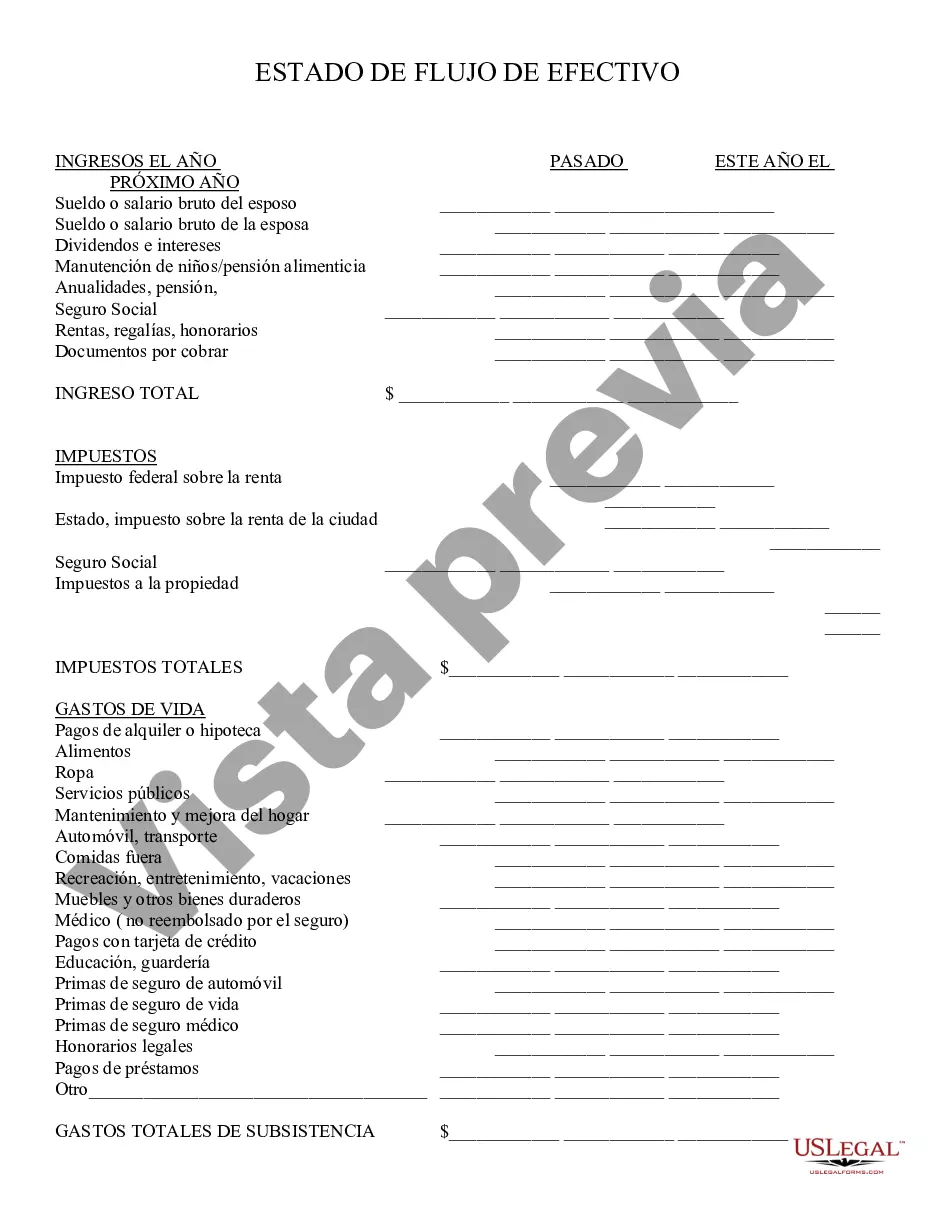

The Cuyahoga Ohio Cash Flow Statement is a financial document that provides a comprehensive overview of the cash inflows and outflows for an organization located in Cuyahoga County, Ohio. It is an essential component of the organization's financial statements and is used to assess the financial health and liquidity of the entity. The cash flow statement in Cuyahoga Ohio presents the flow of cash from operating activities, investing activities, and financing activities. It allows the organization and its stakeholders to understand how cash is generated and used within the reporting period. Some relevant keywords associated with the Cuyahoga Ohio Cash Flow Statement include: 1. Operating Activities: This section of the cash flow statement represents the cash flows resulting from the core operations of the organization. It includes cash inflows from sales, collection of accounts receivable, and cash outflows for various operating expenses such as salaries, rent, and utilities. 2. Investing Activities: This section focuses on the cash flows related to investment activities undertaken by the organization. It includes cash inflows from the sale of assets, dividends received from investments, and cash outflows for the purchase of property, plant, and equipment, as well as investments in other entities. 3. Financing Activities: This section highlights the cash flows related to the financing of the organization. It includes cash inflows from issuing debt or equity, proceeds from loans, and cash outflows for the repayment of debt, payment of dividends, and share buybacks. 4. Net Cash Flow: The net cash flow represents the difference between the total cash inflow and the total cash outflow for a given period. It is an important indicator of the organization's ability to generate cash and meet its financial obligations. 5. Cash Flow from Operations: This subsection within the operating activities' category provides a breakdown of the cash flows directly related to the organization's primary business activities. It includes cash received from customers and payments made to suppliers and employees. 6. Cash Flow from Investing: This subsection focuses on the cash flows associated with the organization's investment activities. It includes cash received from the sale of investments or fixed assets and payments made for the purchase of new investments or fixed assets. 7. Cash Flow from Financing: This subsection details the cash flows related to the organization's financing activities. It includes cash received from issuing debt or equity, interest paid on debt, and dividends paid to shareholders. Overall, the Cuyahoga Ohio Cash Flow Statement provides a comprehensive analysis of the organization's cash flow dynamics, allowing stakeholders to evaluate its ability to generate cash and maintain financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out Cuyahoga Ohio Estado De Flujo De Efectivo?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cuyahoga Cash Flow Statement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the recent version of the Cuyahoga Cash Flow Statement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Cash Flow Statement:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Cuyahoga Cash Flow Statement and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!