San Diego California Retirement Cash Flow refers to the income or funds individuals receive during their retirement years in San Diego, California. It encompasses the various sources of income, investment strategies, and financial planning techniques that help retirees maintain a steady and comfortable cash flow throughout their retired life in the city. Retirement Cash Flow in San Diego California is often dependent on different factors such as retirement savings, pensions, social security benefits, and investment returns. The city offers a range of retirement cash flow options, catering to the specific needs and preferences of retirees. Some common types of San Diego California Retirement Cash Flow include: 1. Social Security Benefits: Retirees in San Diego can receive regular monthly income through Social Security benefits. These benefits are based on an individual's work history and contributions made over the years. 2. Pension Plans: Many retirees in San Diego may have pension plans from their previous employers. These plans offer a fixed monthly income, usually based on the number of years worked and the salary earned. 3. Individual Retirement Accounts (IRAs): IRAs are popular retirement savings vehicles that allow individuals to contribute funds on a pre-tax or post-tax basis. San Diego retirees can withdraw from their IRAs during retirement, subject to specific IRS rules and regulations. 4. 401(k) Plans: San Diego residents may also have 401(k) plans, especially if they have held jobs with companies offering this retirement savings option. 401(k) plans are employer-sponsored retirement accounts where employees can contribute a portion of their salary on a pre-tax basis. 5. Annuities: Retirees in San Diego can also establish annuity contracts with insurance companies to secure a guaranteed income stream during their retired life. Annuities can be fixed or variable, allowing retirees to receive regular payments based on their investment preferences. 6. Real Estate Investment: Some retirees in San Diego choose to invest in real estate properties to generate rental income and cash flow during retirement. These investments can provide a steady stream of income if managed properly. 7. Stock Market Investments: Retirees in San Diego may opt to invest in stocks and bonds to generate cash flow through dividends and interest payments. However, stock market investments carry inherent risks and require careful financial planning. To ensure a smooth retirement cash flow, individuals in San Diego California should engage in comprehensive financial planning. This includes budgeting, managing expenses, diversifying investments, and seeking advice from financial professionals experienced in retirement planning. By creating a well-structured retirement cash flow strategy, retirees can increase their chances of enjoying a financially secure and comfortable retirement lifestyle in San Diego, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Flujo de caja de jubilación - Retirement Cash Flow

Description

How to fill out San Diego California Flujo De Caja De Jubilación?

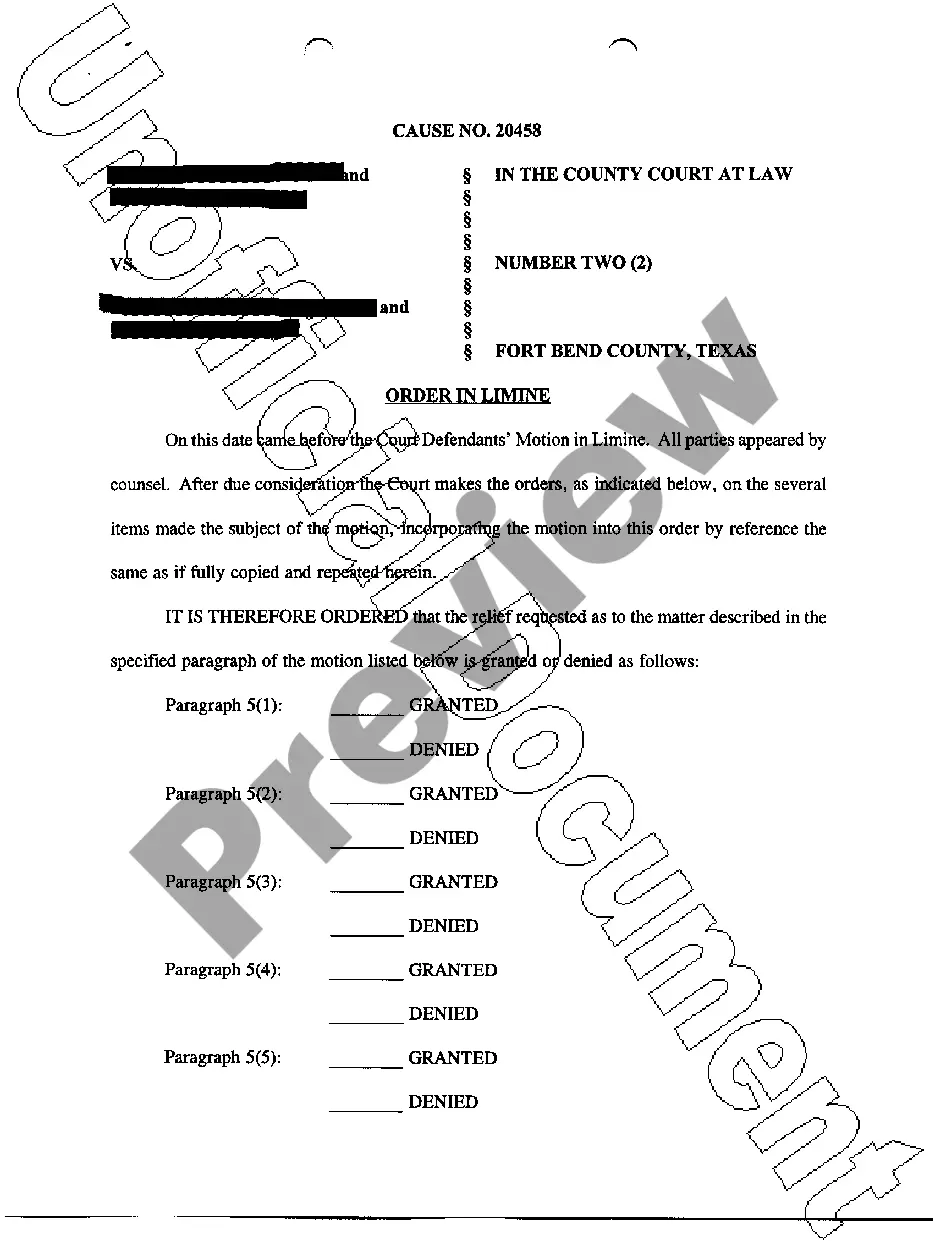

Draftwing forms, like San Diego Retirement Cash Flow, to take care of your legal matters is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for various cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the San Diego Retirement Cash Flow template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting San Diego Retirement Cash Flow:

- Make sure that your template is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the San Diego Retirement Cash Flow isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!