Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to impart validity to the instrument and entitle it to probate. A valid testamentary trust is created only where the purported will attempting to create it complies with the formalities of the statute of wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling provisions governing the execution of wills. Pertinent statutes should be consulted.

In general terms, a remainder interest refers to someone with a future interest in an asset. It may be a future interest in the estate created by a trust, a contingent interest when a life tenant surrenders a claim to the estate, or a vested interest that becomes effective at a specified future date. It is often created when a grantor leaves property to pass to a family member upon the grantor's death.

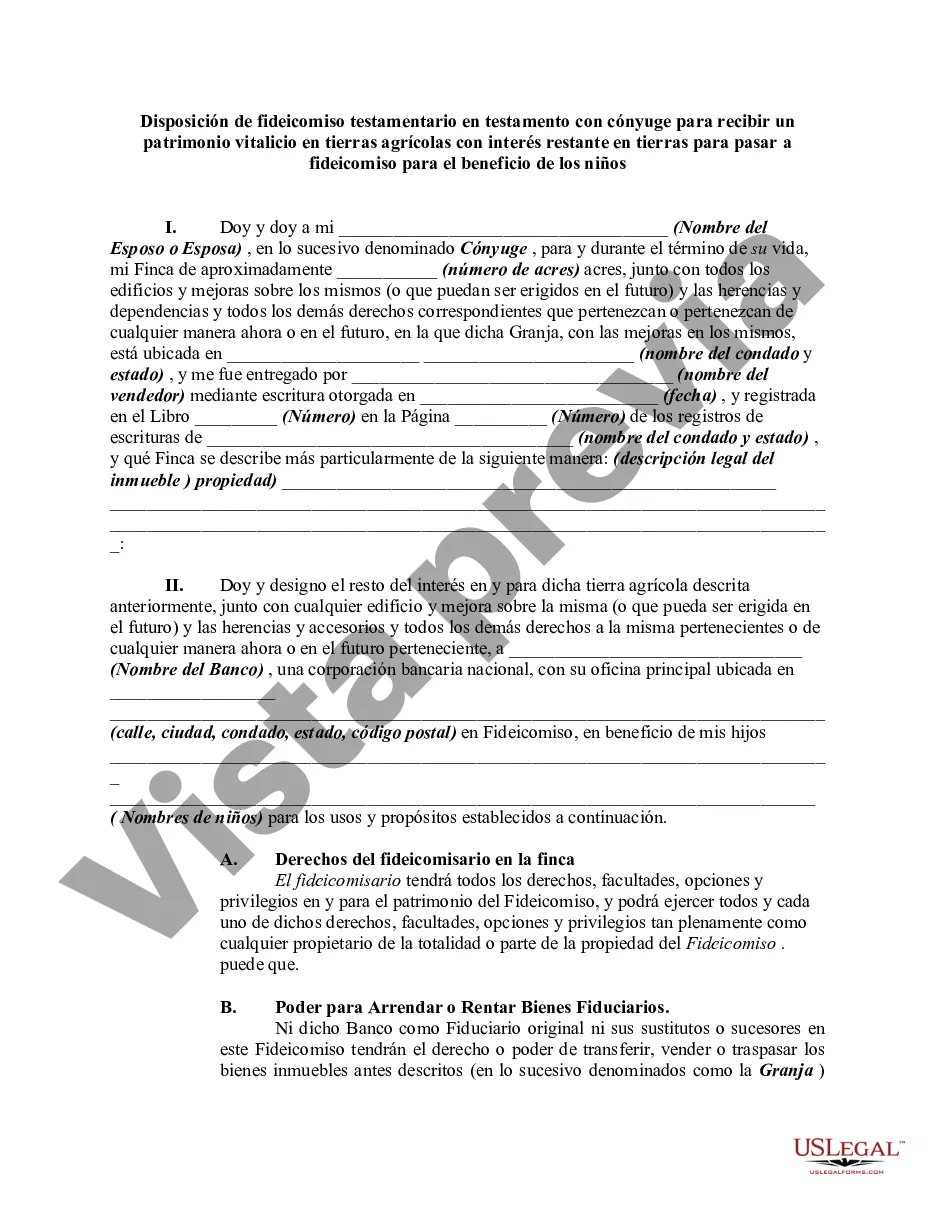

Dallas Texas Testamentary Trust Provision refers to a specific provision in a will that creates a trust for the benefit of children, while providing a life estate in farm land to the surviving spouse. This provision ensures that the surviving spouse can use and maintain the farm land for their lifetime, while also securing the children's inheritance in the form of a trust. The purpose of a Dallas Texas Testamentary Trust Provision is to protect and manage the assets for the benefit of the children after the death of both parents. By establishing a trust, the testator can outline specific instructions on how the assets, including the farm land, should be managed and distributed for the benefit of the children. There are different types of Dallas Texas Testamentary Trust Provisions that can be included in a will. Some common types include: 1. Traditional Testamentary Trust: This type of trust provides a designated trustee to manage and distribute the assets, including the farm land, for the benefit of the children. The surviving spouse receives a life estate in the farm land, allowing them to use and enjoy it during their lifetime. After the death of the surviving spouse, the remainder interest in the land passes to the trust for the benefit of the children. 2. Spendthrift Testamentary Trust: This type of trust includes provisions to protect the assets from creditors or irresponsible spending by the beneficiaries. It allows for the trustee to control the distribution of funds and assets, ensuring that they are used responsibly for the children's benefit. 3. Special Needs Testamentary Trust: If a child has special needs or disabilities, this type of trust can be created to ensure their financial stability and support throughout their lifetime. The trust can provide for their specific needs, including medical expenses, education, and daily care, while also considering any government benefit programs the child may be eligible for. 4. Charitable Testamentary Trust: In this type of trust, a portion of the assets, such as income generated from the farm land, is designated to be distributed to charitable organizations or causes specified in the will. The remainder interest in the land would still pass to the trust for the benefit of the children. By including a Dallas Texas Testamentary Trust Provision in a will, individuals can provide for the long-term financial security of their children while ensuring that the surviving spouse can continue to use and manage the farm land during their lifetime.Dallas Texas Testamentary Trust Provision refers to a specific provision in a will that creates a trust for the benefit of children, while providing a life estate in farm land to the surviving spouse. This provision ensures that the surviving spouse can use and maintain the farm land for their lifetime, while also securing the children's inheritance in the form of a trust. The purpose of a Dallas Texas Testamentary Trust Provision is to protect and manage the assets for the benefit of the children after the death of both parents. By establishing a trust, the testator can outline specific instructions on how the assets, including the farm land, should be managed and distributed for the benefit of the children. There are different types of Dallas Texas Testamentary Trust Provisions that can be included in a will. Some common types include: 1. Traditional Testamentary Trust: This type of trust provides a designated trustee to manage and distribute the assets, including the farm land, for the benefit of the children. The surviving spouse receives a life estate in the farm land, allowing them to use and enjoy it during their lifetime. After the death of the surviving spouse, the remainder interest in the land passes to the trust for the benefit of the children. 2. Spendthrift Testamentary Trust: This type of trust includes provisions to protect the assets from creditors or irresponsible spending by the beneficiaries. It allows for the trustee to control the distribution of funds and assets, ensuring that they are used responsibly for the children's benefit. 3. Special Needs Testamentary Trust: If a child has special needs or disabilities, this type of trust can be created to ensure their financial stability and support throughout their lifetime. The trust can provide for their specific needs, including medical expenses, education, and daily care, while also considering any government benefit programs the child may be eligible for. 4. Charitable Testamentary Trust: In this type of trust, a portion of the assets, such as income generated from the farm land, is designated to be distributed to charitable organizations or causes specified in the will. The remainder interest in the land would still pass to the trust for the benefit of the children. By including a Dallas Texas Testamentary Trust Provision in a will, individuals can provide for the long-term financial security of their children while ensuring that the surviving spouse can continue to use and manage the farm land during their lifetime.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.