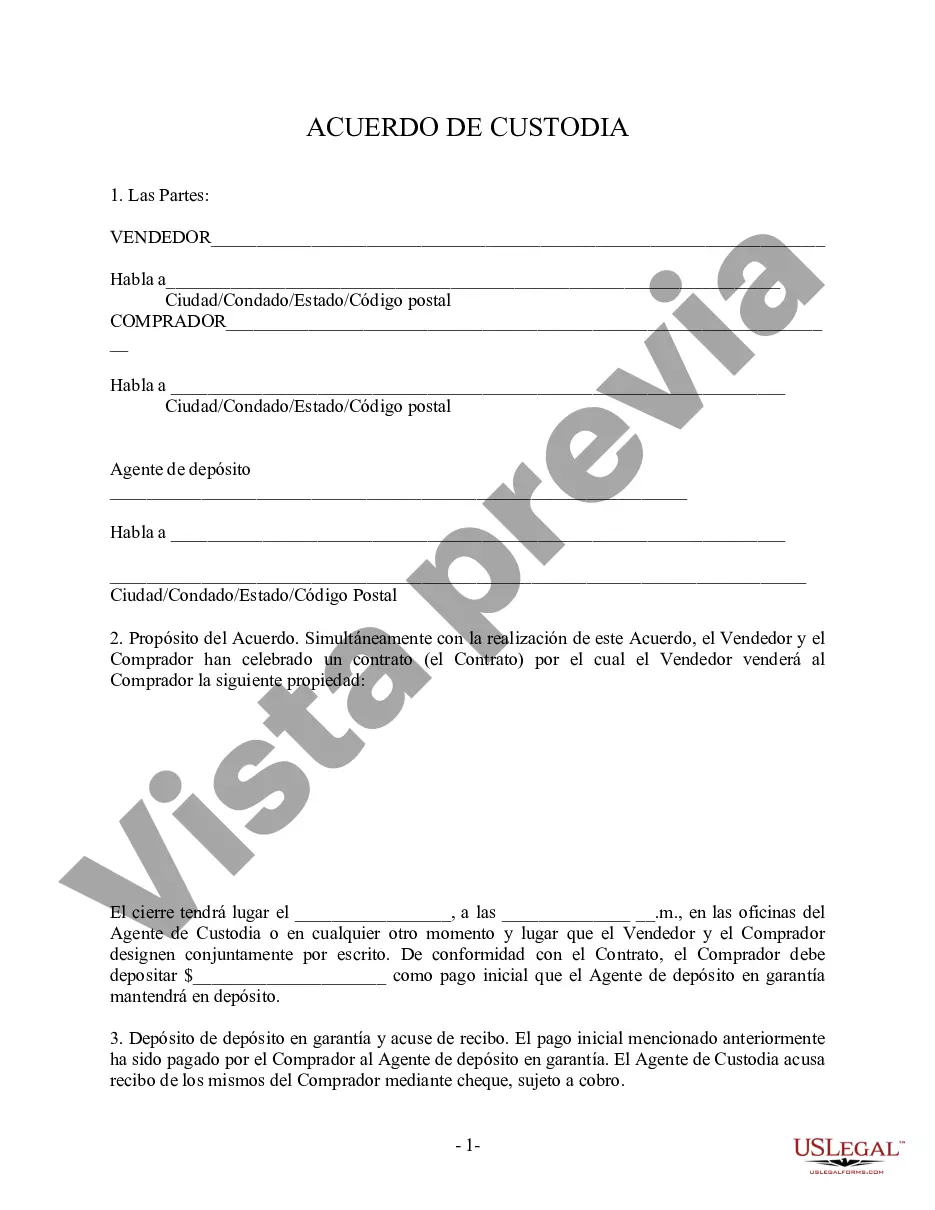

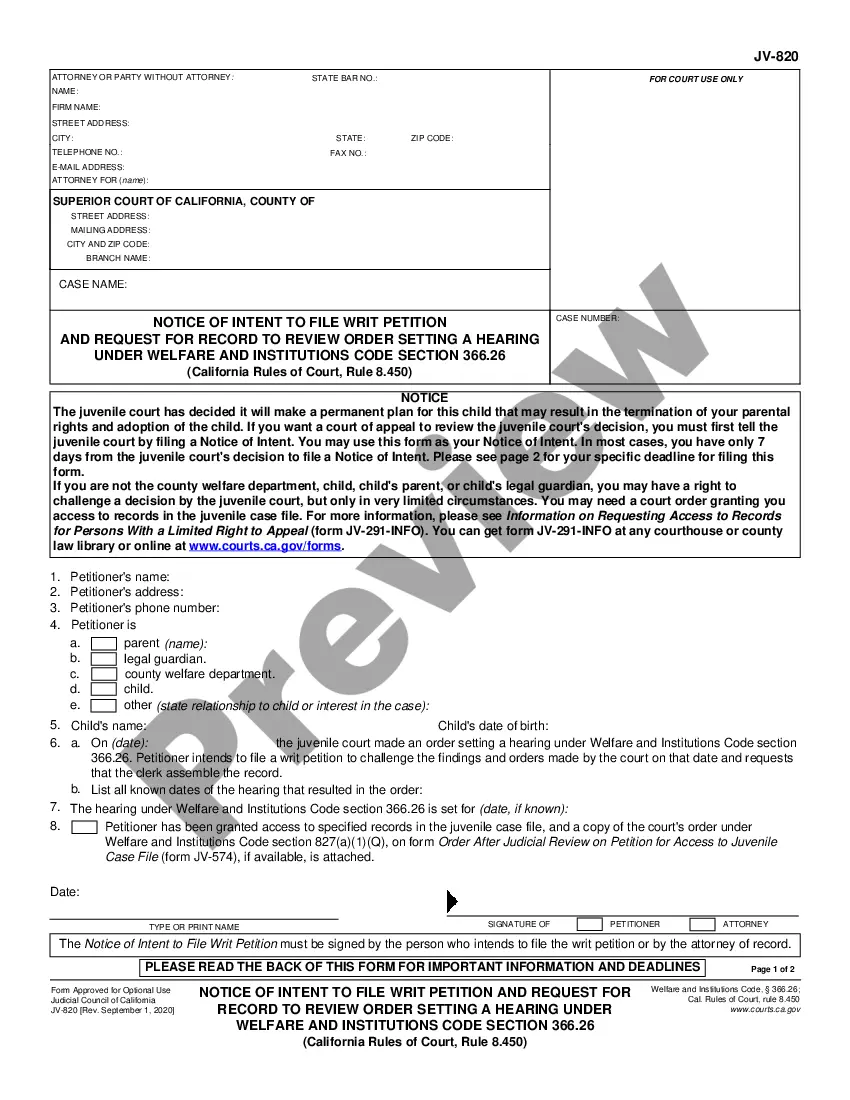

The Suffolk New York Escrow Agreement for Residential Sale is a legally binding contract commonly used in real estate transactions in Suffolk County, New York. This agreement is established between the buyer, seller, and an independent third party known as the escrow agent. It outlines the terms and conditions under which the escrow agent will hold funds and documents related to the residential property sale until all the agreed-upon obligations are met. In this escrow agreement, the buyer and seller designate an escrow agent to act as a neutral intermediary. The chosen escrow agent can be a title company, attorney, or any other licensed professional who specializes in handling escrow matters. The purpose of this agreement is to provide security and protection for both parties involved in the sale of a residential property. The Suffolk New York Escrow Agreement for Residential Sale generally includes the following key elements: 1. Identification of the parties: The agreement clearly specifies the names, addresses, and contact information of the buyer, seller, and escrow agent. 2. Property details: The agreement includes a detailed description of the residential property being sold, including its address, legal description, and tax identification number. 3. Purchase price and deposit: The escrow agreement states the total purchase price of the property and the amount of the initial deposit to be held in escrow by the agent. 4. Property inspections: If there are any agreed-upon inspections to be conducted, such as a home inspection or termite inspection, the escrow agreement will outline the conditions and timeframe for these inspections. 5. Contingencies and timelines: Any contingencies that need to be satisfied for the sale to proceed, such as obtaining financing or clear title, will be specified in the agreement along with their respective deadlines. 6. Closing procedures: The escrow agreement includes instructions on how the closing of the sale will be handled, including the distribution of funds and the transfer of ownership. 7. Dispute resolution: This section outlines the procedures for resolving any disputes that may arise during the escrow process, such as arbitration or mediation. There may be different types of Suffolk New York Escrow Agreements for Residential Sale, depending on the specific nature of the transaction. Some examples are: 1. Cash Sale Escrow Agreement: This type of agreement is used when the buyer is paying the full purchase price in cash without relying on any financing. 2. Mortgage Contingency Escrow Agreement: In situations where the buyer is obtaining financing, this agreement includes provisions related to the mortgage contingency, specifying the conditions under which the buyer can cancel the contract if unable to secure a mortgage. 3. Short Sale Escrow Agreement: If the property is being sold as a short sale, where the sale price is less than the outstanding mortgage balance, a specialized escrow agreement is needed to address the complexities involved in such transactions. In summary, the Suffolk New York Escrow Agreement for Residential Sale is an essential document that ensures a smooth and secure transaction for both the buyer and the seller. With the involvement of an escrow agent, this agreement provides protection and impartiality throughout the sale process, allowing for the transfer of funds and property only after all predetermined conditions are met.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Contrato de depósito en garantía para la venta residencial - Escrow Agreement for Residential Sale

Description

How to fill out Suffolk New York Contrato De Depósito En Garantía Para La Venta Residencial?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Suffolk Escrow Agreement for Residential Sale, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Suffolk Escrow Agreement for Residential Sale from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Suffolk Escrow Agreement for Residential Sale:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!