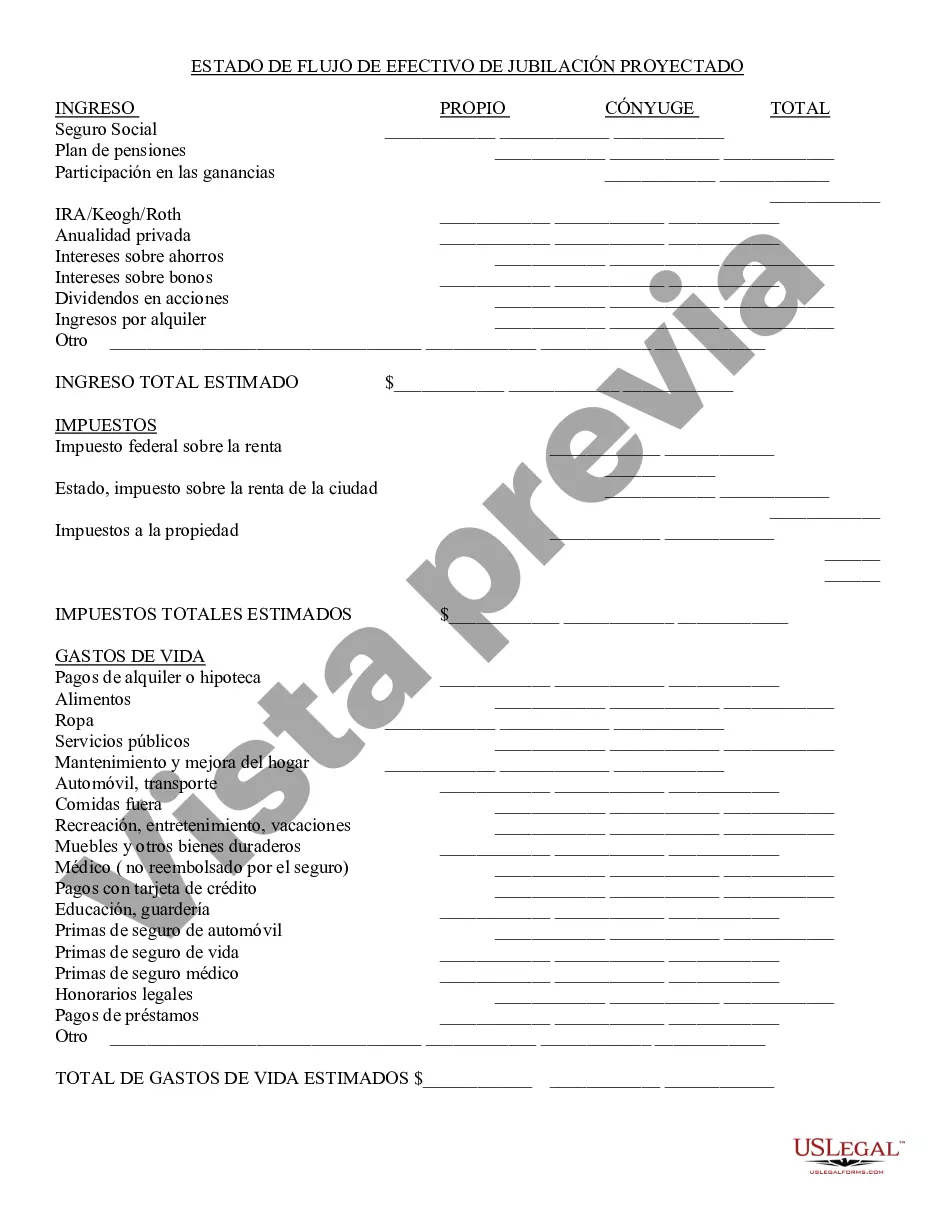

Oakland Michigan Retirement Cash Flow refers to the income or cash flow generated by retirees living in Oakland County, Michigan. It specifically focuses on the financial aspects of retirement planning and the various sources of income available to retirees in the region. Retirement Cash Flow in Oakland Michigan can be categorized into several types, including: 1. Pension Income: Many retirees in Oakland Michigan receive pension payments from their former employers. These can be defined benefit plans, where the retiree receives a fixed amount of income for life, or defined contribution plans, such as 401(k) plans, where the income is based on the returns of investments made over the years. 2. Social Security Benefits: Retirees in Oakland Michigan are eligible to receive Social Security benefits, which provide a source of income during retirement. These benefits are calculated based on the individual's earnings history and the age at which they start receiving benefits. 3. Individual Retirement Accounts (IRAs) and 401(k)s: These retirement savings accounts allow individuals to contribute money on a pre-tax basis, and the funds accumulate tax-free until retirement. In Oakland Michigan, retirees may utilize their IRAs or 401(k)s as a source of income during retirement, either by making regular withdrawals or converting them into annuities. 4. Investment Income: Some retirees in Oakland Michigan may rely on investment income generated from their portfolios, which may include stocks, bonds, real estate, or other assets. The income generated from these investments can contribute to their retirement cash flow. 5. Rental Income: Retirees who own rental properties in Oakland Michigan can benefit from rental income that supplements their retirement cash flow. Investing in real estate properties and leasing them to tenants can provide a reliable source of income during retirement. 6. Part-Time Employment: Some retirees may opt to continue working on a part-time basis during retirement to supplement their retirement cash flow. Part-time employment can help cover expenses and provide ongoing income. It's important for retirees in Oakland Michigan to carefully plan and manage their retirement cash flow to ensure financial security during their retirement years. Consulting with financial advisors and having a well-diversified portfolio can help retirees optimize their income sources and lead a comfortable retirement lifestyle.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Flujo de caja de jubilación - Retirement Cash Flow

Description

How to fill out Oakland Michigan Flujo De Caja De Jubilación?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

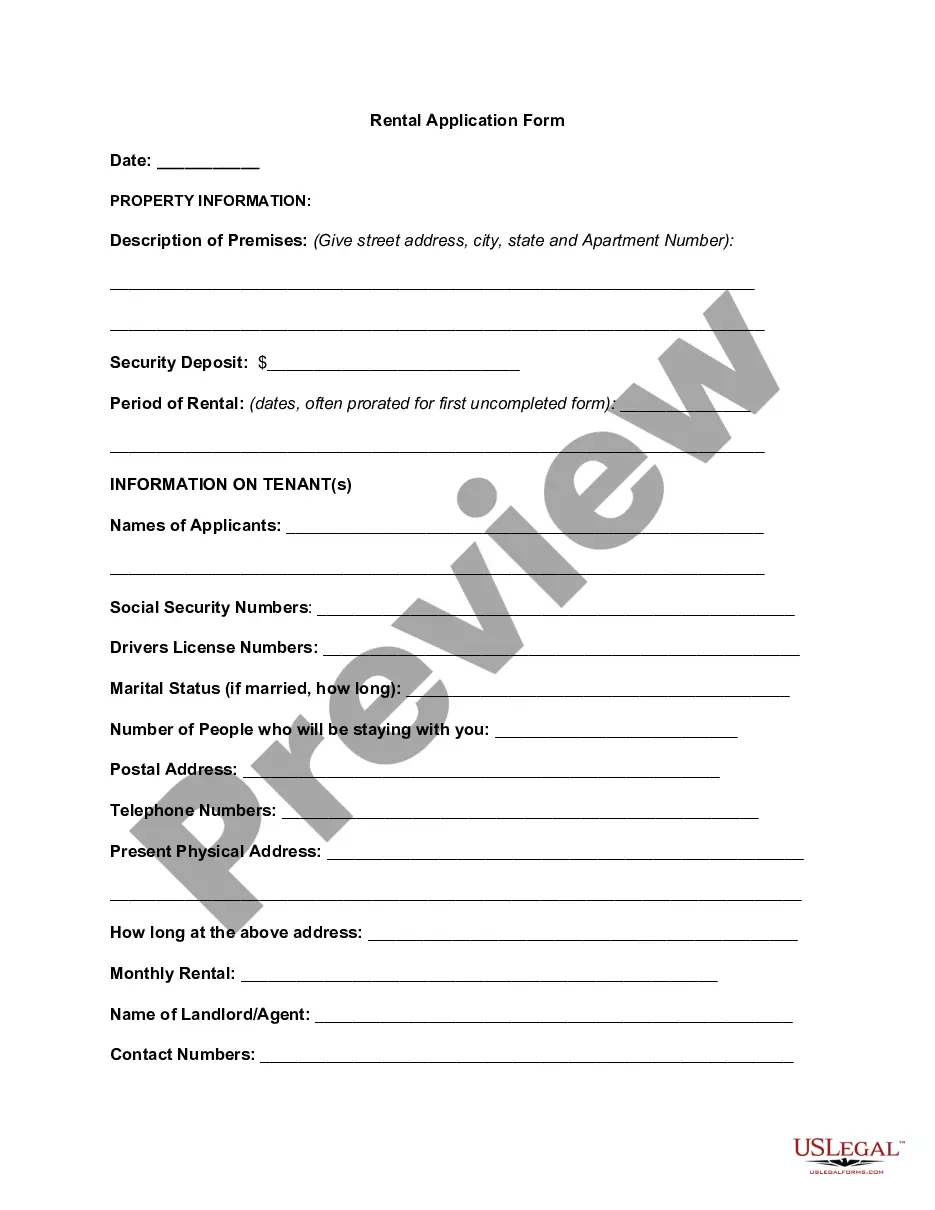

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Oakland Retirement Cash Flow.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Oakland Retirement Cash Flow will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Oakland Retirement Cash Flow:

- Ensure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Oakland Retirement Cash Flow on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!