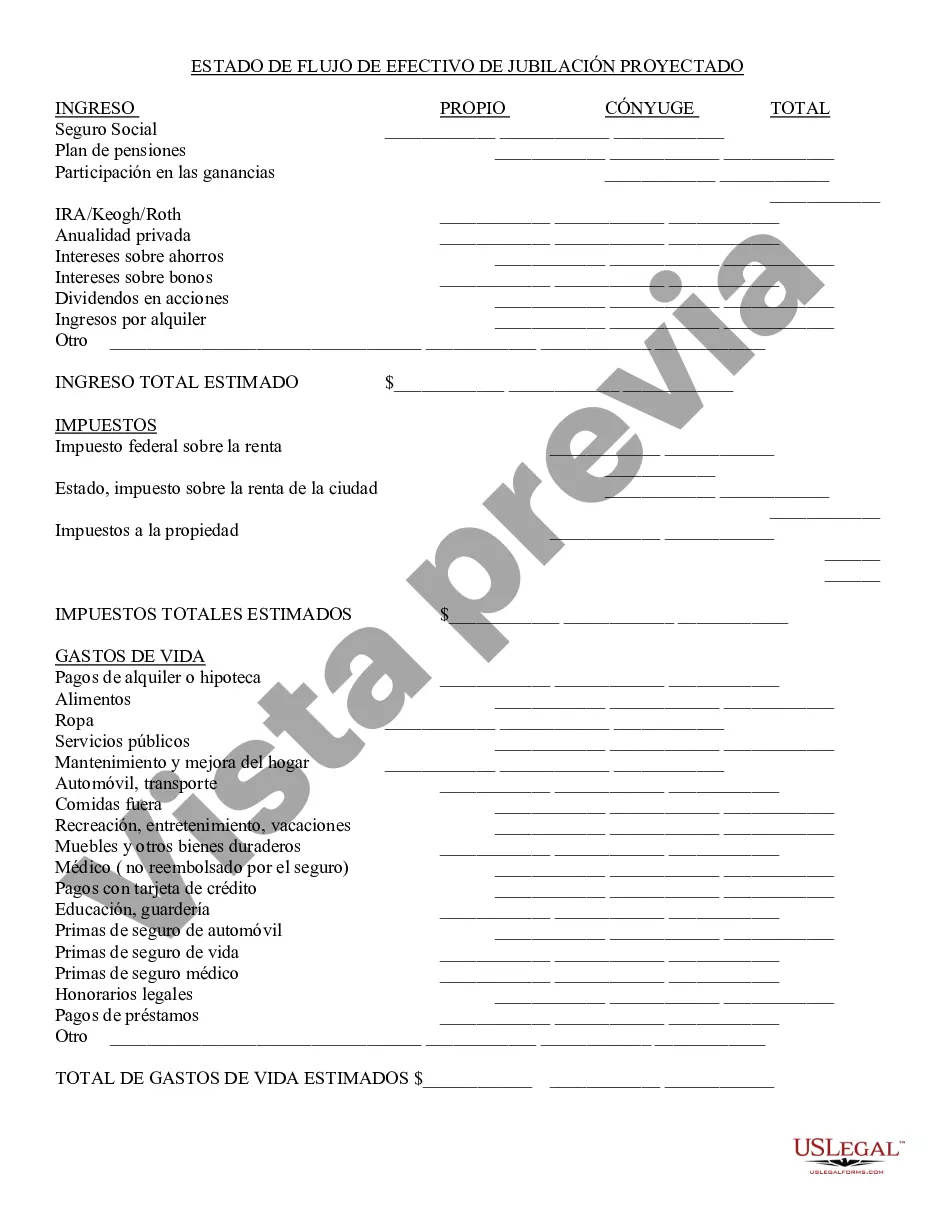

Miami-Dade Florida Retirement Cash Flow refers to the income and financial resources that individuals or couples receive during their retirement years in Miami-Dade County, Florida. This financial term encompasses the various ways retirees generate income to support their lifestyle and cover their expenses in this specific region. In Miami-Dade, there are several types of Retirement Cash Flow options available to retirees: 1. Social Security Benefits: Retirees who have contributed to the Social Security system during their working years are eligible to receive monthly retirement benefits. These benefits are based on an individual's earnings history and can serve as a crucial component of their retirement cash flow. 2. Pension Plans: Some retirees may have pension plans provided by their former employers. These plans offer regular payments to retirees, typically based on factors such as years of service and average salary. Having a pension plan can significantly contribute to retirement cash flow. 3. Retirement Savings and Investments: Miami-Dade retirees often rely on personal savings and investment accounts to supplement their retirement income. These include 401(k) plans, Individual Retirement Accounts (IRAs), mutual funds, stocks, and bonds. By carefully managing these assets, retirees can generate cash flow and ensure financial stability. 4. Real Estate: Retirees in Miami-Dade may also choose to invest in real estate properties to generate rental income or enjoy returns from property appreciation. Rental income can provide a steady cash flow stream, especially if retirees own multiple properties or invest in vacation rentals. 5. Annuities: Annuities are financial products that guarantee a regular income stream for a specific period or for life in exchange for an initial lump sum or regular contributions. Retirees can opt for immediate or deferred annuities to supplement their retirement cash flow. 6. Part-time Employment: Some Miami-Dade retirees may choose to continue working part-time or take on consulting roles to supplement their retirement cash flow. This allows them to enjoy the benefits of retirement while still earning income. To maximize Miami-Dade Florida Retirement Cash Flow, it is essential for retirees to engage in comprehensive retirement planning, considering their unique financial situation, goals, and desired lifestyle. Consulting with financial advisors who specialize in retirement planning can help individuals create a well-rounded strategy that ensures a comfortable cash flow throughout their retirement years.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Flujo de caja de jubilación - Retirement Cash Flow

State:

Multi-State

County:

Miami-Dade

Control #:

US-01717-AZ

Format:

Word

Instant download

Description

AZ-PER-17

Miami-Dade Florida Retirement Cash Flow refers to the income and financial resources that individuals or couples receive during their retirement years in Miami-Dade County, Florida. This financial term encompasses the various ways retirees generate income to support their lifestyle and cover their expenses in this specific region. In Miami-Dade, there are several types of Retirement Cash Flow options available to retirees: 1. Social Security Benefits: Retirees who have contributed to the Social Security system during their working years are eligible to receive monthly retirement benefits. These benefits are based on an individual's earnings history and can serve as a crucial component of their retirement cash flow. 2. Pension Plans: Some retirees may have pension plans provided by their former employers. These plans offer regular payments to retirees, typically based on factors such as years of service and average salary. Having a pension plan can significantly contribute to retirement cash flow. 3. Retirement Savings and Investments: Miami-Dade retirees often rely on personal savings and investment accounts to supplement their retirement income. These include 401(k) plans, Individual Retirement Accounts (IRAs), mutual funds, stocks, and bonds. By carefully managing these assets, retirees can generate cash flow and ensure financial stability. 4. Real Estate: Retirees in Miami-Dade may also choose to invest in real estate properties to generate rental income or enjoy returns from property appreciation. Rental income can provide a steady cash flow stream, especially if retirees own multiple properties or invest in vacation rentals. 5. Annuities: Annuities are financial products that guarantee a regular income stream for a specific period or for life in exchange for an initial lump sum or regular contributions. Retirees can opt for immediate or deferred annuities to supplement their retirement cash flow. 6. Part-time Employment: Some Miami-Dade retirees may choose to continue working part-time or take on consulting roles to supplement their retirement cash flow. This allows them to enjoy the benefits of retirement while still earning income. To maximize Miami-Dade Florida Retirement Cash Flow, it is essential for retirees to engage in comprehensive retirement planning, considering their unique financial situation, goals, and desired lifestyle. Consulting with financial advisors who specialize in retirement planning can help individuals create a well-rounded strategy that ensures a comfortable cash flow throughout their retirement years.

Free preview