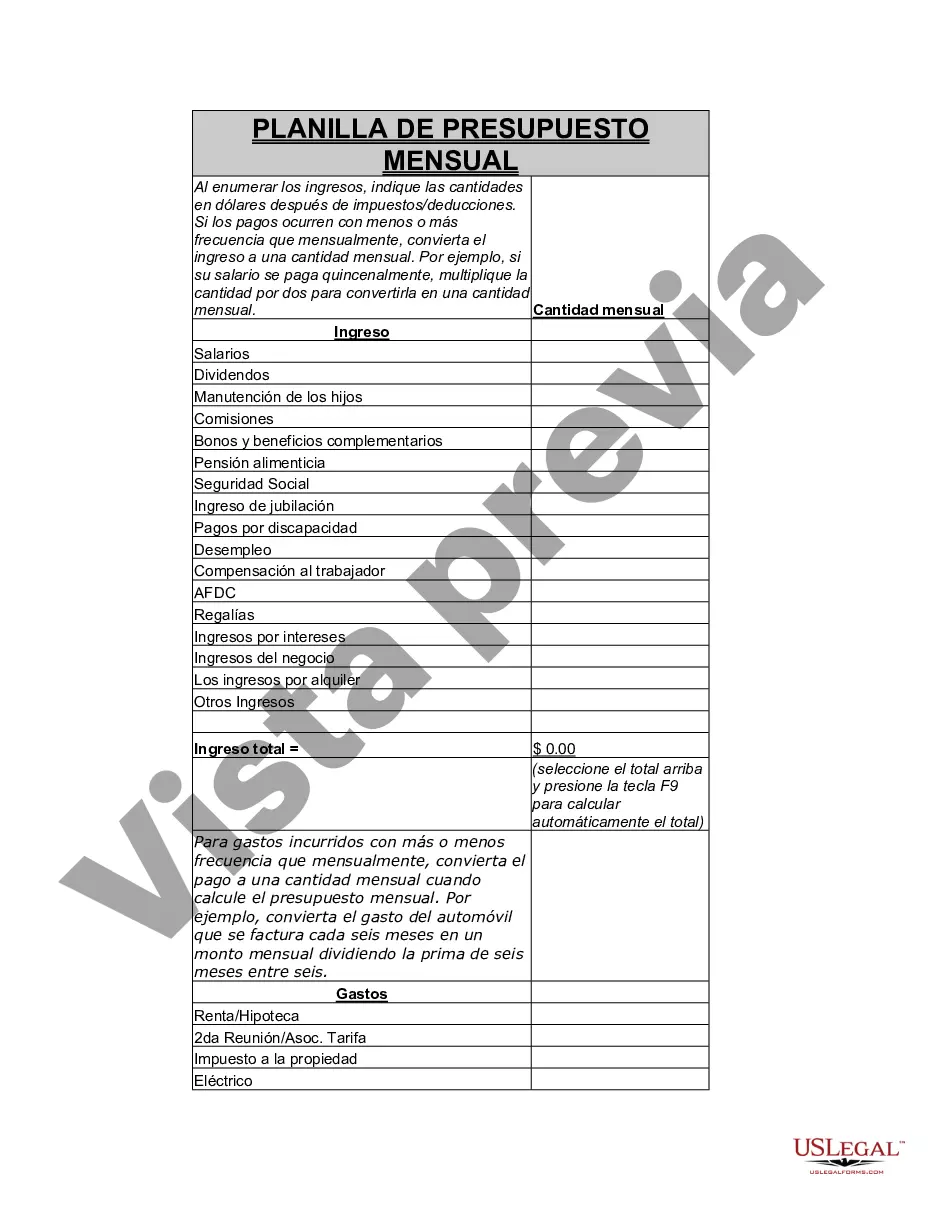

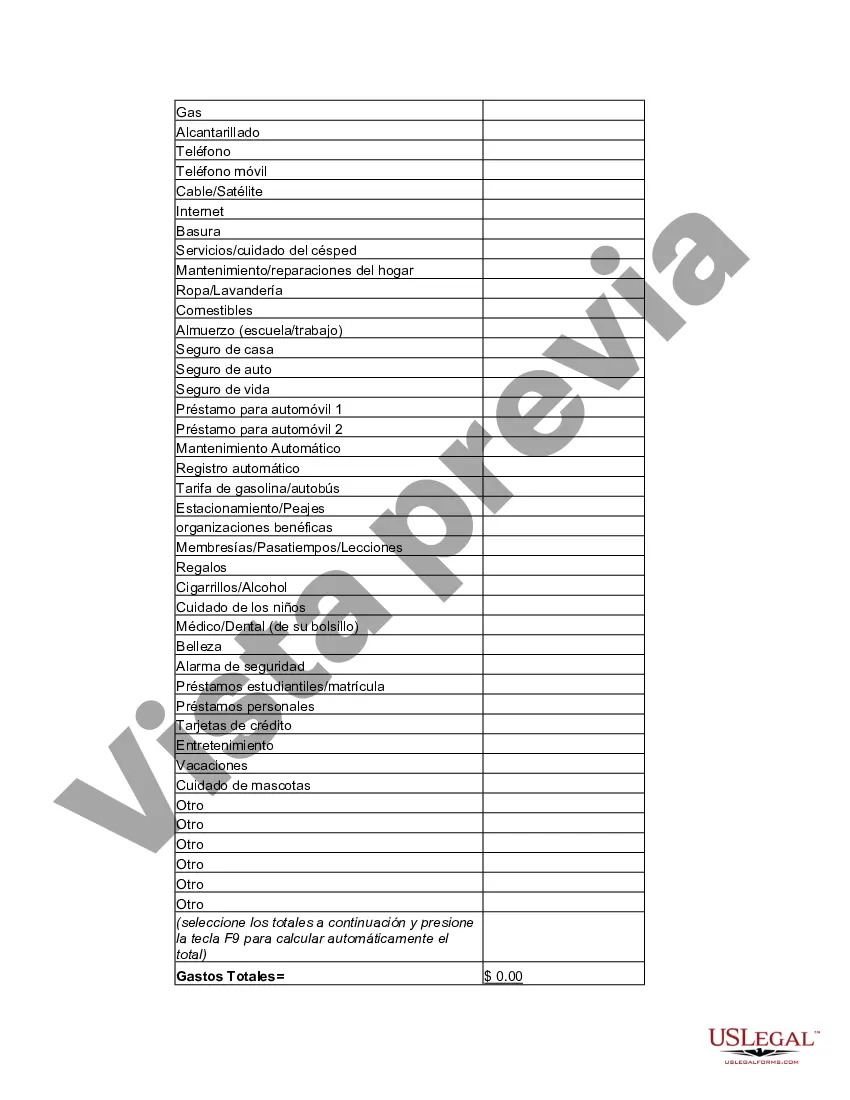

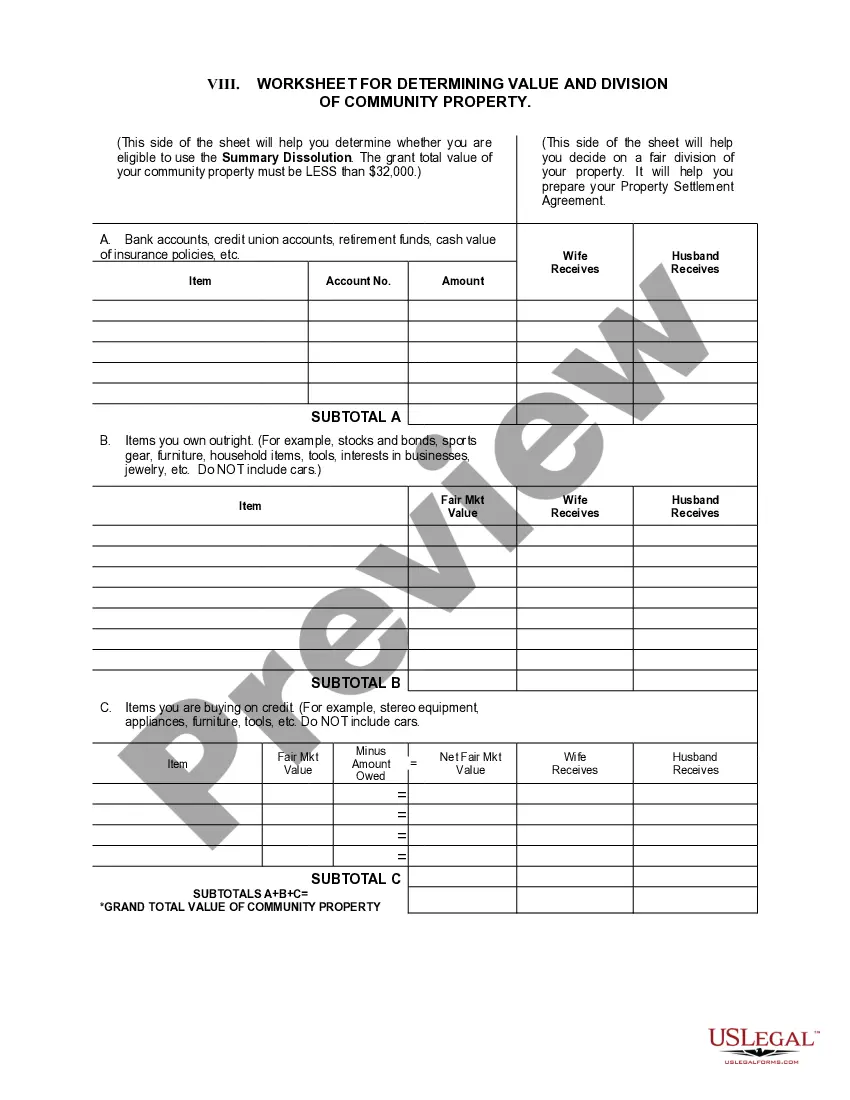

Orange California Personal Monthly Budget Worksheet is a comprehensive tool designed to help individuals manage their finances effectively. This budget worksheet caters specifically to residents of Orange, California, taking into account the unique financial aspects and cost of living in this area. The Orange California Personal Monthly Budget Worksheet acts as a customizable template that allows users to track and organize their income, expenses, and savings on a monthly basis. This helps users gain a clear understanding of their financial situation and make informed decisions for managing their money. The worksheet includes various sections that cover different aspects of personal finance. These sections may include: 1. Income Tracking: This section enables individuals to list their various sources of income, such as wages, self-employment earnings, or investment income. It allows users to enter both fixed and variable income amounts. 2. Expense Tracking: This section helps individuals record and categorize their monthly expenses, such as rent/mortgage payments, utilities, groceries, transportation costs, healthcare expenses, and entertainment expenses. It encourages users to be diligent in tracking their spending habits and identify areas where they can cut back or reduce expenses. 3. Savings and Investment: This section emphasizes the importance of saving and investing by encouraging individuals to allocate a certain percentage of their income towards savings, retirement contributions, or emergency funds. It also provides tools to calculate future savings goals and estimate investment returns. 4. Debt Management: This section focuses on managing existing debts, such as credit card balances, student loans, or car loans. It enables users to keep track of their debt payments and monitor their progress towards becoming debt-free. 5. Financial Goals: This section helps users set and monitor their financial goals, whether it's saving for a down payment on a house, a vacation, or paying off existing debts. It allows individuals to prioritize their goals and track their progress over time. 6. Summary and Analysis: This section provides a summary of the individual's financial situation, including total income, total expenses, savings, debt, and net worth. It may also include charts or graphs to visually represent the individual's financial progress. Different types of Orange California Personal Monthly Budget Worksheets may include variations in design, layout, or additional features. Some worksheets might include separate sections for managing expenses related to housing, healthcare, or education. Others may have specific sections for tracking and managing irregular income or business-related expenses for self-employed individuals. In summary, the Orange California Personal Monthly Budget Worksheet is a valuable tool for Orange residents to plan, track, and manage their finances effectively. It provides an organized approach to budgeting, empowering individuals to take control of their money, achieve financial goals, and make informed decisions for a stable financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hoja De Presupuesto Personal - Personal Monthly Budget Worksheet

Description

How to fill out Orange California Hoja De Trabajo De Presupuesto Mensual Personal?

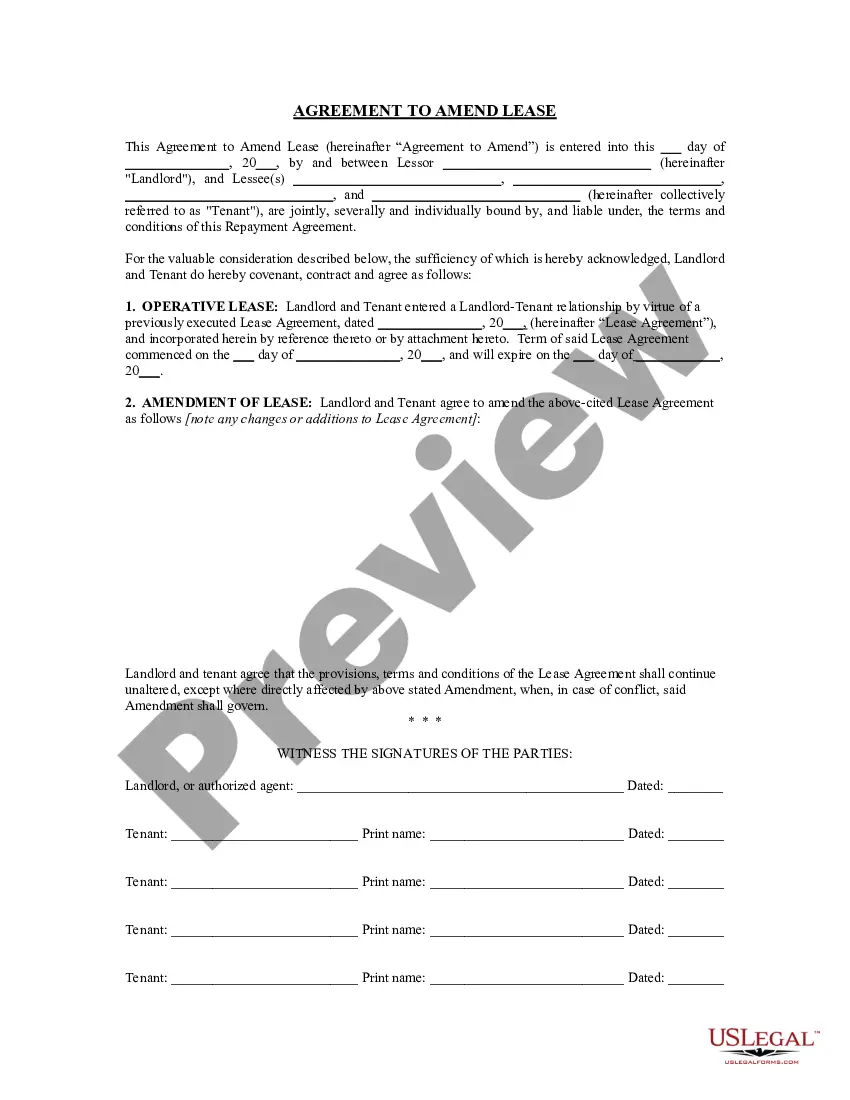

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Orange Personal Monthly Budget Worksheet without expert assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Orange Personal Monthly Budget Worksheet by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Orange Personal Monthly Budget Worksheet:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any scenario with just a couple of clicks!