Houston, Texas Counter Offer to Purchase 3 — Residential: A Comprehensive Guide When engaging in real estate transactions in the vibrant city of Houston, Texas, it is not uncommon for buyers and sellers to negotiate various terms, including the purchase price, contingencies, and closing dates through counter offers. A counter offer is a response to an original offer that modifies specific terms and conditions, aiming to find a middle ground that satisfies both parties involved. In this article, we will highlight the different types of counter offers available in Houston, Texas for residential properties, thereby facilitating a better understanding of the intricacies involved in the local real estate market. 1. Price Adjustment Counter Offer: One of the most common types of counter offers encountered in Houston is the price adjustment counter offer. In this scenario, the seller proposes a new purchase price that differs from the original offer presented by the buyer. The seller may adjust the price either upwards or downwards, depending on the prevailing market conditions, property value, or negotiating strategy. 2. Closing Date Counter Offer: Another crucial aspect of purchasing residential properties in Houston is negotiating the closing date, which refers to the day when the buyer assumes ownership. In a closing date counter offer, either the buyer or the seller suggests a revised or extended timeline to align with their respective needs. It could be due to logistical reasons, such as additional time for financing or moving arrangements, or unforeseen circumstances that necessitate a new closing date. 3. Contingency Counter Offer: In Houston's real estate transactions, contingencies are clauses added to a purchase agreement that outline specific conditions that must be met for the sale to proceed. Common contingencies include home inspections, financing, or appraisal contingencies. A contingency counter offer presents revised terms regarding these conditions, either removing or modifying specific contingencies to create a more agreeable deal for both parties. 4. Repair Credit Counter Offer: When a buyer conducts a home inspection and identifies repair needs or issues with the property, they may choose to submit a repair credit counter offer. This type of counter offer proposes a monetary credit towards the purchase price instead of the seller making physical repairs. For example, if the inspection reveals a faulty HVAC system, the buyer might suggest a counter offer that deducts the estimated repair cost from the purchase price. Houston, Texas presents a dynamic real estate market featuring diverse counter offers catered to residential properties. While the above-mentioned types encompass the most common scenarios, there are often unique counter offers tailored to individual cases based on the negotiations between the buyer and the seller. Therefore, it is essential to work closely with experienced real estate professionals familiar with Houston's intricacies to navigate the counter offer process effectively and secure a successful residential property transaction.

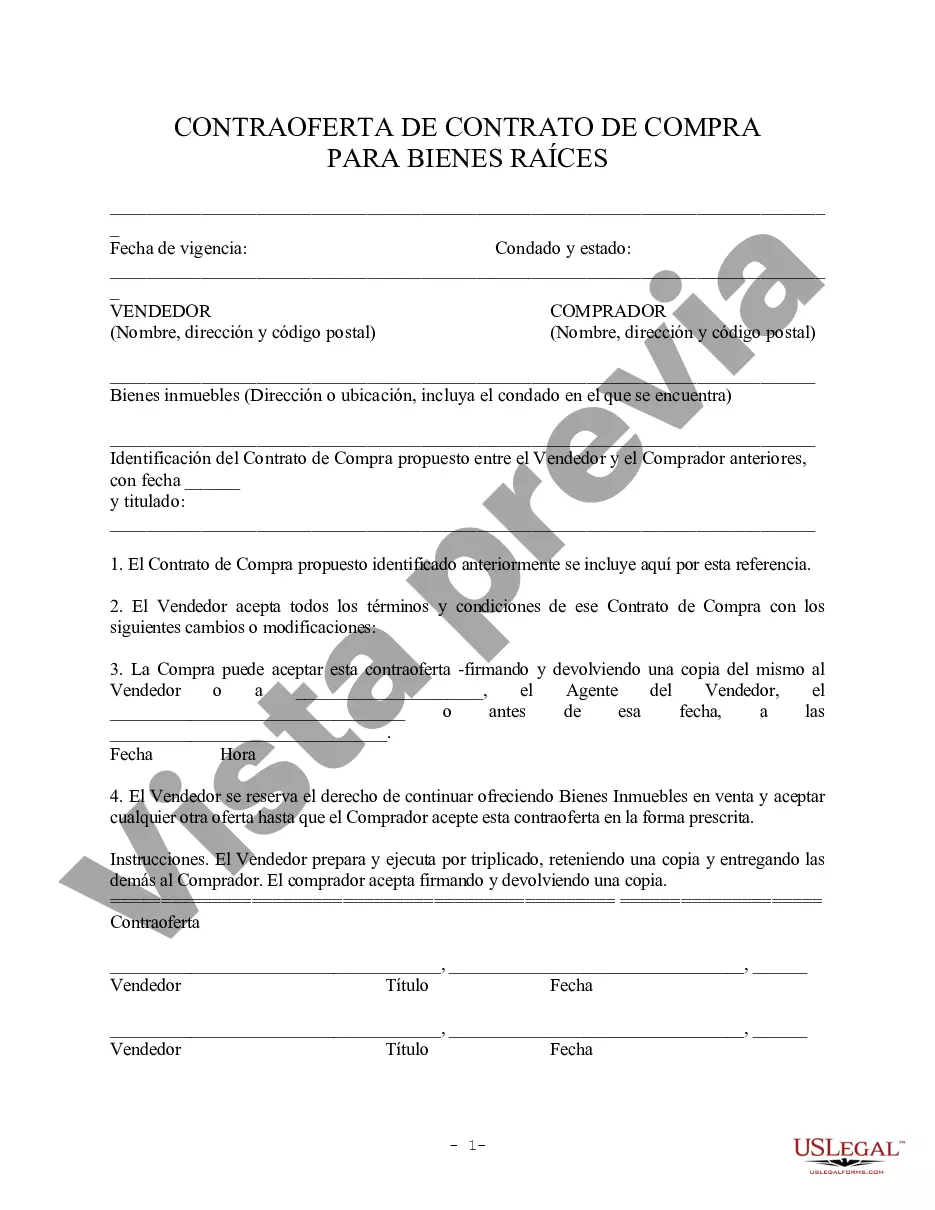

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Contraoferta de compra 3 - Residencial - Counter Offer to Purchase 3 - Residential

Description

How to fill out Houston Texas Contraoferta De Compra 3 - Residencial?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Houston Counter Offer to Purchase 3 - Residential without professional assistance.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Houston Counter Offer to Purchase 3 - Residential by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Houston Counter Offer to Purchase 3 - Residential:

- Look through the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!