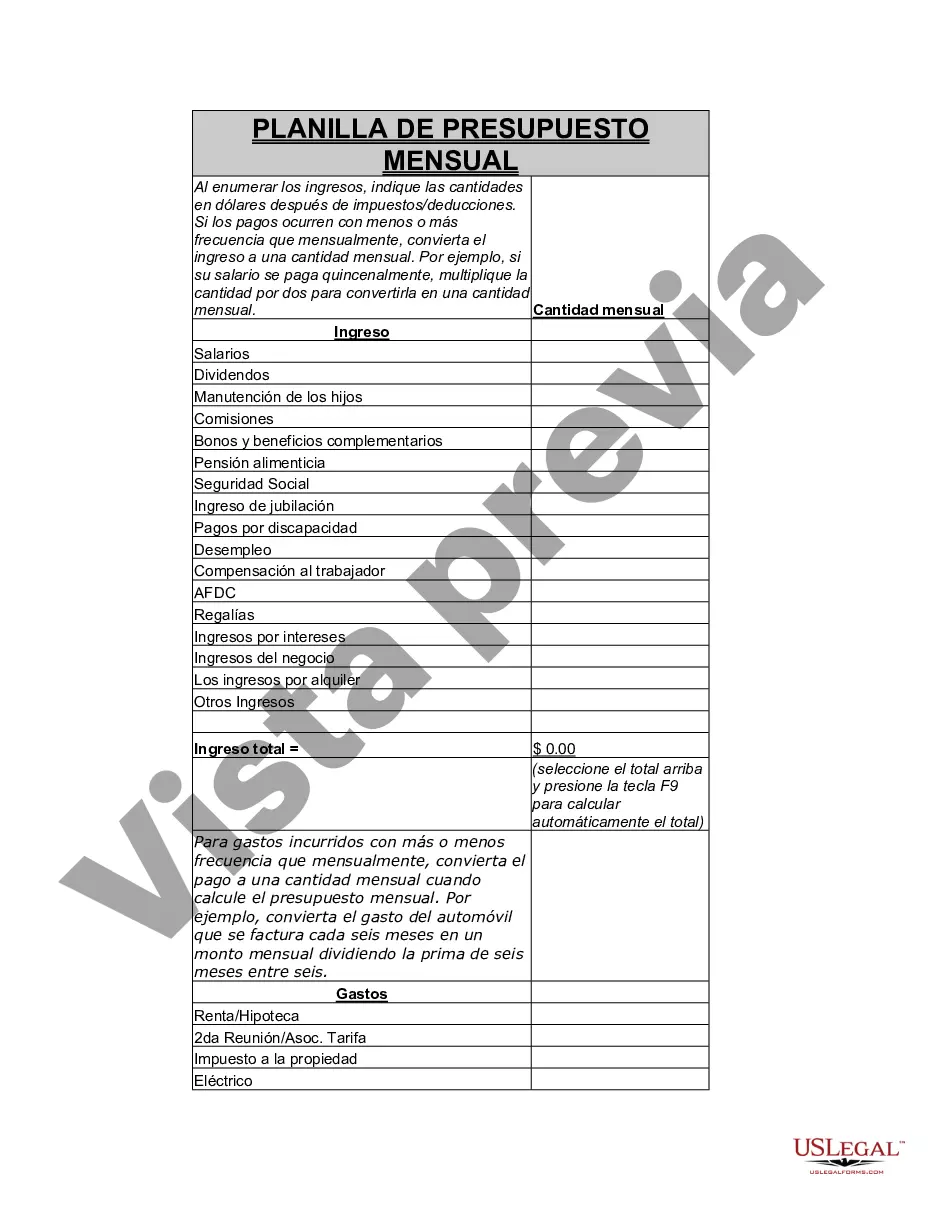

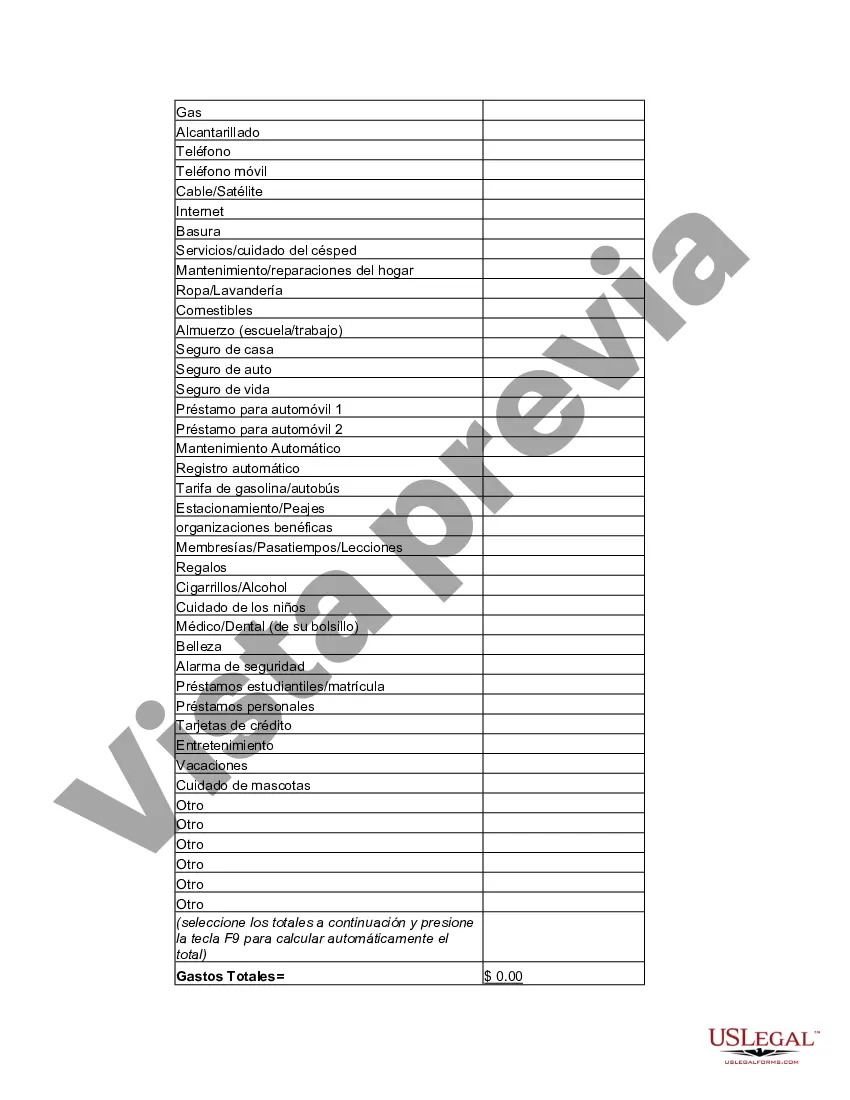

Kings New York Personal Monthly Budget Worksheet is a comprehensive financial tool designed to help individuals track and manage their expenses effectively. This worksheet is an essential resource for anyone looking to gain control over their financial situation, set financial goals, and establish a sustainable budget. Organized in a user-friendly format, the Kings New York Personal Monthly Budget Worksheet provides different sections to record income, expenses, and savings. It offers a holistic view of the individual's financial status, allowing them to monitor their expenses, identify areas of overspending, and make necessary adjustments. This worksheet serves as a roadmap to keep personal finances on track and achieve financial stability. The Kings New York Personal Monthly Budget Worksheet consists of various categories for tracking expenses, such as: 1. Housing Expenses: Under this category, individuals can record their mortgage or rent payments, property taxes, homeowners or renters insurance, and maintenance costs. 2. Utilities: This section enables individuals to document their monthly bills for electricity, gas, water, internet, and phone services. 3. Transportation: Individuals can track their car loan or lease payments, fuel expenses, parking fees, insurance, and maintenance costs. 4. Food and Groceries: This category allows individuals to record their monthly expenses for groceries, dining out, and any other food-related costs. 5. Personal Care: Individuals can keep a record of expenses related to personal care, including salon visits, grooming products, and healthcare costs not covered by insurance. 6. Entertainment: This section helps individuals track expenses for recreational activities, such as movie tickets, concerts, subscriptions, and hobbies. 7. Debt Repayments: For those individuals working towards paying off debts, this category provides space to track monthly payments and monitor progress. 8. Savings: Individuals can set goals and track their progress in building an emergency fund, retirement savings, or any other savings target. These are just a few examples of categories covered in the Kings New York Personal Monthly Budget Worksheet. The worksheet is versatile and can be tailored to suit individual preferences and financial situations. It enables users to adapt the budgeting tool to their specific needs, depending on personal circumstances. By utilizing the Kings New York Personal Monthly Budget Worksheet, individuals can gain a better understanding of their spending habits, identify areas where adjustments are needed, and make informed financial decisions. Staying committed to consistently updating and analyzing the worksheet will ultimately help individuals achieve their financial goals and improve their overall financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out Kings New York Hoja De Trabajo De Presupuesto Mensual Personal?

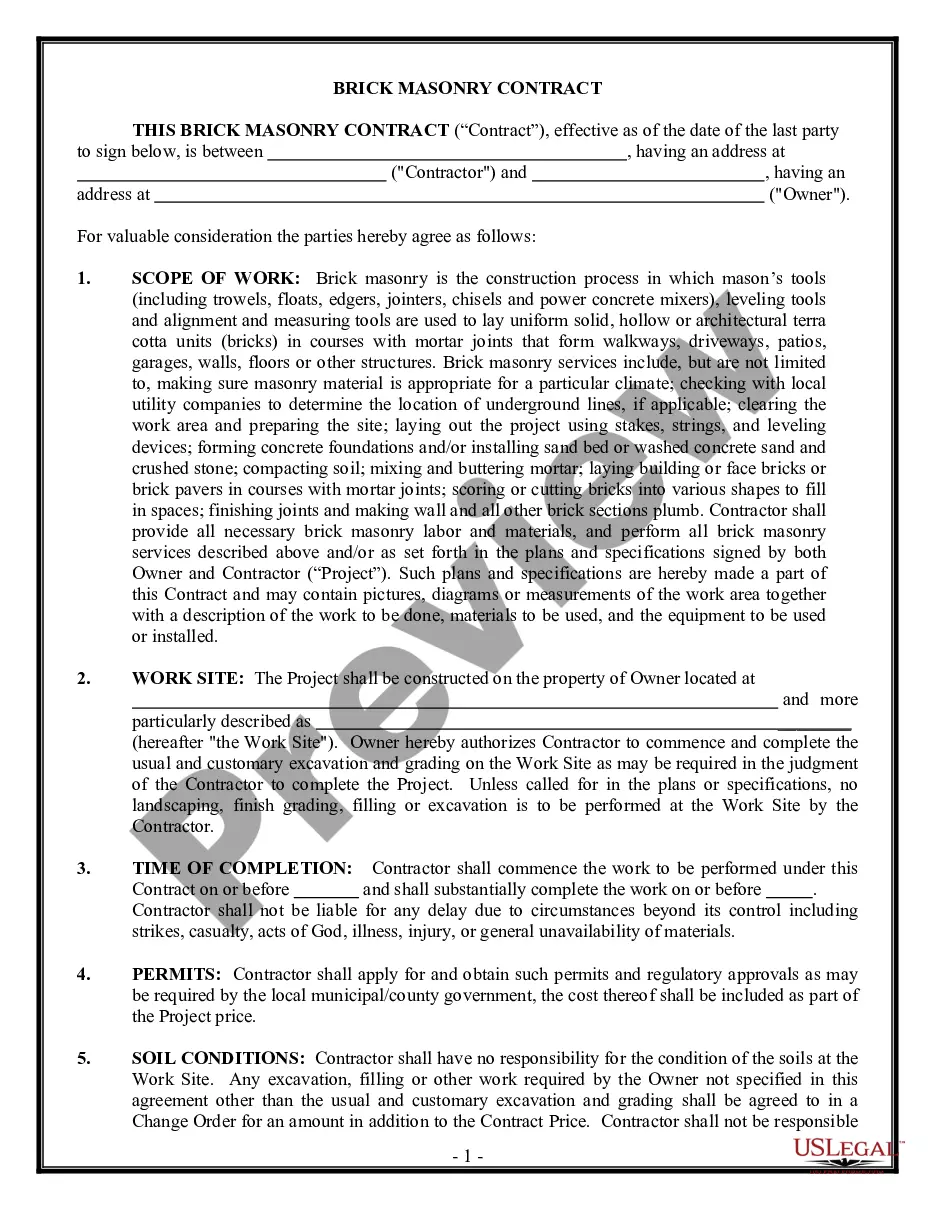

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Kings Personal Monthly Budget Worksheet, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Kings Personal Monthly Budget Worksheet from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Kings Personal Monthly Budget Worksheet:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!