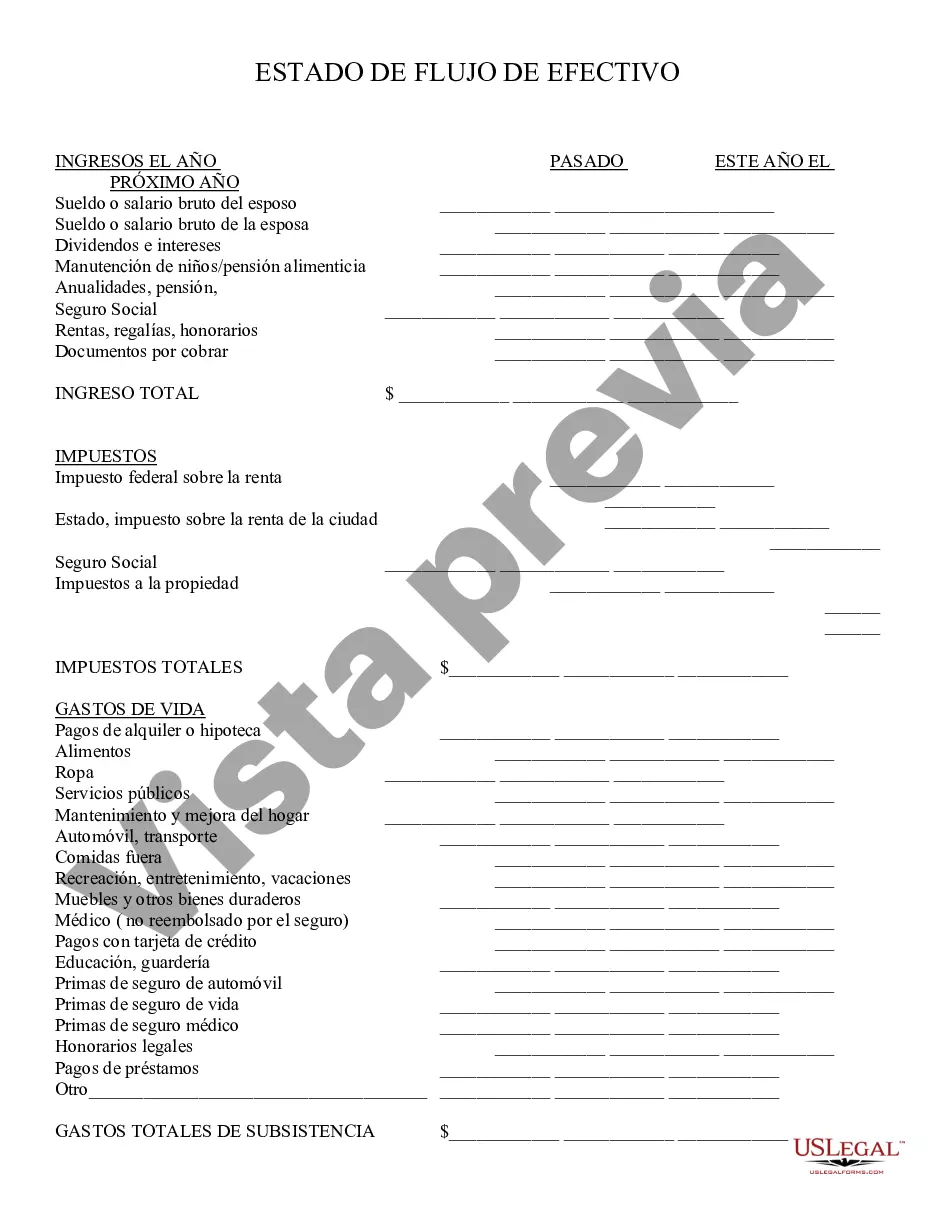

The San Jose California Cash Flow Statement is a financial document that provides a detailed description of the movement of cash in and out of an entity within the San Jose, California region. It allows individuals, businesses, and organizations to analyze their cash flows, identify areas of revenue generation and expenditure, and make informed financial decisions. The cash flow statement consists of three main sections: operating activities, investing activities, and financing activities. These sections categorize the various sources and uses of cash within a specific accounting period, typically a year. The statement also includes the beginning and ending cash balances, indicating the net change in cash during the period. 1. Operating Activities: This section reports cash flows resulting from the core operations of a business or organization. It includes cash generated from sales of goods or services, payments to suppliers, wages and salaries, taxes, and other operational expenses. It primarily reflects the ability of the entity to generate positive cash flow from its day-to-day operations. 2. Investing Activities: Here, cash flows related to investment activities are recorded. These activities involve the purchase and sale of long-term assets such as property, equipment, investments, and acquisitions. Cash inflows in this section can come from the sale of investments or assets, while outflows include the purchase of new assets or investments. 3. Financing Activities: This section focuses on cash flows associated with financing the entity's operations and growth. It includes activities such as obtaining loans, issuing or repurchasing equity shares, and paying out dividends. Cash inflows could come from borrowing money or issuing shares, while outflows might result from repaying loans or distributing dividends to shareholders. By analyzing the various sections of the San Jose California Cash Flow Statement, individuals and organizations can evaluate the overall health of their cash flows and make necessary adjustments to optimize their financial performance. It enables them to identify potential cash shortages, improve working capital management, plan for future investments, and determine profitability. No specific types of San Jose California Cash Flow Statements exist as it follows the standard structure provided by accounting principles. However, different entities within San Jose, California, such as businesses, nonprofit organizations, or government entities, will have their own unique cash flow statements tailored to their respective operations and financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out San Jose California Estado De Flujo De Efectivo?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Jose Cash Flow Statement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to get the San Jose Cash Flow Statement. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Cash Flow Statement in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!