Mecklenburg County in North Carolina is known for its diverse and thriving business community. When a partner of a business located in Mecklenburg County passes away, the remaining partners may need to engage in the sale of the deceased partner's interest. This process involves transferring ownership rights and financial benefits to a new individual or entity. The sale of a deceased partner's interest can vary depending on the specific circumstances, including the type of business partnership and any existing agreements. One type of Mecklenburg North Carolina sale of a deceased partner's interest is the sale within a general partnership. In this scenario, all partners share equal responsibility and liability for the business's debts and operations. When a partner dies, the surviving partners may choose to sell the deceased partner's interest to an existing partner or an external party. This allows for a smooth transition of ownership and ensures the continuity of the business. Another type of Mecklenburg North Carolina sale of a deceased partner's interest involves limited partnerships. Limited partnerships consist of both general partners, who have active management roles, and limited partners, who are passive investors. When a limited partner passes away, their interest can be sold to another limited partner or, in some cases, converted into a general partnership interest. Limited liability companies (LCS) are also common in Mecklenburg County, and the sale of a deceased partner's interest in an LLC follows specific rules outlined in the operating agreement. An operating agreement is a legal document that regulates a company's internal operations, including guidelines for the disposal of a deceased partner's interest. The remaining members of an LLC can either purchase the deceased member's interest themselves or find a new member to fill the void. Proper valuation is crucial for the Mecklenburg North Carolina sale of a deceased partner's interest. Valuing a partner's interest can be complex, considering factors such as the deceased partner's share of profits, the company's current assets and liabilities, client relationships, and potential future earnings. Consulting with an experienced business appraiser or accountant is essential to ensure a fair and accurate valuation. Overall, the sale of a deceased partner's interest in Mecklenburg County, North Carolina, requires careful consideration and adherence to legal, financial, and operational protocols specific to the type of business partnership. With the right professional guidance, this process can be managed efficiently, protecting the interests of the deceased partner's estate and the future of the business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Venta de Interés de Socio Fallecido - Sale of Deceased Partner's Interest

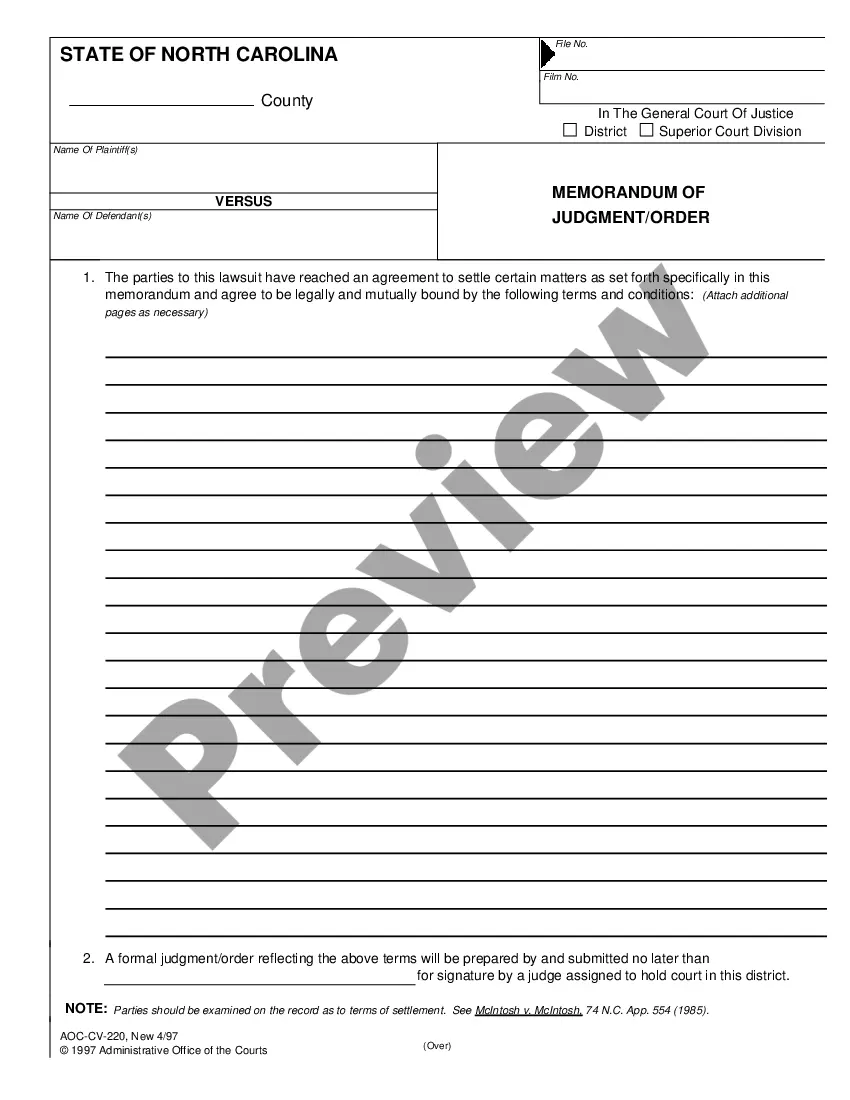

Description

How to fill out Mecklenburg North Carolina Venta De Interés De Socio Fallecido?

If you need to get a reliable legal document supplier to obtain the Mecklenburg Sale of Deceased Partner's Interest, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it simple to locate and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse Mecklenburg Sale of Deceased Partner's Interest, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Mecklenburg Sale of Deceased Partner's Interest template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the Mecklenburg Sale of Deceased Partner's Interest - all from the comfort of your home.

Join US Legal Forms now!