Montgomery Maryland Sale of Deceased Partner's Interest is a legal process that occurs when a partner in a business or partnership passes away, and their interests in the partnership need to be sold or transferred. This sale is necessary in order to settle any outstanding debts, distribute assets, and ensure the smooth continuation of the business. In Montgomery, Maryland, the sale of a deceased partner's interest is governed by specific laws and regulations. The process typically involves several crucial steps and considerations to ensure fairness and transparency. It is important to consult with an experienced attorney specializing in business and estate law to navigate through this complex procedure. Different types of Montgomery Maryland Sale of Deceased Partner's Interest can include: 1. Private Sale: In some cases, the remaining partners may choose to buy the deceased partner's interest privately. This can be done through negotiations and agreements between the involved parties, and typically involves valuing the interest based on various factors such as the partnership's assets, income, and potential future earnings. 2. Public Auction: If the remaining partners are unable or unwilling to purchase the deceased partner's interest, a public auction may be held to sell the interest to a third party. The auction process ensures that interested buyers have the opportunity to bid on the interest, leading to a fair market value determination. 3. Transfer to Heirs or Beneficiaries: If the deceased partner has designated heirs or beneficiaries in their will or estate plan, their interest may be transferred to these individuals. This scenario requires coordination between the partnership, the deceased partner's estate executor or administrator, and the intended recipients. The sale of a deceased partner's interest involves various legal aspects, including valuation techniques, tax implications, asset distribution, and potential buyout options. It is crucial to consult professionals who specialize in business and estate law to ensure compliance with Montgomery, Maryland's specific laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Venta de Interés de Socio Fallecido - Sale of Deceased Partner's Interest

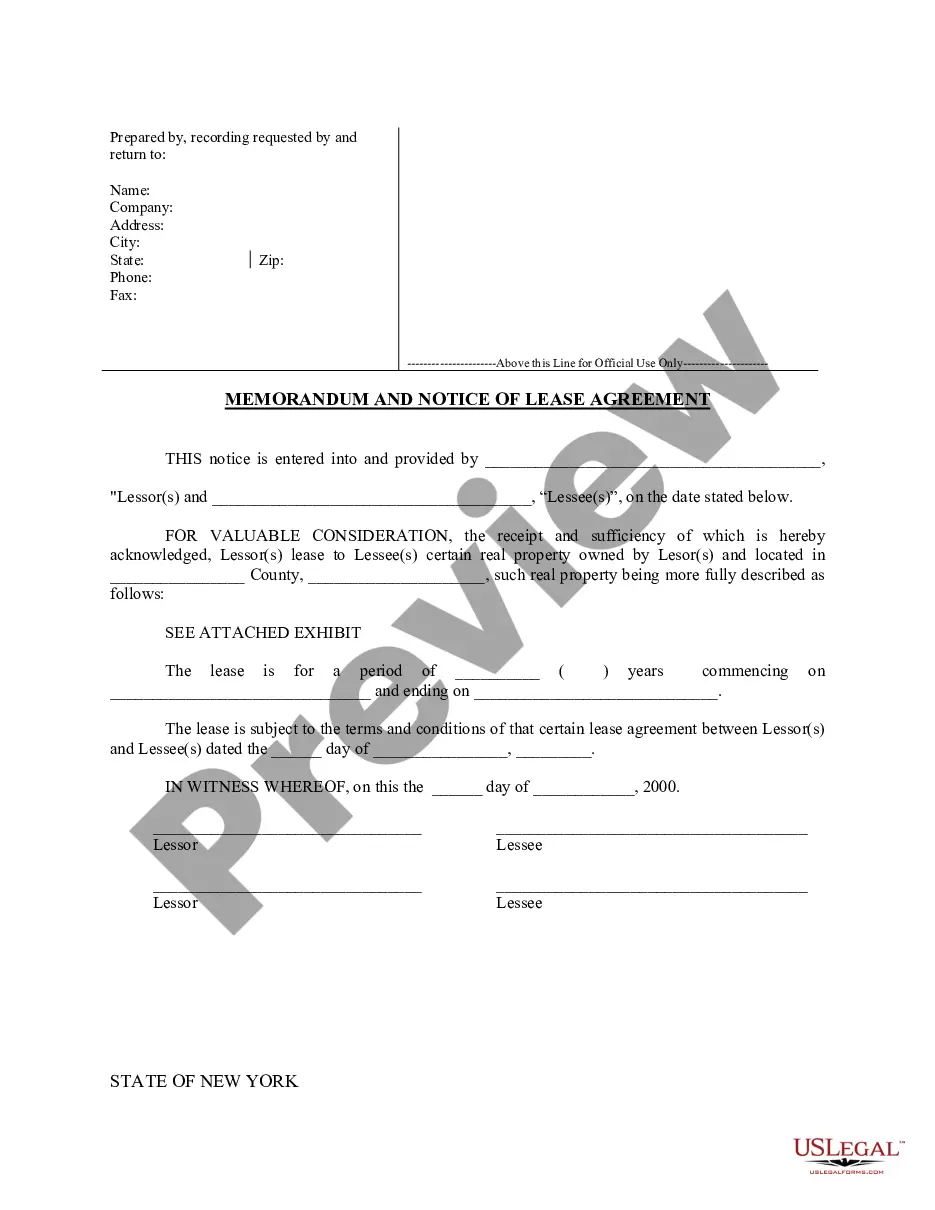

Description

How to fill out Montgomery Maryland Venta De Interés De Socio Fallecido?

Do you need to quickly create a legally-binding Montgomery Sale of Deceased Partner's Interest or maybe any other form to manage your own or business affairs? You can go with two options: hire a legal advisor to write a legal document for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including Montgomery Sale of Deceased Partner's Interest and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, double-check if the Montgomery Sale of Deceased Partner's Interest is tailored to your state's or county's laws.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Montgomery Sale of Deceased Partner's Interest template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!