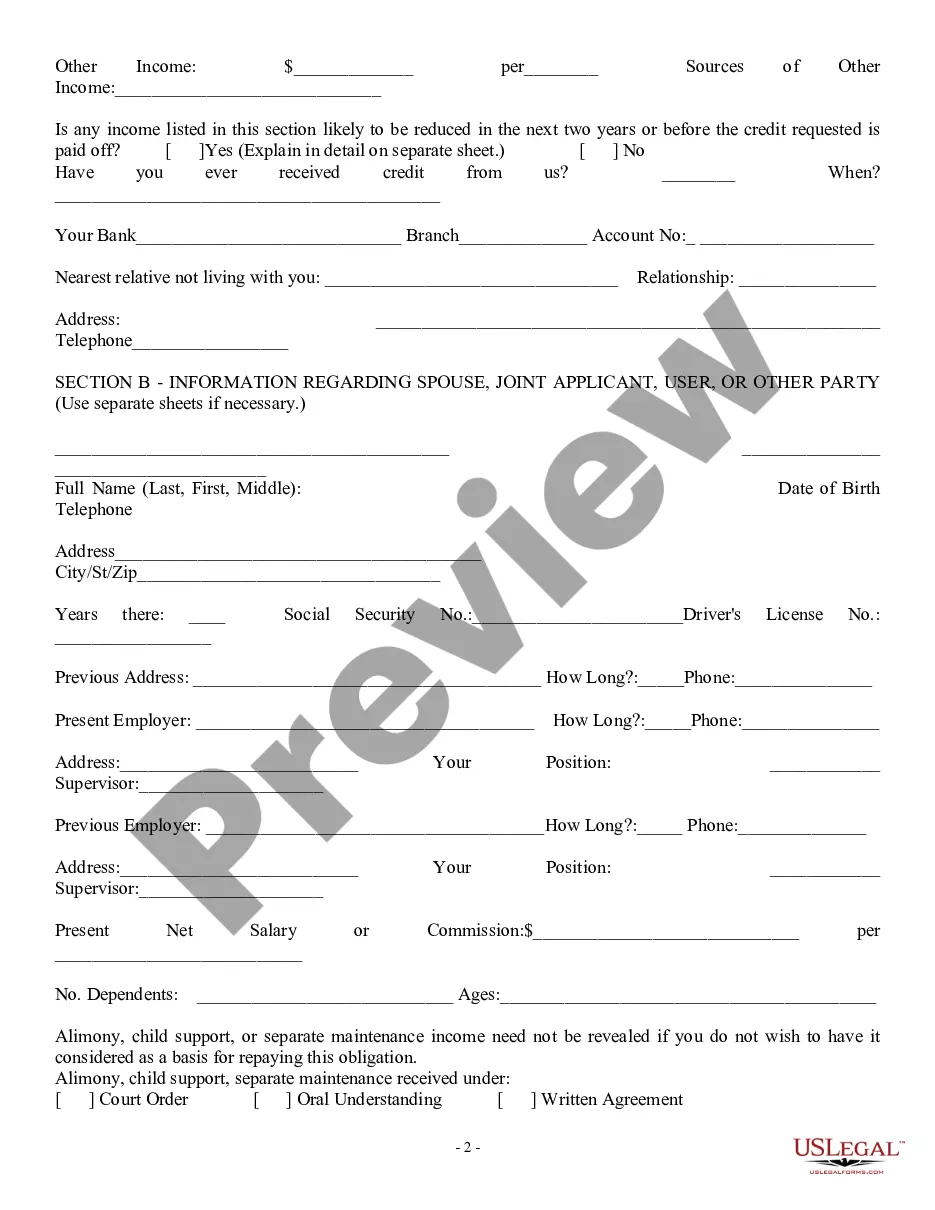

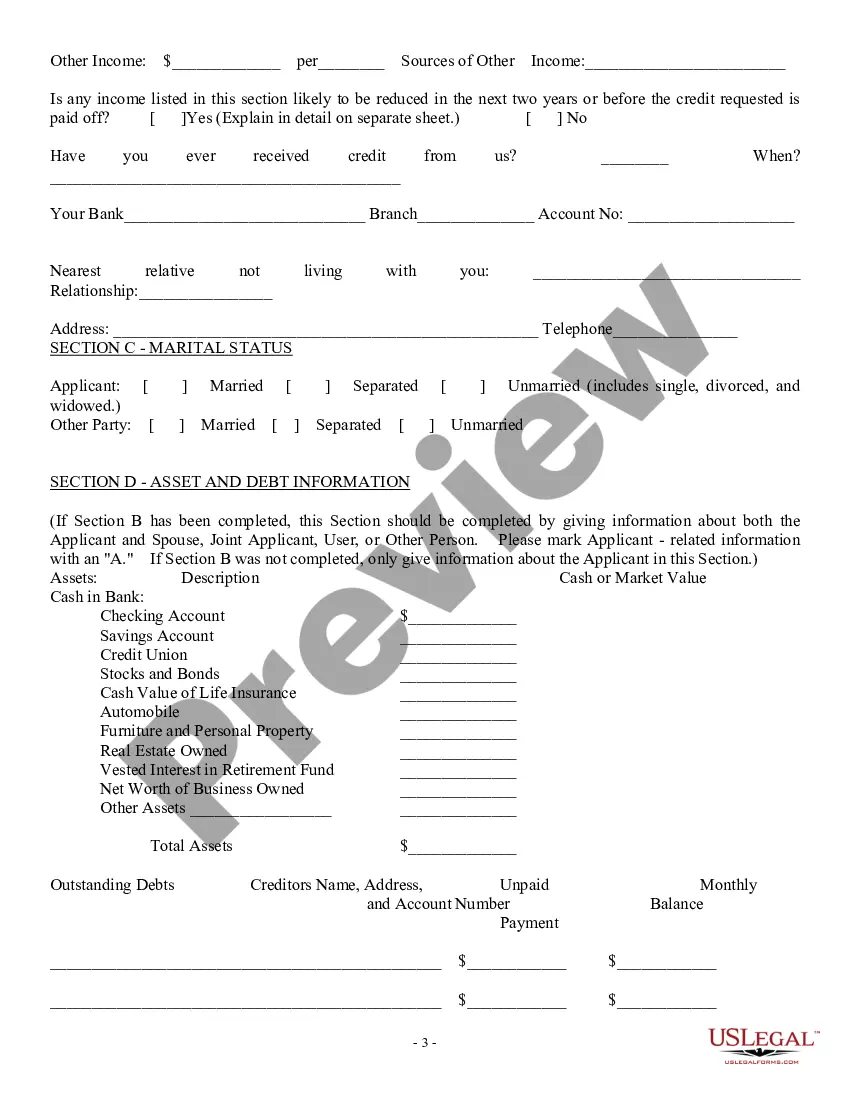

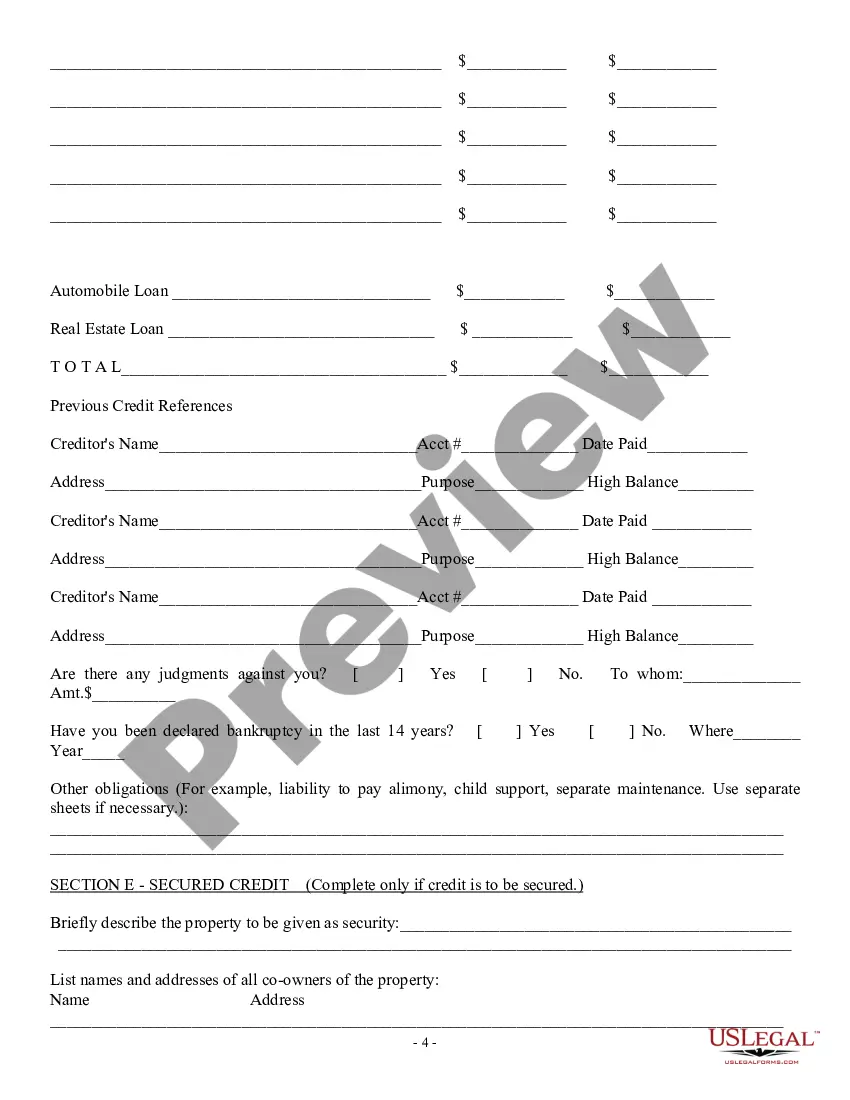

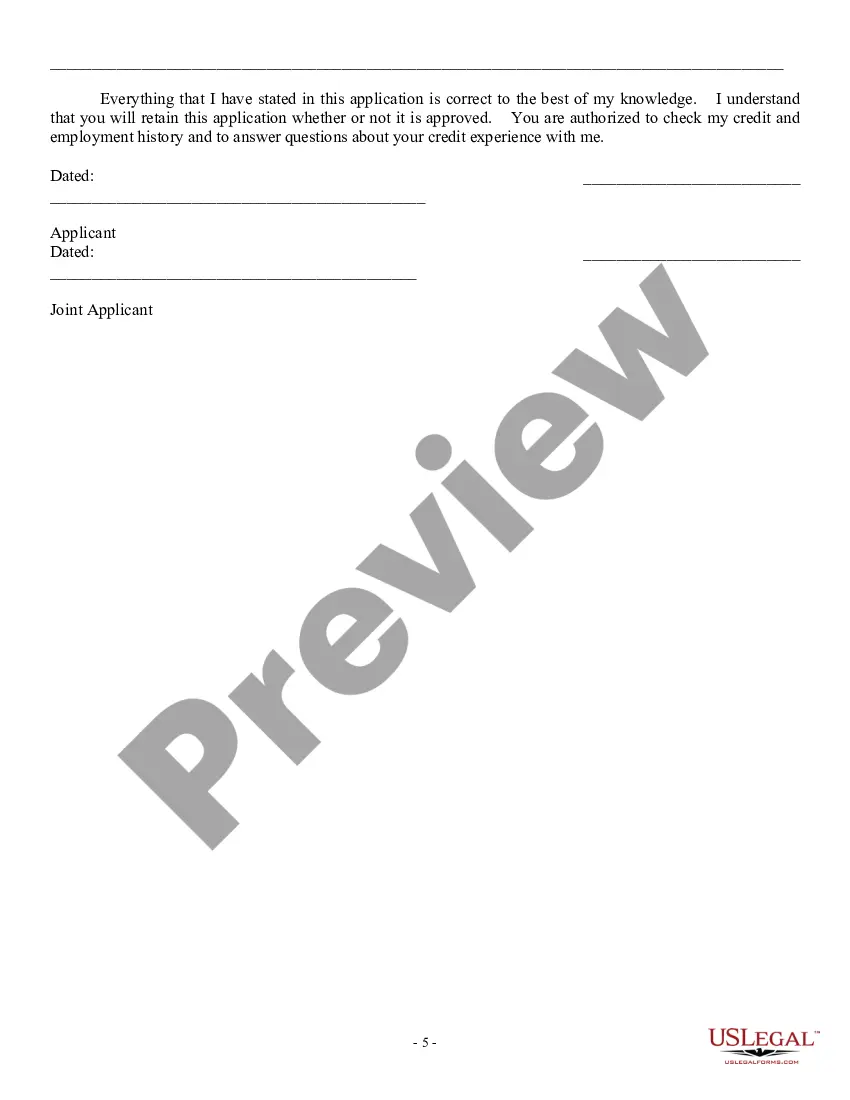

Mecklenburg, North Carolina Consumer Loan Application — Personal Loan Agreement: A Comprehensive Description In Mecklenburg, North Carolina, accessing financial assistance through consumer loans is made possible with the Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement. This agreement serves as a contractual document between the borrower and the lender, outlining the terms, conditions, and obligations associated with obtaining a personal loan. The Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement grants residents of Mecklenburg County the opportunity to secure monetary assistance for various personal needs, such as debt consolidation, medical expenses, home improvement, and emergency funding, among others. This agreement ensures transparency and legal clarity for all parties involved while adhering to state-specific regulations. When filling out the Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement, applicants must provide essential information including personal details, contact information, employment status, income verification, social security number, and banking details. The application may also require applicants to disclose their desired loan amount, repayment period preference, and purpose of the loan. The Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement encompasseseveralnt types of loans to meet the diverse needs of potential borrowers. These include: 1. Secured Personal Loans: These loans require collateral, such as real estate holdings or vehicles, as a form of security for the lender. If the borrower fails to repay the loan, the lender can seize the collateral to recover the outstanding balance. 2. Unsecured Personal Loans: Unlike secured loans, unsecured personal loans do not require collateral. These loans are granted based on the borrower's creditworthiness, income, and financial stability. However, interest rates for unsecured loans are often higher to compensate for the increased risk taken by the lender. 3. Installment Loans: A popular choice for personal financing, installment loans enable borrowers to repay the loan amount plus interest in fixed monthly installments over a predetermined period. Payments are structured to ensure affordability and convenience for the borrower. 4. Payday Loans: Payday loans are short-term loans designed to provide immediate cash flow to borrowers who need funds until their next paycheck. These loans often come with high interest rates and are to be repaid in full on the borrower's payday. 5. Debt Consolidation Loans: Specifically tailored for individuals burdened with multiple debts, debt consolidation loans allow borrowers to combine their outstanding debts into a single manageable loan. This can streamline repayment, potentially reducing interest rates and monthly payments. The Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement acts as a binding agreement, protecting both the borrower and the lender by clearly defining the terms of the loan. It outlines the loan amount, interest rate, repayment schedule, late payment penalties, early repayment options, and any additional fees or charges. It is crucial for applicants to carefully review and understand the Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement before signing, as it legally binds them to its terms. Applicants should also consult with legal or financial experts to ensure they fully comprehend the implications and obligations associated with the loan. In summary, the Mecklenburg North Carolina Consumer Loan Application — Personal Loan Agreement provides residents of Mecklenburg County a structured and regulated means of obtaining personal loans. By offering various loan types to cater to different financial circumstances, this agreement enables borrowers to access the financial assistance they need while protecting their rights and interests.

Mecklenburg North Carolina Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Mecklenburg North Carolina Consumer Loan Application - Personal Loan Agreement?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Mecklenburg Consumer Loan Application - Personal Loan Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Mecklenburg Consumer Loan Application - Personal Loan Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Consumer Loan Application - Personal Loan Agreement:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Mecklenburg Consumer Loan Application - Personal Loan Agreement and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!