Statutes in effect in the various jurisdictions prescribe certain formalities which must be observed in connection with the execution of a will in order to impart validity to the instrument and entitle it to probate. A valid testamentary trust is created only where the purported will attempting to create it complies with the formalities of the statute of wills. An instrument will be denied probate where it fails to conform at least substantially to the controlling provisions governing the execution of wills. Pertinent statutes should be consulted.

In general terms, a remainder interest refers to someone with a future interest in an asset. It may be a future interest in the estate created by a trust, a contingent interest when a life tenant surrenders a claim to the estate, or a vested interest that becomes effective at a specified future date. It is often created when a grantor leaves property to pass to a family member upon the grantor's death.

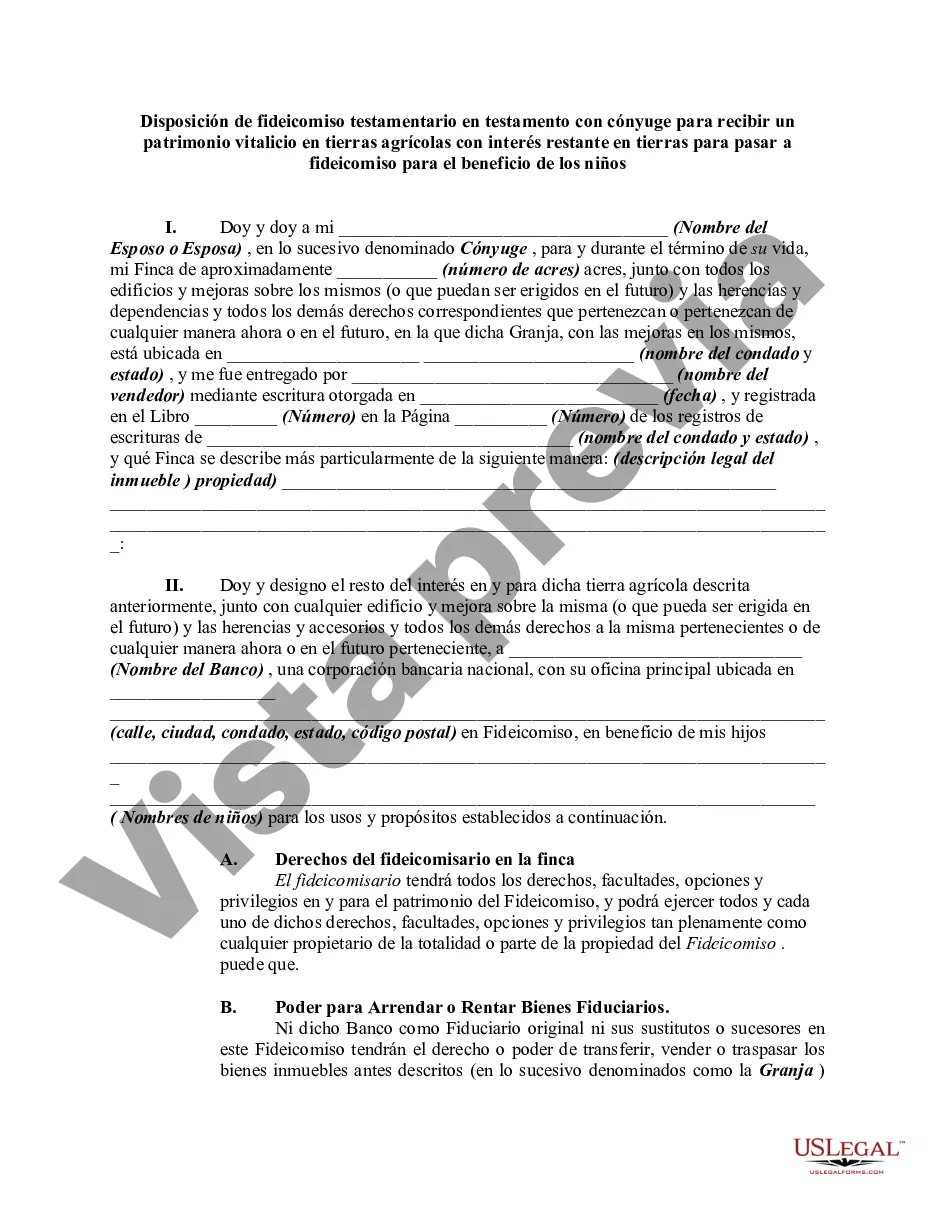

A Philadelphia Pennsylvania Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land is a legal arrangement that allows individuals to ensure the well-being and financial security of their spouse and children after their passing, particularly when the estate includes valuable farm land. This provision provides specific instructions regarding the distribution and management of assets, ensuring that the surviving spouse receives a life estate in the farm land while the remainder interest in the land passes into a trust for the benefit of the children. This type of testamentary trust provision is designed to address the unique circumstances of farm land ownership, where preserving the land's value and agricultural operations' stability is paramount. By granting the spouse a life estate, they can continue to reside on and utilize the land during their lifetime, providing them with necessary support and stability. Simultaneously, the remainder interest in the land is passed into a trust, which safeguards the interests of the children and ensures the preservation, management, and optimal use of the land. The Philadelphia Pennsylvania Testamentary Trust Provision with a Spouse to Receive a Life Estate in Farm Land is typically accompanied by specific legal terms and conditions to guarantee the effective execution of the provision. These may include guidelines for maintaining the property, leasing or selling rights, financial management, and the transfer of assets upon the spouse's death. Different types or variations of this trust provision may exist based on the specific needs and desires of the individual creating the will. Some potential variations could include naming successor trustees to manage the trust upon the spouse's passing, granting the spouse limited rights to sell or lease the land under certain circumstances, or including provisions for the care and support of any minor children during the spouse's life tenancy. It is crucial to work with an experienced attorney specializing in estate planning to draft and establish a Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land in Philadelphia, Pennsylvania. This ensures that the provision aligns with state laws, addresses the unique circumstances of the family and the farm land, and serves the best interests of the surviving spouse and children.A Philadelphia Pennsylvania Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land is a legal arrangement that allows individuals to ensure the well-being and financial security of their spouse and children after their passing, particularly when the estate includes valuable farm land. This provision provides specific instructions regarding the distribution and management of assets, ensuring that the surviving spouse receives a life estate in the farm land while the remainder interest in the land passes into a trust for the benefit of the children. This type of testamentary trust provision is designed to address the unique circumstances of farm land ownership, where preserving the land's value and agricultural operations' stability is paramount. By granting the spouse a life estate, they can continue to reside on and utilize the land during their lifetime, providing them with necessary support and stability. Simultaneously, the remainder interest in the land is passed into a trust, which safeguards the interests of the children and ensures the preservation, management, and optimal use of the land. The Philadelphia Pennsylvania Testamentary Trust Provision with a Spouse to Receive a Life Estate in Farm Land is typically accompanied by specific legal terms and conditions to guarantee the effective execution of the provision. These may include guidelines for maintaining the property, leasing or selling rights, financial management, and the transfer of assets upon the spouse's death. Different types or variations of this trust provision may exist based on the specific needs and desires of the individual creating the will. Some potential variations could include naming successor trustees to manage the trust upon the spouse's passing, granting the spouse limited rights to sell or lease the land under certain circumstances, or including provisions for the care and support of any minor children during the spouse's life tenancy. It is crucial to work with an experienced attorney specializing in estate planning to draft and establish a Testamentary Trust Provision in a Will with a Spouse to Receive a Life Estate in Farm Land in Philadelphia, Pennsylvania. This ensures that the provision aligns with state laws, addresses the unique circumstances of the family and the farm land, and serves the best interests of the surviving spouse and children.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.