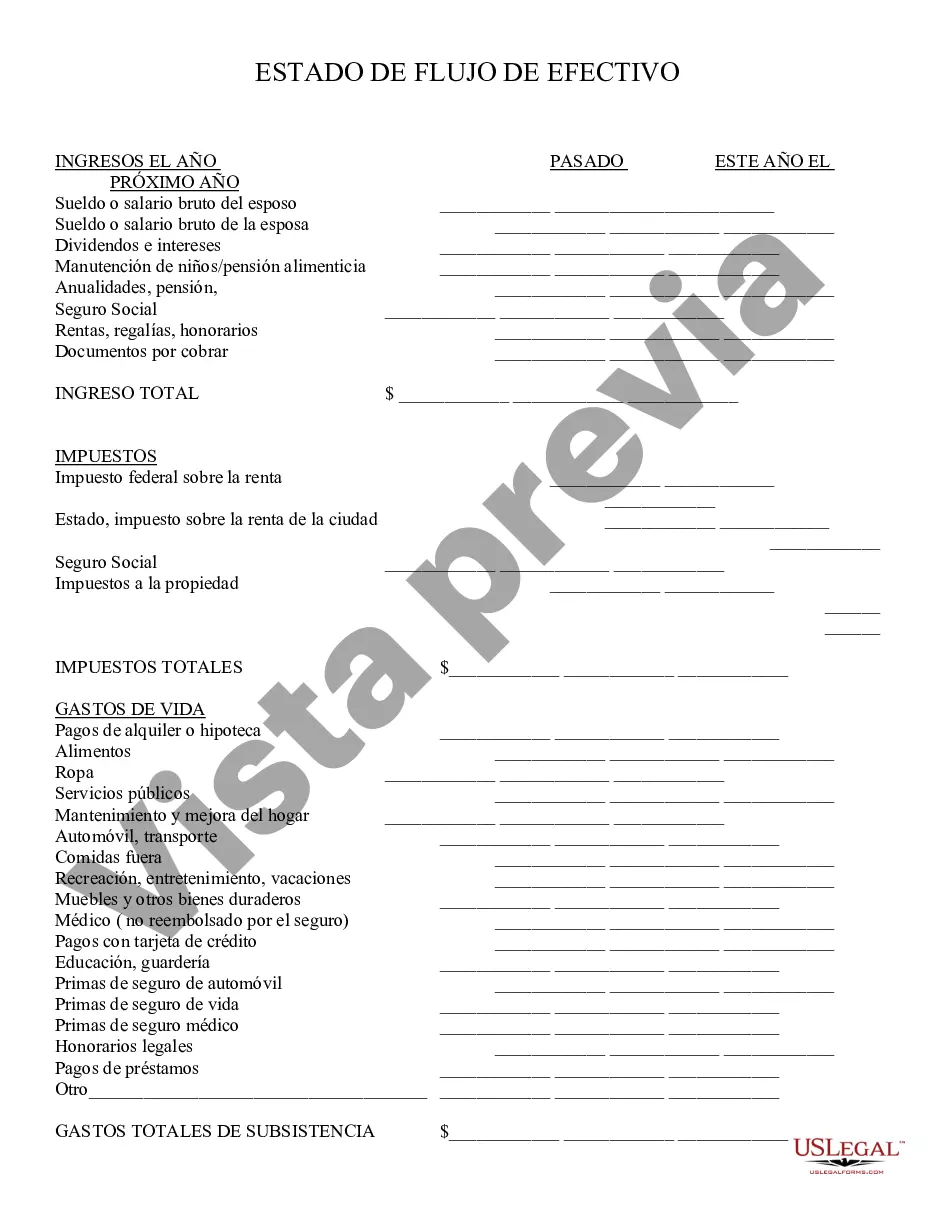

Kings New York Cash Flow Statement, also known as the Statement of Cash Flows, is a financial statement that summarizes the inflow and outflow of cash from the company's operating, investing, and financing activities. It provides crucial insights into a company's ability to generate cash, manage liquidity, and fund its operations effectively. The Kings New York Cash Flow Statement is divided into three main sections: 1. Operating Activities: This section records the cash flows resulting from the company's core business operations. It includes cash inflows from customer payments, interest received, and dividends received. It also includes cash outflows related to payments to suppliers, salaries and wages, interest paid, taxes paid, and other operating expenses. 2. Investing Activities: This section represents cash flows related to the purchase or sale of long-term assets and investments. It includes cash inflows from the sale of property, plant, and equipment, as well as proceeds from the sale of marketable securities or other investments. Cash outflows typically include payments for acquisitions, capital expenditures, and purchases of investments. 3. Financing Activities: This section focuses on cash flows resulting from the company's financing activities. It includes cash inflows from the issuance of debt, equity, or other financing instruments like loans. Cash outflows involve payments for dividends, share repurchases, debt repayments, and other financing-related expenses. Different types of Kings New York Cash Flow Statements may include: 1. Direct Method: This method presents the actual cash inflows and outflows directly from various activities, such as cash received from customers and cash paid to suppliers. It provides a more detailed view of a company's cash flow sources and uses. 2. Indirect Method: This method starts with net income and makes adjustments to reconcile it with the cash flow from operating activities. It involves adding or subtracting non-cash items, such as depreciation, amortization, changes in working capital, and gains or losses on the sale of assets. The Kings New York Cash Flow Statement is an essential tool for investors, creditors, and stakeholders as it helps them assess a company's cash generation capabilities, evaluate its ability to pay dividends or repay debts, and understand the overall financial health of the organization. It complements other financial statements, such as the balance sheet and income statement, to provide a comprehensive understanding of a company's financial performance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out Kings New York Estado De Flujo De Efectivo?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Kings Cash Flow Statement without professional help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Kings Cash Flow Statement by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Kings Cash Flow Statement:

- Examine the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

En esencia, el metodo directo organiza las operaciones de la empresa y las clasifica en categorias semejantes a lo que seria un estado de cuenta bancaria, por ejemplo en las actividades de operacion detalla el efectivo que se recibe de los clientes, una entrada de efectivo y enlista las salidas de efectivo como podrian

Metodos para elaborar un flujo de efectivo: Directo e Indirecto Cobranza en efectivo a los clientes. Cobros derivados de la operacion. Pagos en efectivo a personal y proveedores. Efectivo que ha sido recibido por concepto de intereses, dividendos y rendimientos sobre inversiones.

Estructura basica del estado de flujo de efectivo Actividades de operacion. Actividades de inversion. Actividades de financiamiento.

Estado de flujos de efectivo por el metodo directo. El estado de flujos de efectivo esta conformado por tres elementos: Actividades de Operacion, Inversion y Financiacion. Para elaborar el flujo de efectivo necesitamos el balance general de los dos ultimos anos y el ultimo estado de resultados.

Metodo directo para el estado de flujo de efectivo En este metodo, deben de presentarse por separado las actividades de operacion siguientes: Cobros en efectivo a clientes. Pagos en efectivo a proveedores de bienes o servicios. Pagos en efectivo a los empleados.

El estado de flujo de efectivo con el metodo directo sobre las actividades operacionales se realiza al detallar los principales componentes de los ingresos y los egresos brutos del efectivo originado por estas. Por ejemplo, el cobro a clientes y el pago a proveedores y empleados.

Para la interpretacion del flujo de efectivo se debe comenzar por la parte final donde aparece el saldo que puedes identificar como el aumento o disminucion del efectivo, el saldo inicial y final de todo el efectivo que incluye los saldos de caja, bancos e inversiones que no tengan vencimiento para el cobro en un

Como se realiza el estado de flujos por el metodo indirecto. En el metodo indirecto, el flujo de efectivo se determina a partir de la utilidad arrojada por el estado de resultados para luego proceder a depurarla hasta llegar al saldo de efectivo que hay en los libros de contabilidad.