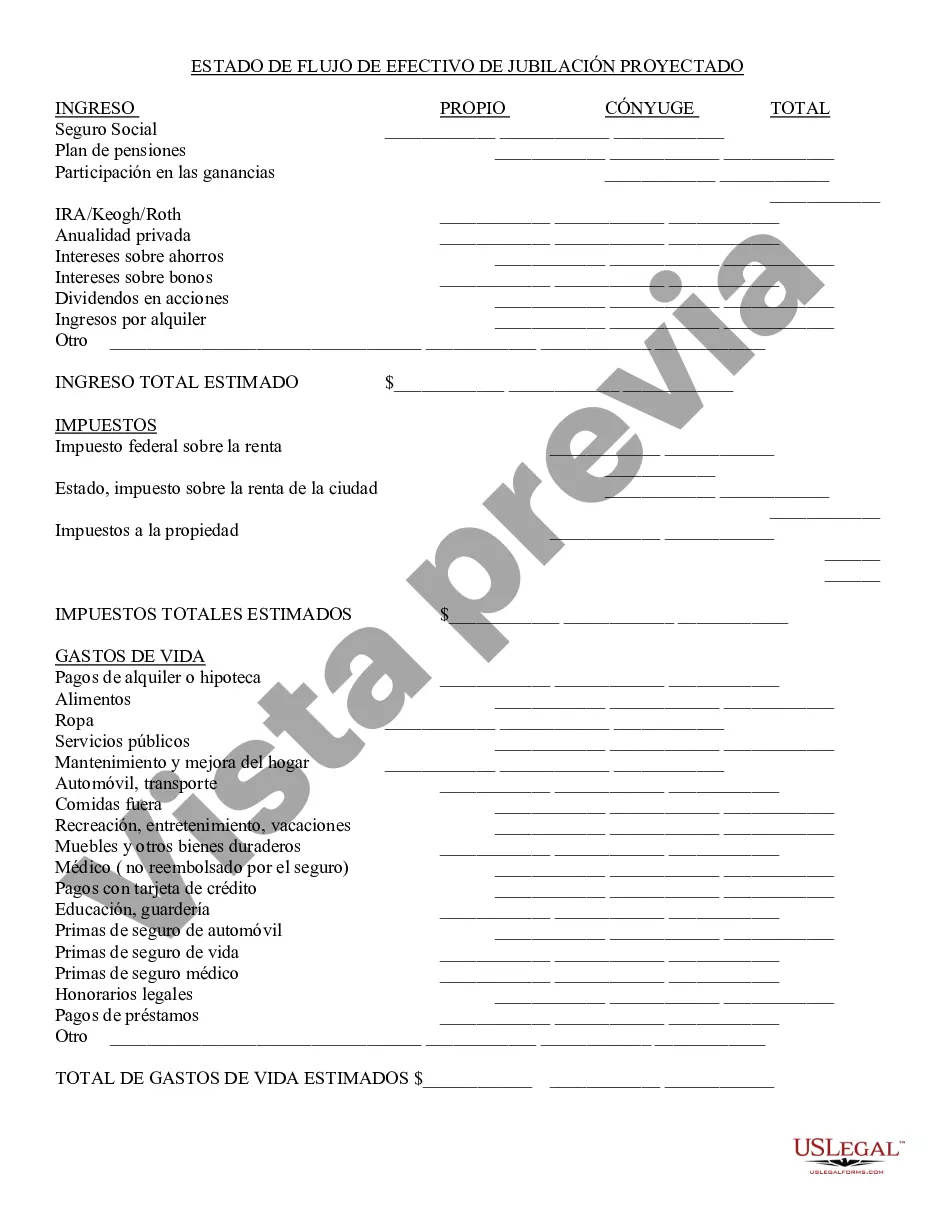

Fairfax Virginia Retirement Cash Flow refers to the financial resources available to retired individuals or couples living in Fairfax, Virginia. It encompasses the income, investments, pensions, and other sources of cash flow that enable retirees to cover their living expenses and enjoy their retirement years comfortably. Fairfax, being one of the affluent counties in Virginia and part of the Washington D.C. metropolitan area, offers various retirement options for individuals who desire a high standard of living, cultural amenities, and access to healthcare facilities. The retirement cash flow in Fairfax can be derived from several sources and can be categorized into different types, including: 1. Social Security Benefits: Retirees in Fairfax can benefit from the social security system, which provides a monthly income based on their lifetime earnings and age of retirement. These benefits form a significant portion of retirement cash flow for many individuals. 2. Pension Plans: Retired workers in Fairfax who were employed in the public or private sector may receive pension payments from their former employers. Pension plans ensure a steady stream of income throughout retirement, which contributes to the retirement cash flow. 3. Individual Retirement Accounts (IRAs): Fairfax retirees often hold IRAs, which are personal savings accounts that offer tax advantages to encourage retirement savings. The cash flow from these accounts can vary depending on investment returns, contribution amounts, and withdrawal strategies. 4. 401(k) Plans: Many Fairfax residents accumulate retirement savings through 401(k) plans, which are offered by their employers. Upon retirement, the funds from these plans can be used to supplement retirement cash flow through systematic withdrawals or annuity payments. 5. Investments and Dividends: Retired individuals in Fairfax may have invested in stocks, bonds, mutual funds, or real estate properties, generating cash flow through dividends, interest, or rental income. These investment portfolios can be carefully managed to provide a consistent cash flow during retirement. 6. Part-Time Employment: Some retirees in Fairfax choose to continue working part-time to supplement their retirement cash flow. This can include consulting, freelance work, or pursuing their hobbies and passions as a source of income. 7. Rental Income: Fairfax's real estate market offers opportunities for retirees to generate retirement cash flow by owning and renting out properties. Rental income can contribute significantly to their overall financial well-being. In summary, Fairfax Virginia Retirement Cash Flow refers to the combination of income sources, including social security benefits, pension plans, retirement savings accounts, investments, part-time employment, and rental income, that ensure a financially stable and enjoyable retirement for residents in Fairfax, Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Flujo de caja de jubilación - Retirement Cash Flow

Description

How to fill out Fairfax Virginia Flujo De Caja De Jubilación?

If you need to get a trustworthy legal paperwork provider to obtain the Fairfax Retirement Cash Flow, consider US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to find and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Fairfax Retirement Cash Flow, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Fairfax Retirement Cash Flow template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate contract, or execute the Fairfax Retirement Cash Flow - all from the convenience of your home.

Join US Legal Forms now!