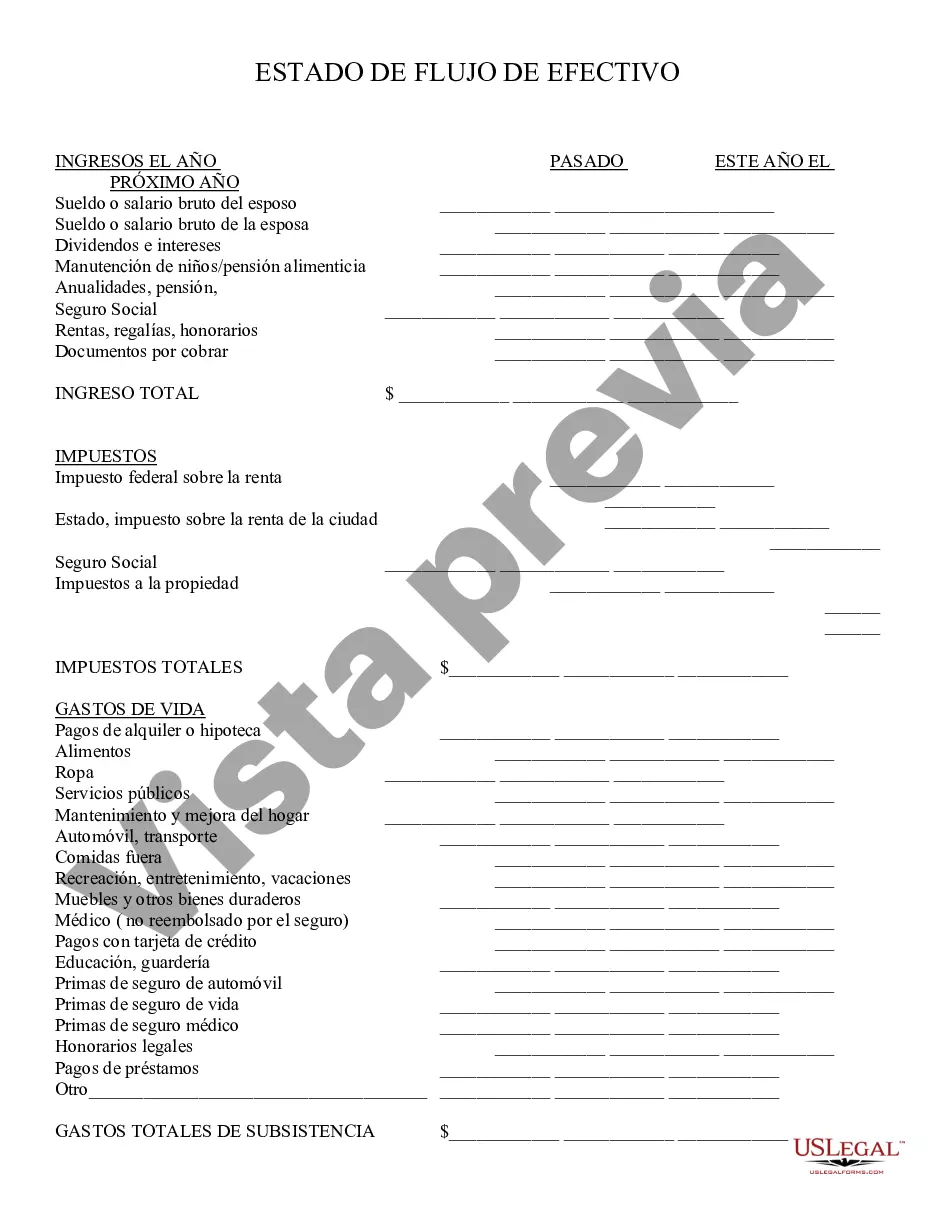

Allegheny Pennsylvania Cash Flow Statement is a financial document that provides a comprehensive overview of the inflows and outflows of cash for a specific period in the Allegheny region of Pennsylvania. It presents vital information about how cash has been generated and used by an organization within the mentioned area. The cash flow statement is a crucial tool for individuals, businesses, investors, and creditors to understand the financial health and operational efficiency of a company or entity operating in Allegheny County, Pennsylvania. The cash flow statement primarily consists of three main sections: operating activities, investing activities, and financing activities. Each section represents a distinct category of cash flow, offering insights into different aspects of the entity's financial activities. 1. Operating Activities: This section of the Allegheny Pennsylvania Cash Flow Statement includes cash flows resulting from the core operations of a company or entity in the Allegheny region. It encompasses cash receipts and payments from day-to-day business activities, such as revenue from sales, payment of suppliers, payment of salaries, and other operational expenses. Positive cash flow from operating activities indicates the entity's ability to generate sufficient cash from its core business operations. 2. Investing Activities: This section of the cash flow statement in Allegheny Pennsylvania focuses on the cash flow arising from investments in long-term assets. It includes cash inflows and outflows related to the purchase or sale of property, equipment, investments, or other fixed assets. Positive cash flow from investing activities represents a net cash inflow resulting from wise investment decisions, such as acquiring profitable assets or selling non-essential assets. 3. Financing Activities: The third section of the cash flow statement in Allegheny Pennsylvania represents cash flows related to financing the entity's operations. It includes cash inflows and outflows associated with raising capital, repaying loans, issuing or buying back shares, and paying dividends. Positive cash flow from financing activities indicates a stable financial position, as it reflects the ability to attract investment capital and meet debt obligations. Moreover, there can be different types of Allegheny Pennsylvania Cash Flow Statements, such as monthly cash flow statements, quarterly cash flow statements, or annual cash flow statements. Each type focuses on a specific time frame, offering users valuable insights into the cash flow trends or patterns over a particular period. To conclude, the Allegheny Pennsylvania Cash Flow Statement is a fundamental financial report that highlights the sources and uses of cash for a company or entity operating in this specific region. It provides investors, creditors, and stakeholders with a detailed understanding of the financial performance, liquidity, and cash flow management of an organization in Allegheny County, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out Allegheny Pennsylvania Estado De Flujo De Efectivo?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Allegheny Cash Flow Statement suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Allegheny Cash Flow Statement, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Allegheny Cash Flow Statement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Allegheny Cash Flow Statement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!