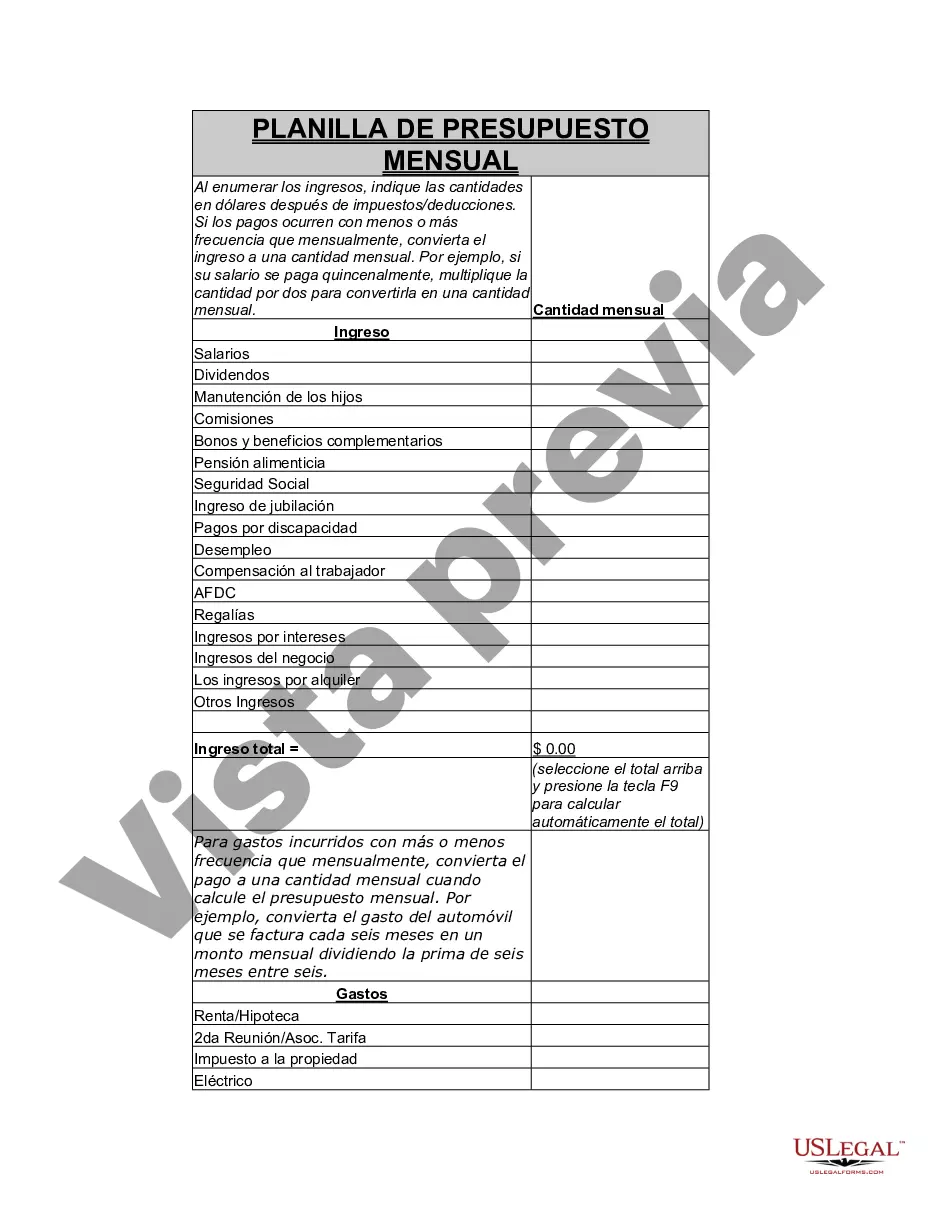

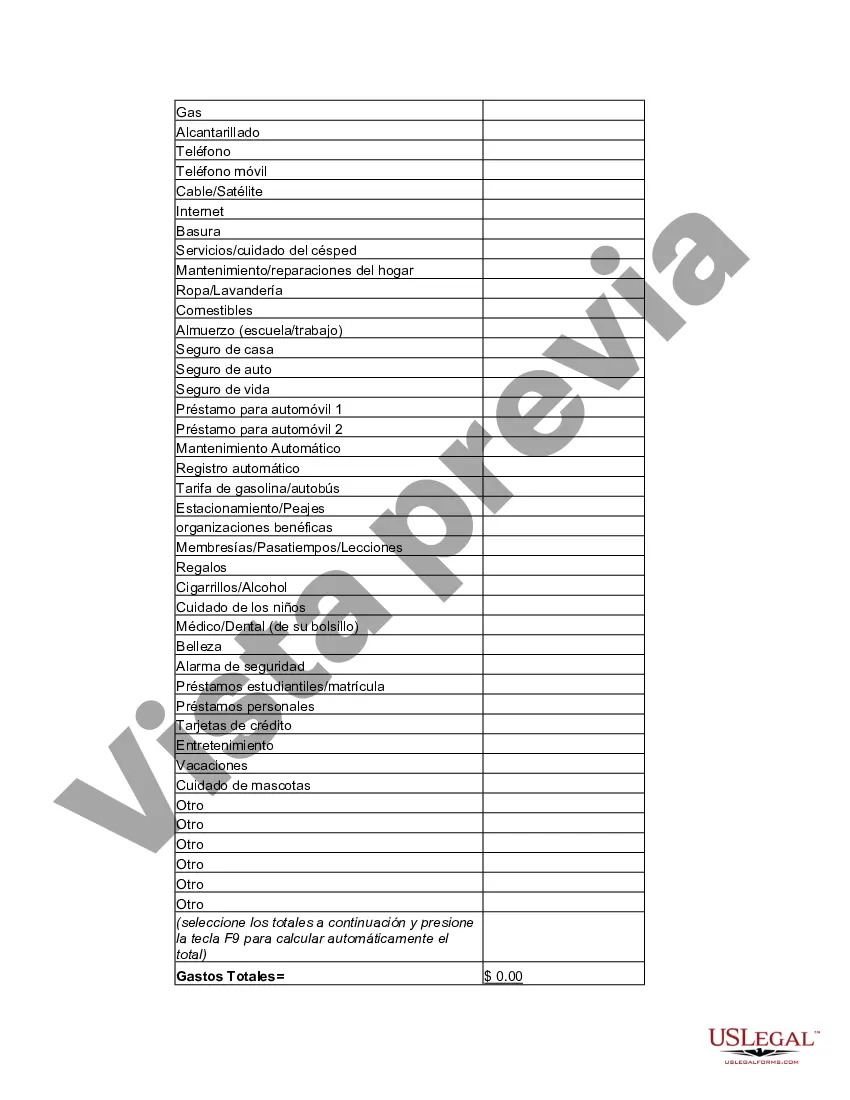

King Washington Personal Monthly Budget Worksheet is a comprehensive tool designed to help individuals effectively manage their finances on a monthly basis. It provides a structured format for organizing income, expenses, and savings, allowing users to gain a clear understanding of their financial situation. This budget worksheet enables individuals to track their monthly income from various sources, such as wages, investments, and rental property. By categorizing income sources, users can easily calculate their total monthly earnings. In terms of expenses, the King Washington Personal Monthly Budget Worksheet allows individuals to list and categorize their expenditure items. This includes fixed expenses like rent or mortgage payments, utilities, loan repayments, insurance premiums, and taxes. Variable expenses such as groceries, dining out, transportation, entertainment, and healthcare can also be recorded. By tracking these expenses, individuals can identify areas where they may be overspending and make adjustments accordingly. The worksheet also facilitates budgeting for savings and debt repayment. Users can allocate a portion of their income towards savings goals, such as an emergency fund, vacation fund, or retirement savings. Additionally, users can track their debt obligations, including credit card balances, student loans, and car payments, to gauge progress in paying off these debts. With the King Washington Personal Monthly Budget Worksheet, users can monitor their cash flow and determine if they are operating within their means. By subtracting total expenses from income, individuals can determine whether they have a surplus or a deficit at the end of each month. This analysis helps users make informed financial decisions and plan for the future. Different types of King Washington Personal Monthly Budget Worksheet may include variations tailored to specific financial goals or situations. For instance, there might be a version designed for individuals with irregular income, such as freelancers or self-employed individuals. Another type could be focused on budgeting for specific life stages, such as newlyweds, parents, or retirees. Additionally, there might be worksheets that prioritize debt repayment strategies or emphasize saving for specific goals, like buying a house or starting a business. In summary, the King Washington Personal Monthly Budget Worksheet is a versatile financial management tool that empowers individuals to take control of their money. By providing a structured framework to track income, expenses, savings, and debt, this worksheet ensures a comprehensive approach to budgeting and facilitates better financial decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out King Washington Hoja De Trabajo De Presupuesto Mensual Personal?

Are you looking to quickly create a legally-binding King Personal Monthly Budget Worksheet or probably any other form to manage your personal or corporate affairs? You can go with two options: contact a professional to draft a legal paper for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including King Personal Monthly Budget Worksheet and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the King Personal Monthly Budget Worksheet is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search over if the document isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the King Personal Monthly Budget Worksheet template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. In addition, the templates we offer are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!