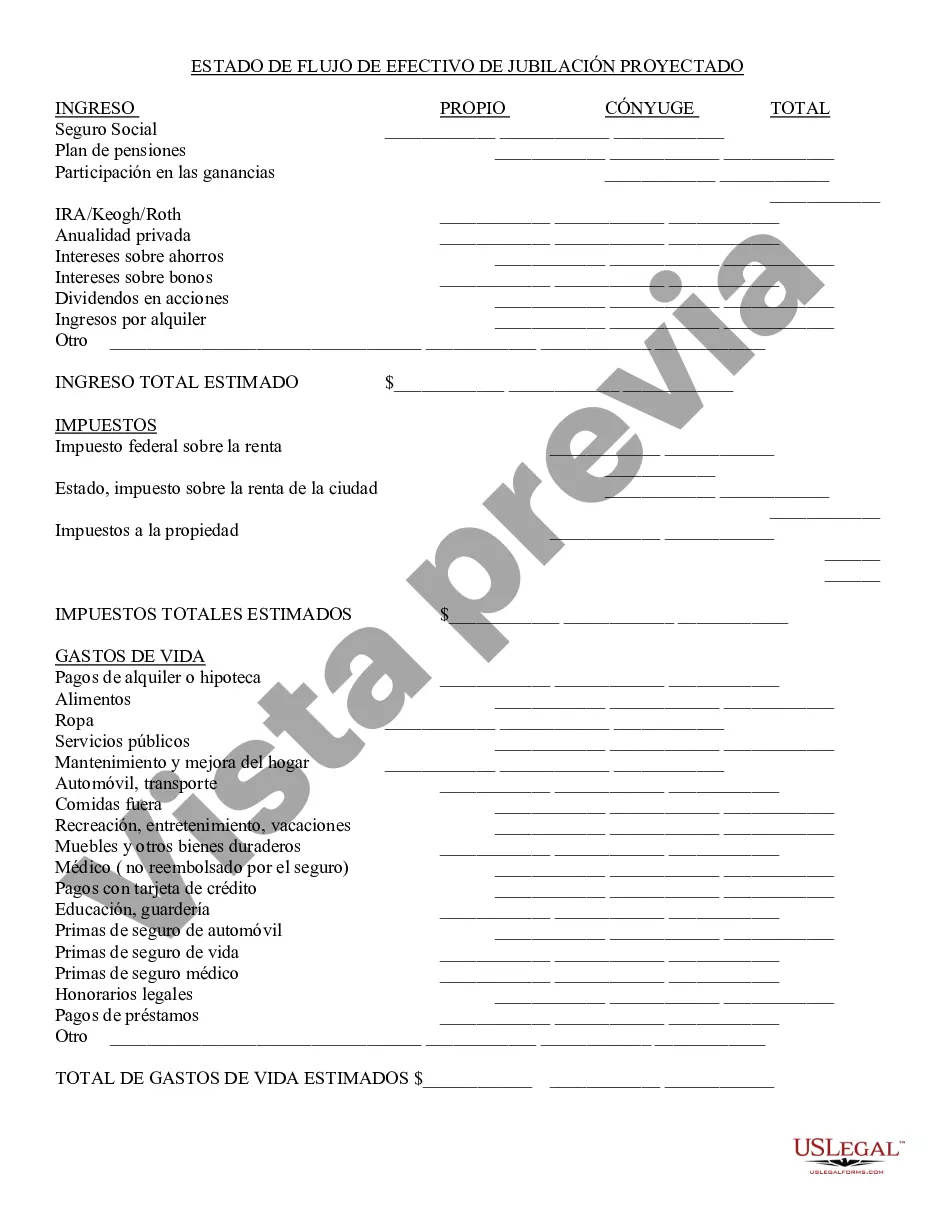

Hennepin Minnesota Retirement Cash Flow is a financial strategy that aims to provide a steady stream of income for individuals who have retired or are planning for their retirement in Hennepin County, Minnesota. This carefully designed method focuses on generating continuous cash flow from various retirement assets and investments. One type of Hennepin Minnesota Retirement Cash Flow is based on pension income. Many individuals in Hennepin County are entitled to receive pension payments from their former employers upon retirement. These payments can be a significant source of retirement cash flow, ensuring financial stability and allowing retirees to cover their living expenses. Another type of Hennepin Minnesota Retirement Cash Flow revolves around Social Security benefits. Social Security is a federal program that provides retirement income to eligible individuals who have contributed to the system throughout their working years. Retirees in Hennepin County can rely on these benefits as a steady cash flow to support their retirement lifestyle. Additionally, Hennepin Minnesota Retirement Cash Flow can be generated through individual retirement accounts (IRAs) and 401(k) plans. These tax-advantaged accounts allow individuals to contribute money during their working years, which then grows over time. Upon retirement, individuals can withdraw funds from these accounts, creating a reliable cash flow stream to cover expenses and enjoy their retirement years. Furthermore, some Hennepin Minnesota retirees may opt for annuities as part of their retirement cash flow strategy. Annuities are insurance contracts that offer a guaranteed income for a set period or for the remainder of an individual's life. By investing a lump sum or making periodic contributions, retirees in Hennepin Minnesota can receive regular payments from annuities to ensure a steady flow of retirement cash. Lastly, real estate investments can also contribute to Hennepin Minnesota Retirement Cash Flow. Retirees can choose to invest in rental properties or participate in real estate investment trusts (Rests) to generate passive income. These investments can provide a consistent cash flow stream that supplements other retirement income sources. In summary, Hennepin Minnesota Retirement Cash Flow encompasses various income sources, including pensions, Social Security benefits, IRAs, 401(k) plans, annuities, and real estate investments. By utilizing these different types of cash flow, retirees in Hennepin County can secure their financial well-being and enjoy a comfortable retirement lifestyle.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Flujo de caja de jubilación - Retirement Cash Flow

Description

How to fill out Hennepin Minnesota Flujo De Caja De Jubilación?

Are you looking to quickly create a legally-binding Hennepin Retirement Cash Flow or maybe any other document to take control of your own or corporate matters? You can select one of the two options: contact a professional to write a valid document for you or create it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you receive professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant document templates, including Hennepin Retirement Cash Flow and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Hennepin Retirement Cash Flow is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Hennepin Retirement Cash Flow template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!