Title: Exploring Harris Texas Purchase Contract and Receipt — Residential: Types and Key Details Introduction: In Harris County, Texas, the Purchase Contract and Receipt — Residential serves as a crucial legal document designed to establish and solidify the agreement between buyers and sellers during a residential property transaction. In this article, we will delve into the specifics of this contract, explore its contents, and highlight various types of Purchase Contracts and Receipts relevant to Harris County. 1. Harris Texas Purchase Contract and Receipt — Residential: Overview: The Harris Texas Purchase Contract and Receipt — Residential outlines the terms and conditions agreed upon by both parties involved in a residential property purchase. It acts as a binding agreement aimed at protecting the rights and interests of both the buyer and seller. 2. Key Elements of a Harris Texas Purchase Contract and Receipt — Residential: a. Property Information: This section includes details such as the property address, legal description, zoning, and parcel identification number. b. Buyer and Seller Information: Pertinent information about the buyer and seller, including names, contact details, and identification details. c. Purchase Price and Financing: Specifies the agreed-upon purchase price, down payment, financing terms if applicable, and any contingencies related to financing approval. d. Property Inspection and Disclosures: Ensures that the buyer has the opportunity to inspect the property and highlights any known defects or issues. e. Title and Closing: Outlines the responsibilities of each party regarding title insurance, closing costs, and the anticipated closing date. f. Contingencies and Addenda: May include contingencies related to financing, appraisal, sale of another property, or additional addenda that address specific circumstances or requests. g. Earnest Money: Specifies the amount of earnest money provided by the buyer to demonstrate serious intent to purchase and the terms for its handling. h. Default and Termination: Outlines the consequences and procedures in the event of default or termination of the agreement by either party. 3. Types of Harris Texas Purchase Contracts and Receipts — Residential: a. Standard Purchase Contract: The most common type used for straightforward residential transactions without significant complexities. b. FHA or VA Purchase Contract: Designed specifically for transactions involving Federal Housing Administration (FHA) or Department of Veterans Affairs (VA) loans, ensuring compliance with their respective requirements. c. Cash Purchase Contract: Used when a buyer intends to purchase a property without obtaining any financing, typically requiring fewer contingencies related to financing approval. d. Lease-to-Own Purchase Contract: Pertains to agreements where the buyer leases the property with an option to purchase it at a later date, outlining the terms and conditions for the lease and future purchase. Conclusion: The Harris Texas Purchase Contract and Receipt — Residential plays a pivotal role in ensuring a smooth and legally secure residential property transaction process. Understanding the various types of this contract allows both buyers and sellers to tailor the agreement to their specific needs or circumstances. It is advisable to seek legal counsel or professional assistance when drafting or reviewing such contracts to ensure compliance with local laws and regulations.

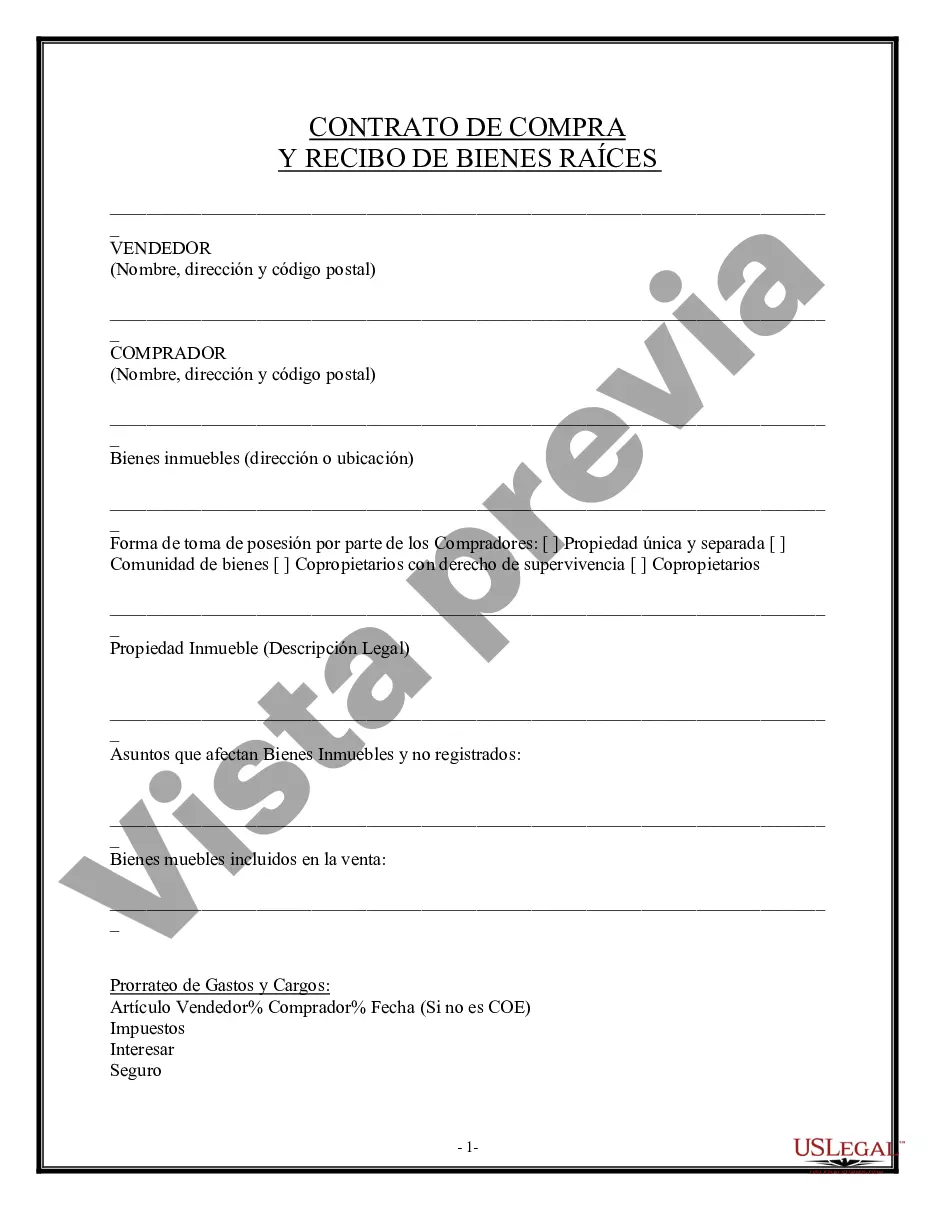

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Contrato de Compra y Recibo - Residencial - Purchase Contract and Receipt - Residential

Description

How to fill out Harris Texas Contrato De Compra Y Recibo - Residencial?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Harris Purchase Contract and Receipt - Residential, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the current version of the Harris Purchase Contract and Receipt - Residential, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Harris Purchase Contract and Receipt - Residential:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Harris Purchase Contract and Receipt - Residential and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!