Title: Understanding Oakland Michigan Cash Flow Statement: Types and Detailed Explanation Introduction: In the financial realm, understanding a company's cash flow is essential, as it provides insights into its financial health and sustainability. This article aims to provide a detailed description of the Oakland Michigan Cash Flow Statement, its purpose, components, and the different types that exist. What is Oakland Michigan Cash Flow Statement? The Oakland Michigan Cash Flow Statement is a financial document that portrays the inflow and outflow of cash within an organization located in Oakland, Michigan. It presents a comprehensive breakdown of a company's operating activities, investing activities, and financing activities, offering valuable perspectives on its capacity to generate and manage cash over a given period. Components of Oakland Michigan Cash Flow Statement: 1. Operating Activities: This section encompasses cash flows generated or used by a company's core business operations. It includes cash received from customers, cash paid to suppliers, employee salaries, income tax payments, and other operating expenses. By analyzing this component, investors can evaluate a company's ability to generate recurring cash flows from its primary operations. 2. Investing Activities: The investing activities section details cash flows related to a company's investments in long-term assets. This includes the purchase or sale of property, plant, and equipment, acquisitions and divestitures, investments in securities, loans made to other entities, and proceeds from the sale of long-term assets. This insight helps investors assess the company's choices in utilizing its cash for future growth or strategic transactions. 3. Financing Activities: This component outlines the cash flows related to how a company finances its operations. It includes cash raised from issuing shares, borrowing loans, repaying debt, or distributing dividends. By examining this segment, investors can evaluate the financial policies and strategies adopted by the company, its dependency on external financial sources, and potential risks associated with its debt obligations. Types of Oakland Michigan Cash Flow Statement: 1. Direct Method: The direct method provides a straightforward representation of cash inflows and outflows from operating activities, presenting actual cash receipts and payments. 2. Indirect Method: The indirect method starts with net income and then adjusts it for non-cash items and changes in working capital to derive the operating cash flow. Although commonly used, the indirect method aligns the operating cash flow with the accrual accounting system, making it a more complex approach. Conclusion: The Oakland Michigan Cash Flow Statement plays a vital role in assessing the financial stability, cash management, and potential growth prospects of a company. The components, including operating activities, investing activities, and financing activities, provide investors with valuable insights. Whether utilizing the direct or indirect method, an organization's cash flow statement is a crucial element in financial analysis and decision-making.

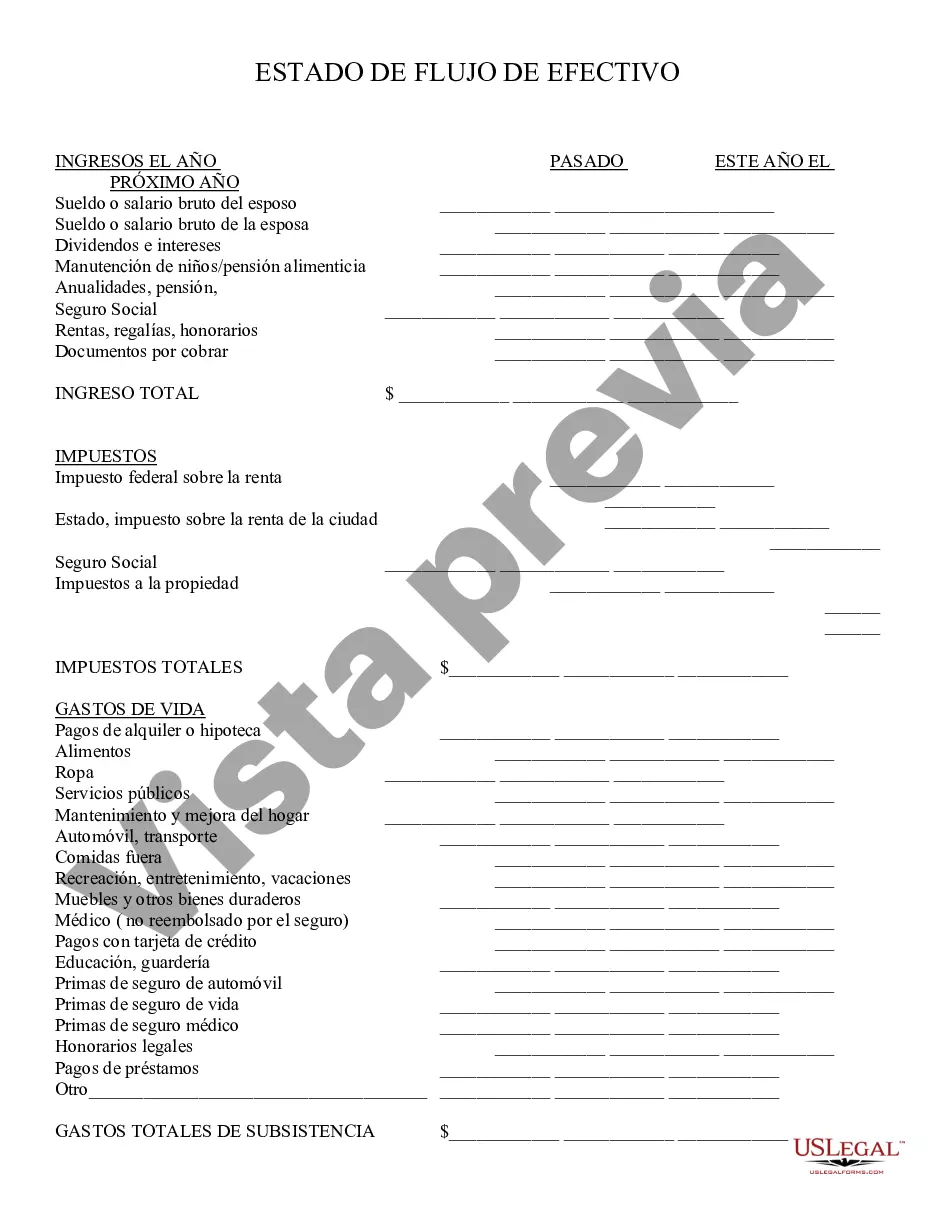

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out Oakland Michigan Estado De Flujo De Efectivo?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the Oakland Cash Flow Statement.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Oakland Cash Flow Statement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Oakland Cash Flow Statement:

- Ensure you have opened the right page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Oakland Cash Flow Statement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!